2017 Prices Without Hysteria

Why is Iran’s central bank into Bitcoin? Record breaking on-chain and trading statistics and everything about the new Hong Kong cryptocurrency regulation

Bitcoin’s price touched $16,000 per coin last week, breaking another record for 2020 while regulators around the world keep moving to regulate cryptocurrency exchanges.

Where in the world are Huobi’s executives?

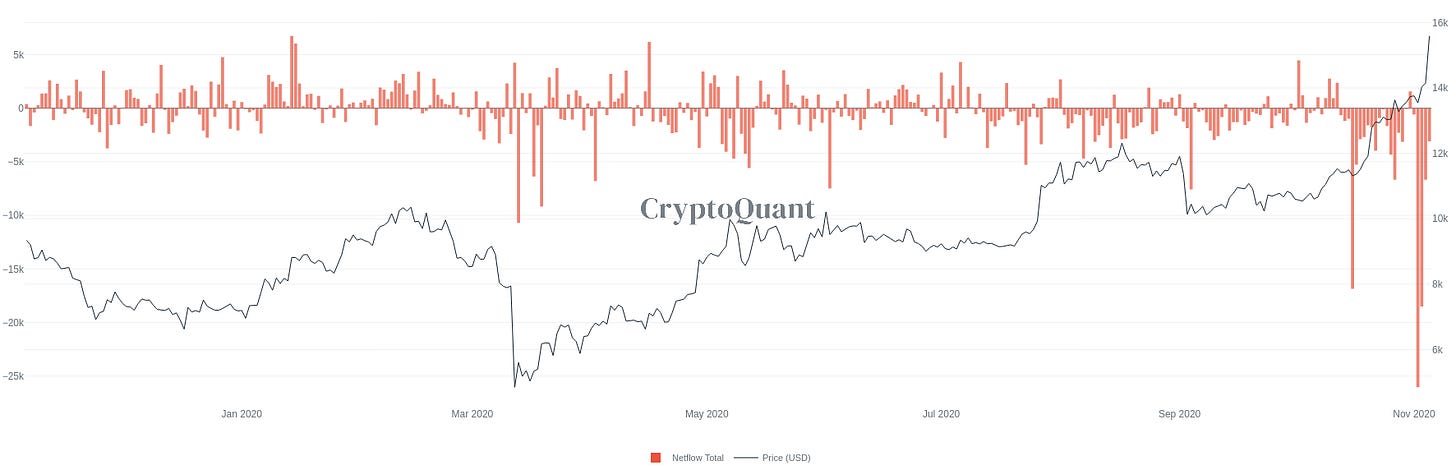

On Monday a 2020 record of 26,000 Bitcoins were withdrawn from Huobi, one of Asia’s most popular exchanges, while rumors circulated of the exchange’s executives being arrested.

Huobi quickly assured the public on their official Twitter account, that not only are all its executives safe and sound, but even if one of them was compromised, client funds would be safe due to their multi-sig system. As the exchange’s executives are not known publicly, it’s hard to know if the rumor has any basis in reality.

Rogue nation adopts borderless currency

Last Sunday Iran Daily reported new legislation requests all Bitcoin miners in the country to supply their coins to the Central Bank of Iran, making Iran the first major country to officially hold Bitcoin with its central bank. Iran, like Saudi Arabia, is a country rich in oil and gas and is considered an energy superpower. According to GlobalPetrolPrices.com, Iran has the cheapest household electricity prices in the world, making Bitcoin mining highly profitable.

The economic sanctions on Iran and its 83 million citizens had been growing in the last decade, led by the United States and its close allies, and have affected both the value of Iran’s local currency and its oil exports. This February Iran was re-added to the FATF’s black list, completely restricting its access to the international banking system. Iran opting to use Bitcoin due to its borderless technology and energy relant production tells us of a future in which Bitcoin and cryptocurrency play a much more meaningful role in international trade and politics.

On-chain records

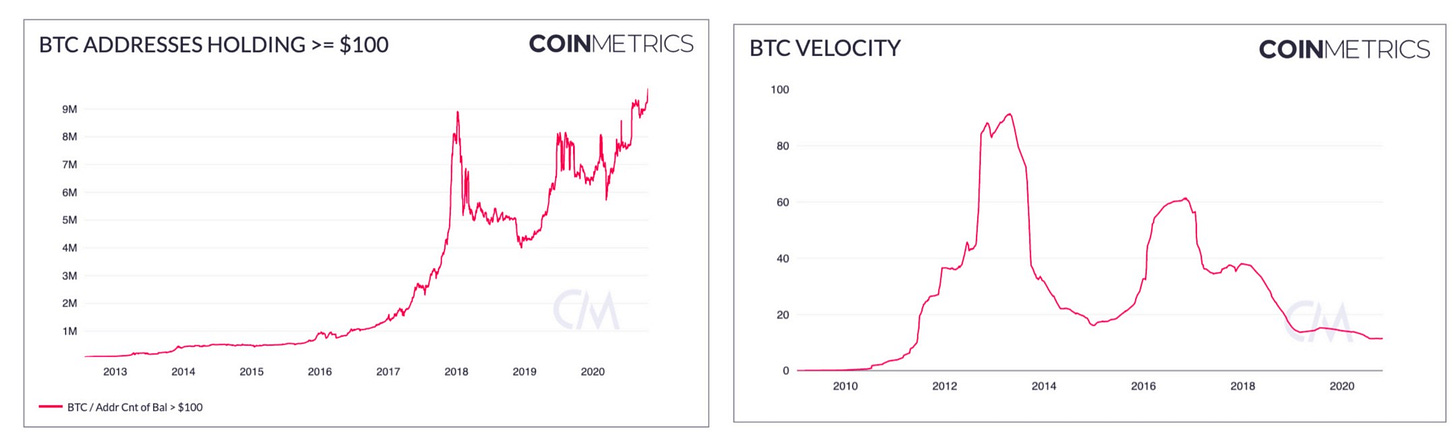

The above chart shows that the amount of addresses holding over $100 worth of Bitcoin are at an all time high, while on the left the low velocity shows Bitcoins are increasingly being stored and not moved. Both of these are positive signs for Bitcoin’s adoption as digital gold.

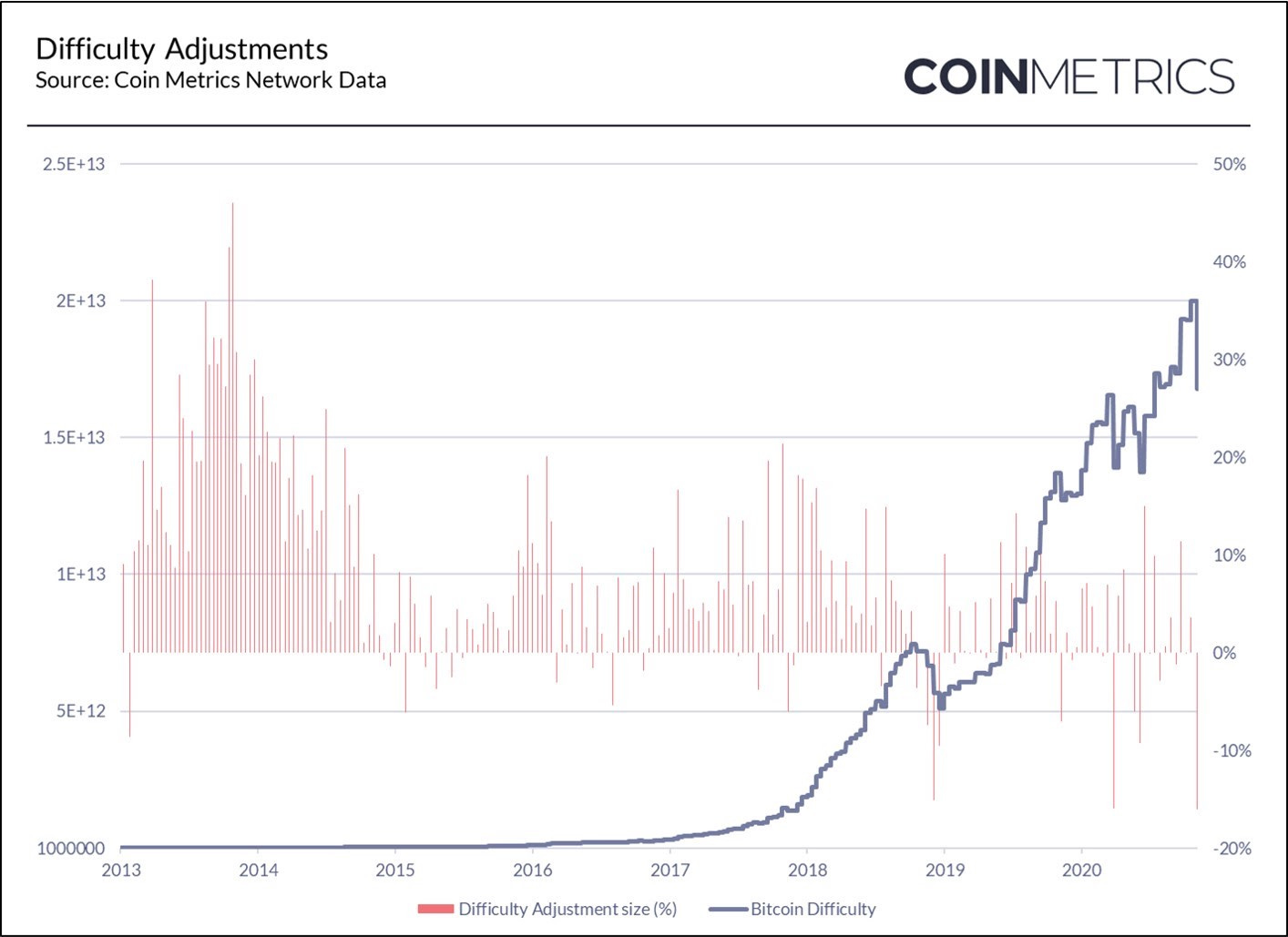

Meanwhile Bitcoin’s miners caused the biggest drop in mining difficulty since 2011 due to the end of the rainy season in Sichuan, China, driving miners to leave the cheap hydroelectric power sourcers. According to CoinMetrics, during the month of October, Bitcoin’s blocks were arriving on average every 13 minutes instead of 10 due to the drop in hashing power. After this massive 16.5% difficulty adjustment, blocks are now back on schedule.

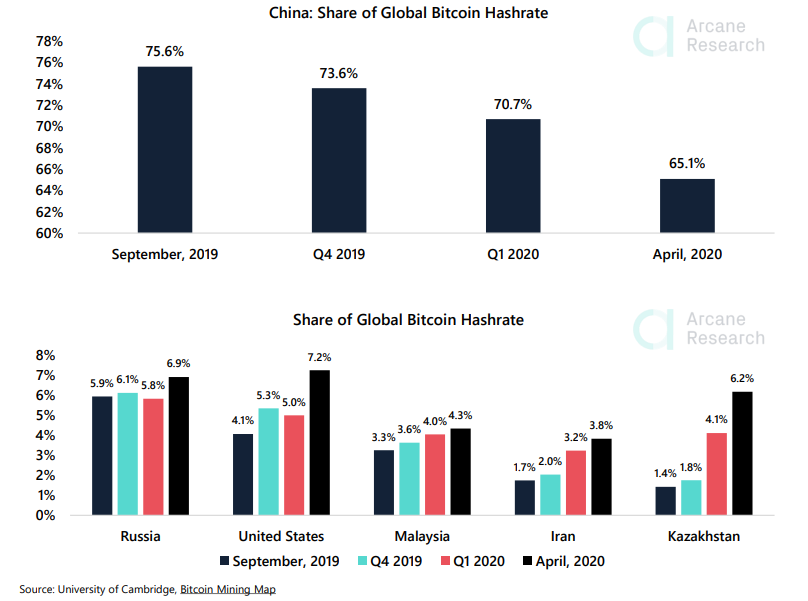

Interestingly, the Bitcoin Mining Map actually shows China lost over 10% of its dominance of Bitcoin mining within a year, due to mining picking up in Kazakhstan, Iran, USA, Malaysia and Russia.

The regulator awakens, part 4: Hong Kong

Just weeks after the Hong Kong Bitcoin Association’s streetcar and billboard campaign promoted Bitcoin across the city, Hong Kong’s government proposed a new licensing regime which could highly influence exchanges in the city, which is a hub for cryptocurrency exchanges.

Under the new proposed amendments to anti-money laundering legislation, all cryptocurrency trading platforms should apply for a SFC licence and will be regulated and supervised under the same standards applied to securities brokers with the motto “Same business, same risks, same rules”. According to the proposal, exchanges serving local residents will be able to serve only accredited investors, which according to Citibank, are only 1.3% of the city’s population. The second part of the suggested legislation aims to significantly restrict the Hong Kong precious metal and diamond markets.

“It is conceivable that the strict proposal is merely an attempt to set expectations for future negotiations,” wrote Leo Weese on the Hong Kong Bitcoin Association’s blog. He also noted that it puts Hong Kong in line with mainland China’s regulation, but that given the resistance from the Hong Kong establishment against previous initiatives aimed at money laundering and the vibrant local precious metals market, we should expect significant push back. He also explained that the lack of commentary from Chinese state-affiliated media suggests that this is an initiative from the SFC to implement FATF decisions, not a conspiracy to ban Bitcoin from the Chinese Government.

“Most importantly, the new regime will allow us to mitigate risks to investors whilst fulfilling our international obligations around money laundering and terrorist financing.” said Ashley Adler, the Head of Hong Kong’s SFC, in his speech announcing this regulation at HK Fintech Week this week. He added that policy makers are “recognising that crypto-assets are here to stay” and went on to remark that CBDCs will be revolutionary, and are being looked at not only in Mainland China but also in Europe. He also mentioned the growing importance of cloud computing, AI and ML to policy makers. The SFC has not yet issued a full licence to any exchange but has agreed in principle to issue a licence to cryptocurrency firm OSL Digital Securities, a unit of a Fidelity-backed group. In the meantime, the uncertainty over the future direction of HK’s regulation is forcing many exchanges to reconsider their options over their jurisdiction, with many considering Singapore as a backup plan, given the historically friendly regulatory approach from the MAS.

Market records

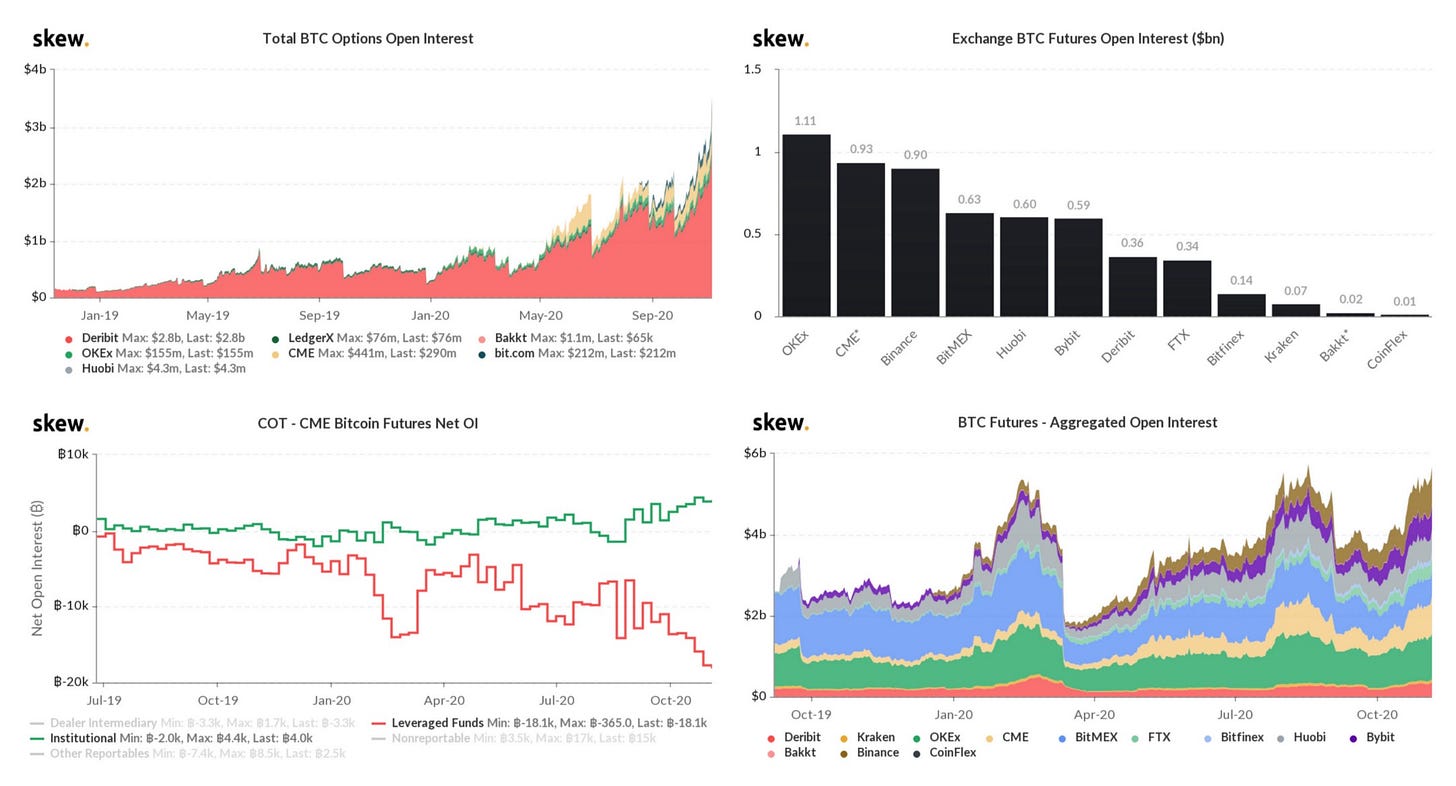

Leveraged funds post record short on Bitcoin futures (-17,700 Bitcoins) in the CME while institutional funds record long positions of 4,000 Bitcoins.

The above charts show Bitcoin options OI breaking to new all-time highs close to $3.5B, while Bitcoin future open interest are close to their all-time highs, at $5.7B.

News & links

American authorities announce they have $1B worth of Bitcoin

OKEx, Alameda Research and Whalepool create BTC IOU tokens for OKEx traders

Fidelity hiring 20+ engineers for cryptocurrency related jobs

Ethereum 2.0 locking & staking contract launched. Mainnet scheduled for December 1st

Venezuela passes law legalizing crypto mining. forces miners to join national mining pool

6. FTX plans to launch support for trading Tokenized Nasdaq Stocks after

CEO donates $5 million to US presidential campaign