Bitcoin: We Recommend Being Bored

Is it just another boring Bitcoin halving cycle? Yes, and we can prove it!

Note from our CEO

Dear clients, partners, and network,

It has been gratifying to witness the recent months' growth in the crypto market, which has borne fruit for us and our partners. As summer approaches and the crypto markets begin to quiet down, this is an opportune time for review and process improvements before the market heats up again.

Your trust has been essential to our success in 2024, and for that, we extend our heartfelt gratitude. With your feedback, we continue to develop new products and trading technology to provide the best solutions for both our existing and new clients.

"A violent wind does not last for a whole morning; a sudden rain does not last for the whole day."

Wishing you all a wonderful summer season,

Yohai Rayfeld

Chart of the month

May’s memecoin craze saw The Block’s Memecoin Index rise from 145 to a peak of 386 on the last day of Q1. April followed with a new record of 74,000 tokens listed to DEXs (on-chain exchanges) in one month, with a flurry of listings on Ethereum, Solana, Base and others, as you can see in the chart below.

Team update

Summer is also conference season and we’ll be present at all major gatherings:

Roei Levav, our co-founder and Zach Ringold, Head of Ecosystem, will represent us at Berlin Blockchain Week from May 18th to 27th. Then Roei will head to Coindesk’s Consensus in Austin Texas from the 29th to 31st of May.

After surviving Dubai, our VP of Sales Andew Tu will join Roei at Consensus.

We recommend being bored

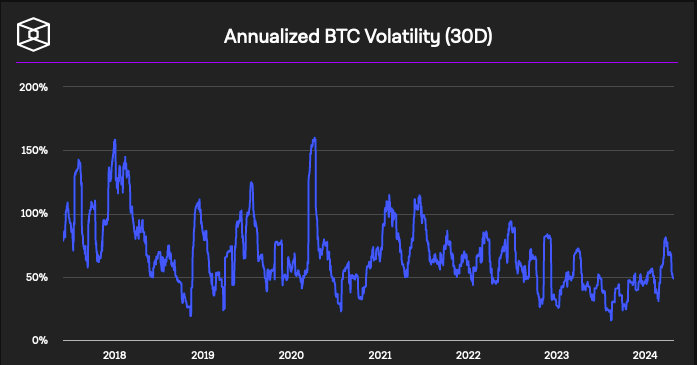

Financial markets, especially in recent decades, and even more in cryptocurrency markets, largely function around human psychology and take us for a volatile trips. The “correction” over the last two weeks took many from euphoria to despair. But most tokens are 2-3 times higher than they were 18 months ago and most major tokens (and of course Bitcoin) remain more than one hundred percent higher than November 2023’s lows. Most importantly, this is only the first leg of the usual 4 year Bitcoin cycle

Normal cycle activity

Our take is not very original but it’s probably correct. ‘The Bitcoin ETF run up’ was in tune with the previous 2 halving cycles. There’s no reason not to expect a continued strong uptrend down the line in 2024 or early 2025.

Recent moves in Bitcoin show in our opinion a strong similarity with the 2016-2020 halving cycle, where Bitcoin ran up from around $3,000 to $15,000 in the summer of 2019, correcting and crossing that threshold only 18 months later, in the final leg of the 2019-2021 bull run.

Two fundamental trends are gaining an undeniable foothold

The first is the continued build out and liquidity of institutional infrastructure for Bitcoin trading.

BTC options and futures at the century old CME today total $10 billion in OI. US ETFs have an additional $11.2 billion in holdings. Deribit options trading is also breaking records. In other words, the ground for mainstream investment in Bitcoin is - at last - ready.

On the tech side, distributed on-chain exchanges, the leading use case for non-Bitcoin cryptocurrency, is booming.

DEXs have regained their uptrend against CeFi spot exchanges with a much higher money velocity. DEX volumes rival 2021 with much less TVL (for now).

This trend is a direct result of the advantages of crypto’s open source finance:

-No hurdles: Permissionless DEXs don’t vet assets or customers, so the asset and customer base are almost limitless.

-Immediacy: Listing of assets and signing up is almost immediate.

Compared to regulated exchanges, there’s no wonder that DEX popularity is growing, which continues to solidify the success of cryptocurrency.