BITCOIN > IMF

Reporting on the IMF’s CBCD panel & global KYC-roadmap plus on-chain metrics fun as Bitcoin hits $13,000 for the first time 2020

First, a quick update

According to GlassNode, 98% of all Bitcoin UTXOs (a proxy for Bitcoin accounts) are currently in a state of profit after Bitcoin broke to 2020 highs, currently touching the $13,000 mark.

Despite one of our market’s biggest exchanges, OKEx, surprisingly halting withdraws on October 16th, Bitcoin continued to rise by more than $1,500 in less than a week.

“We suspect that with deposits sitting [in OKEx] with no end in sight, many have decided to go for broke and further leverage their long positions. This has pushed OKEx’s futures curve to the top of the pile [seen above], amidst an unusually flat contango for a bull market,” wrote QCP.

The big news this week of payments giant PayPal announcing they will integrate Bitcoin buying and selling to their services (including Venmo) reflects the increasing mainstream acceptance of Bitcoin. This is also seen in the Chicago Mercantile Exchange’s open interest in Bitcoin futures, which rose sharply in the last two weeks from $477 million to $779 million.

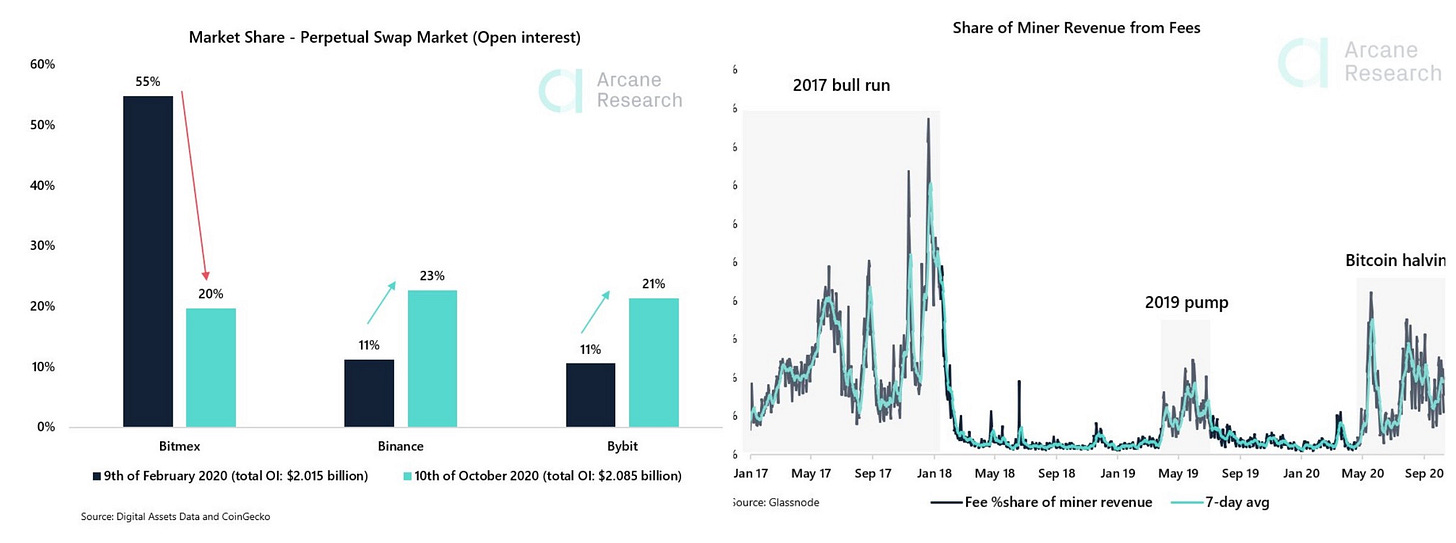

With BitMEX losing liquidity in the last weeks due to its legal issues, the CME is now for the first time in its history the exchange with second biggest amount of open internet in Bitcoin futures. With BitMEX losing liquidity in the last weeks due to its legal issues, the CME is now for the first time in its history the exchange with second biggest amount of open interest in Bitcoin futures.

”Between Feb 9 and Oct 10, BitMEX’s dominance has more than halved, with BitMEX’s share of the total OI falling from 55% to 20%,” wrote Arcane Research. They also noted that transaction fees are currently 9.5% of the miner revenue and that the miner revenue has not been this influenced by transaction fees since the 2017 bull run, as seen in above chart (on the right).

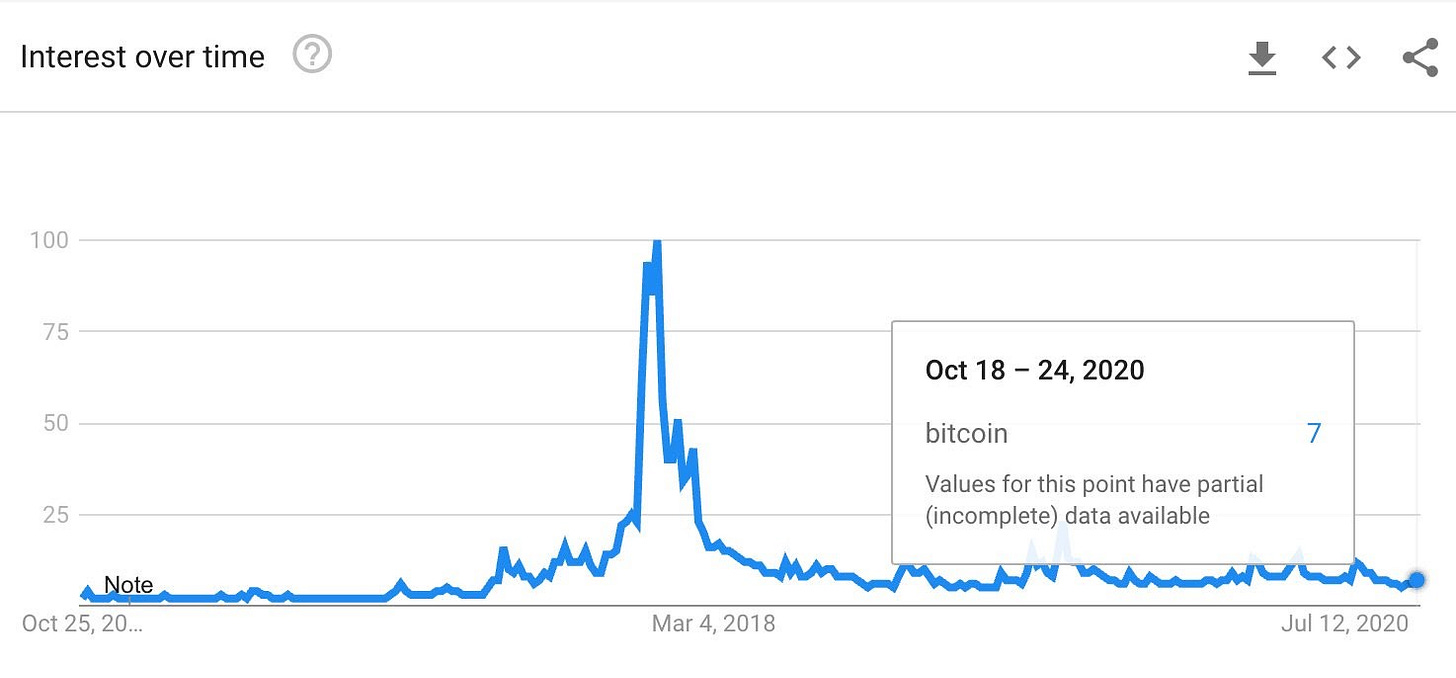

And ending on a extra positive note: Google searches for Bitcoin are still just at 7% of their 2017 peak. We’ll be watching Bitcoin price into the American elections next week, but it’s nice to be reassured that the long time holders have nothing to worry about.

Your friends at the IMF

This Monday was the IMF’s yearly conference (see:what is the IMF). The main panel of this conference was on cross-border payments and digital currencies, which gathered central bankers, including the Federal Reserve chairman Powell, to discuss their efforts at creating CBDC’s (central bank digital currencies) and regulation of cross-border payments.

“I used to say the future is digital, until I realized the future has arrived,” said the moderator of the panel and IMF director Kristalina Georgieva. Most of the panel’s discussion centered around the political consensus of the importance of careful consideration, deep study and multi-disciplinary international team work, mentioning a dozen research centers from Boston to Singapore.

“The dollar still the world’s reserve currency”

All the participants confirmed that the dollar will continue being the world’s reserve currency. Powell voiced the United States commitment to developing technology with the BIS and others and spoke of creating a network of experts, though he did not seem enthusiastic about the subject. “The dollar is the world’s reserve currency and we will be approaching this issue with great care,” he summarized. Other panelists seemed more excited “with the CBDC the central bank will have absolute control on the rules and regulations… and the technology to enforce that.” Said Mr. Carstens, director of the BIS, nicknamed by cryptocurrency enthusiasts “Bitcoin’s final boss.”

Roadmap for international ID and KYC

Dr. Alkholifey, governor of The Central Bank of Saudi Arabia, shared that they are experimenting with digital “fiat money” with their neighbors, the United Arab Emirates, together with 6 commercial banks from both sides of the border. He added that an international ID system that is linked to KYC should be a cornerstone of such an effort for improving cross-border payments. This sentiment echoed the road map published last week by FBS titled “Enhancing Cross-border Payments” and discussed in a following panel, planning standardization and tighter supervision of the cross-border-payments market for all transfers within the G20 and beyond. Grinding forward at a non-start-up pace Georgieva summarized the attitude on the concocting CBDC’s as “Go slow, we’re in a hurry”.

News & links

Users Unimpressed by China’s Digital Yuan Following a $1.5 Million Giveaway

Orders from the Top: The EU’s Timetable for Dismantling End-to-End Encryption

Uk-listed Mode Global Holdings puts 10% of their balance sheet into Bitcoin

Big Oil Goes for Bitcoin: Bitcoin as part of the future electricity grid

Deribit Insights: On Tax Risk in Defi

Twenty-five U.S. based cryptocurrency companies publish guidelines for compliance with G20’s FATF oversight

7. Traders report FileCoin testnet coins sold on mainnet