CFTC dethrones King Arthur

In this edition: Complete breakdown on the BitMEX situation, market commentary, derivatives and on-chain metrics review

On the September 25th KuCoin exchange was hacked for $281 million in cryptocurrency.

On October 1st BitMEX exchange’s executive team was indicted by the US government.

On October 5th notorious cryptocurrency influencer John McAfee was arrested in Spain for tax evasion and illegal market manipulation.

On October 6th the UK FCA banned cryptocurrency derivatives.

But Bitcon’s price barely reacted or acknowledged these dramatic stories. And then this morning, excitement about another Nasdaq-listed technology company (Square Inc) buying Bitcon’s for its corporate treasury seemed to push Bitcoin’s price above $11,000.

So should speculators run for the hills? Or rejoice in the impressive strength of Bitcoin’s price? Perhaps both! So you’re welcome to stretch out in your luxury underground bunker (in the safety of your home) and enjoy our new edition:

BitMEX vs The World

On October 1st, news broke that BitMEX’s founders and executives were charged with operating an illegal derivative trading platform serving US citizens, and indicted by the US attorney for violating the bank secrecy act and not installing anti-money laundering measures (KYC AML). This news came with the arrest of US resident Samuel Reed, one of the cofounders and CTO of BitMEX.

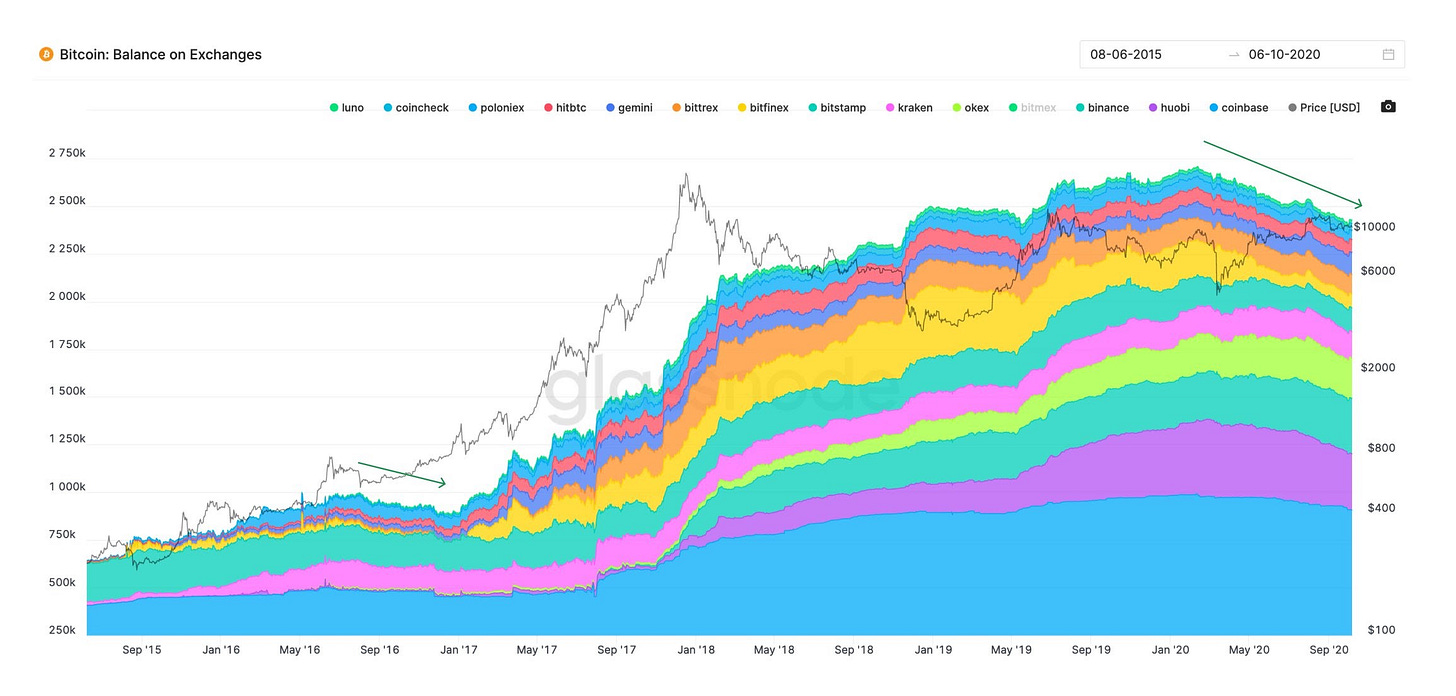

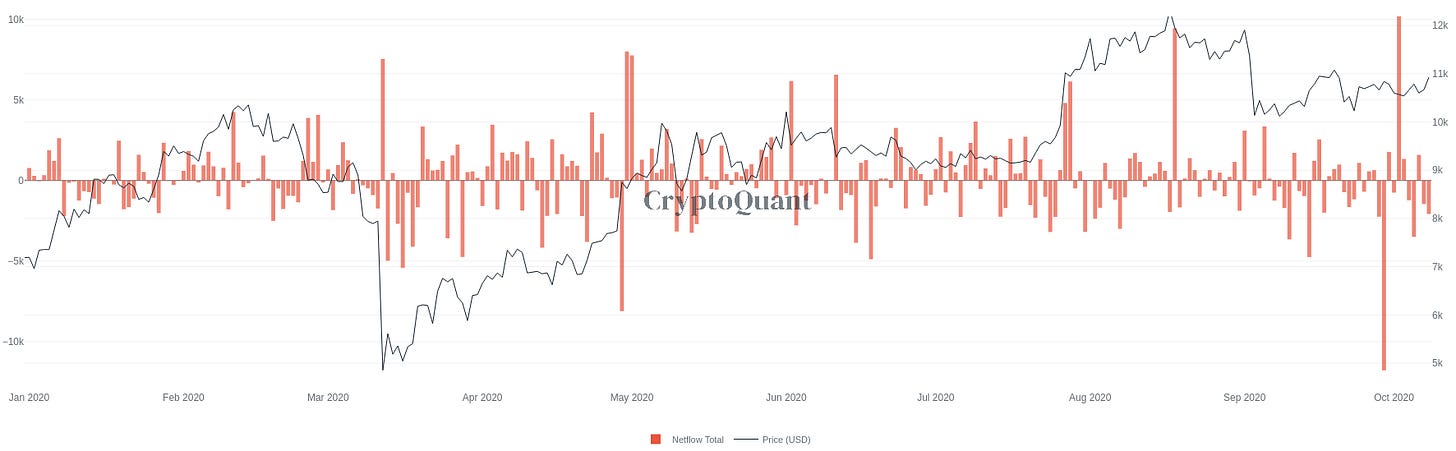

Following, BitMEX opened their exchange for real time withdrawals, and the largest wave of withdrawal of Bitcoin for exchanges in 2020 commenced, with BitMEX experiencing its largest ever withdrawals. The chart above shows net withdrawals and deposits of Bitcoins to 21 leading Bitcoin exchanges since January 1st 2020. According to CryptoQuant, close to 100,000 Bitcoins have left the exchanges since October 1st , 84,242 from Bitmex itself, currently worth $1.1 Billion and $926.6 dollars respectively.

Above: Bitmex net flows and treasury

Until the time of writing customers withdrew a net of 84,243 Bitcoins, or 63% of all Bitcoins held for customers by the Seychelles-based BitMEX, more than double the amount withdrawn a week after the market crash in March.

As for the 15,758 leaving other exchanges, it’s not clearly a sign of fear as Bitcoin has been leaving the exchanges to the safety of private storage since January.

The BitMEX exchange stated on its blog that they have complied to regulation to the best of their understanding and intend to continue operating. Yesterday BitMEX announced that “Founders Arthur Hayes and Samuel Reed have stepped back from all executive management responsibilities for their respective CEO and CTO roles with immediate effect” and that their new interim CEO is their Operations Officer and former Managing Director, Asia Pacific Compliance at Goldman Sachs, Vivien Khoo.

BitMEX, who has no banking infrastructure available to customers and deals only in Bitcoin, seemed to be somewhat prepared for this situation. In July they announced BitMEX had moved to a new holding company named ‘100X Capital’, and started KYC at the end of August.

On Castle Island Podcast, Mark Welsh and Nick Carter commented that they see this as a big statement by the US government, which by “throwing the book” at this large high profile exchange expected to create a ripple effect in the industry. They also added that pushing Bitcoin trading to more regulated venuses will make an approval of an ETF more likely. This interpretation of the US regulators seems to be correct as yesterday the DOJ published a new 83 page document titled “The Cryptocurrency Enforcement Framework”, intended to provide clarity to existing requirements from entities dealing with cryptocurrency.

Market’s reaction to BitMEX’s predicament

As seen above, there is a large gap in the price of future dated contracts. While currently a March 2021 Bitcoin on BitMEX costs $11,211, on Kraken it’s at $11,401. Arbitrageurs could make almost $200 on each contract with no risk, assuming the BitMEX exchange is still operating in March 2021. As this gap remains, it’s clear traders are not discounting BitMEX’s legal situation.

CryptoQuant gave some insight into the movement of Bitcoin’s out of BitMEX and into futures exchanges:

Looking at exchange ‘net-flow’ chart you can see above, that on October 2nd customers deposited 10,555 BTC to Binance, showing the largest single day deposit to Binance in 2020.

On October 1st customers deposited 11,428 Bitcoins to Huobi, creating Houbi’s biggest inflow day since July 2020, which was during a strong Bitcoin price uptrend.

The same goes for FTX who experienced a positive Bitcoin deposit flow for 6 days in a row for the first time since July, taking in a total of 21,152 Bitcoin.

Clear regulation and enforcement is expected to drive semi-regulated and anonymous activity away from centralized exchanges and toward anonymous operators. BitMEX’s situation magnifies the fact that in 2020 it’s more simple to go the fully regulated route with the maturing Bitcoin industry, with the other option being undertaking a ‘pirate’ route of anonymous decentralized trading. The ground between being fully regulated and illegal is shrinking as the regulators are awakening to Bitcon’s importance.

The good news is that it’s easier than ever to run an exchange as a legitimate business.

According to CryptoCompare’s exchange survey, 56% of exchange operators said it has gotten easier to maintain banking relationships in the last 2 years. Exchanges have clearly gotten the regulatory message and are becoming regulated according to the KYC AML regulation of the G7’s FATF. Only 4.3% of the top 26 exchanges inquired by CryptoCompare do not expect to comply with FTAF’s travel rule.

And now for other (exciting) news

According to Cryptocompare’s report: Binance is currently the leading derivatives exchange in terms of volume, with $164.6B volume in September, while BitMEX’s volume was $56.3B, dropping 30%. Both spot and derivatives exchanges total volume went down 17.5% in September.

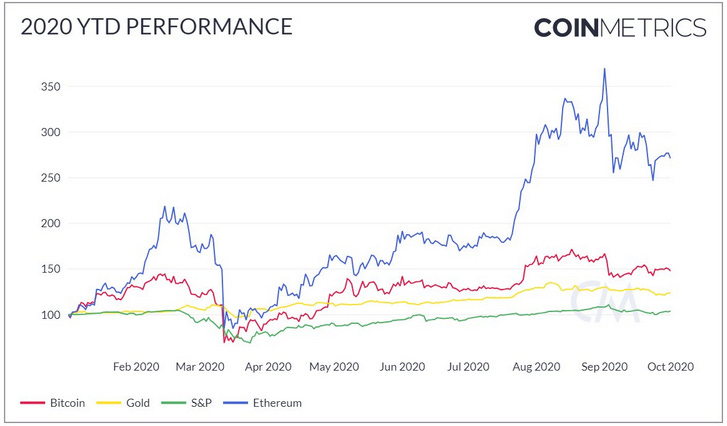

For now we’ll keep to our simple forecast: as long as on-chain and exchange metrics keep breaking all-time records, the coin’s price will keep making higher-highs and higher lows.

This week, Bitcoin and Ethereum reached all-time highs in hashing power created by their respective mining networks.

For the first time, Bitcoin’s hashrate hit 170 exahash while Ethereum miners crossed 250 terahash, now up 80% since the beginning of the year.

The deflation of the DeFi craze can be clearly seen on FTX’s DeFi index.

“ DeFi has seen a very quick boom and bust cycle but we definitely think it is here to stay. And if these cycles continue we can expect significant impact on crypto volatility, particularly ETH.” wrote CoinMetrics.

“This is one of the few times in my Bitcoin career where the fundamentals (on-chain data and metrics from infrastructure players) are in moon mode, yet the market is not woken up to it. They will be by 2021. This is an opportunity I’ve not seen since mid-2016.” explained Willy Woo.

Holding — Bitcoin is increasingly ‘bought and held’ and less moving around. The percent of BTC total supply held for at least one year recently hit 63.5%, its highest level since 2010. Perhaps like people in the covid-19 lock-down, they are prefering to stay at home.

News & links

Bitpanda, Europe’s leading retail cryptocurrency broker, raised $52 million from investors

The three leading retail brokerages in the US are investing in Bitcoin mining company stocks

CoinMetrics: measuring Bitcoin’s decentralization

Crazed users lose $8 million using dangerous software

Official Chinese Communist Party outlets praise cryptocurrency investments.

Metamask Ethereum wallet reports 1 million daily users

7. 150,000 Bitcoins will be returned to MTGox customers on October 15th

Want to join the Efficient Frontier team? We’re hiring!

Efficient Frontier’s market wrap is emailed every other Thursday and published on Medium the following Monday. Join our clients and friends and subscribe to receive it by email