China Exodus

Everything you need to know about the CCP's cryptocurrency miners ban and the effects seen on the Bitcoin network + market summery

Welcome to Efficient Frontier’s newsletter!

On May 21st the high ranking Chinese FSCD called for a general crackdown on cryptocurrency mining and speculation. From May 25th and June 19th local bans were specified in Inner Mongolia, Qinghai and Sichuan provinces.

In Xinjiang province, the ban caused the shut down of the mining hub in Zhundong Industrial Park, which hosts some of the largest mining operations in China. In Yunnan the government instructed miner to buy more expensive electricity from the government's grid, while it banned the popular practice of bypassing the electrical grid and buying electricity directly from power stations.

Network effect

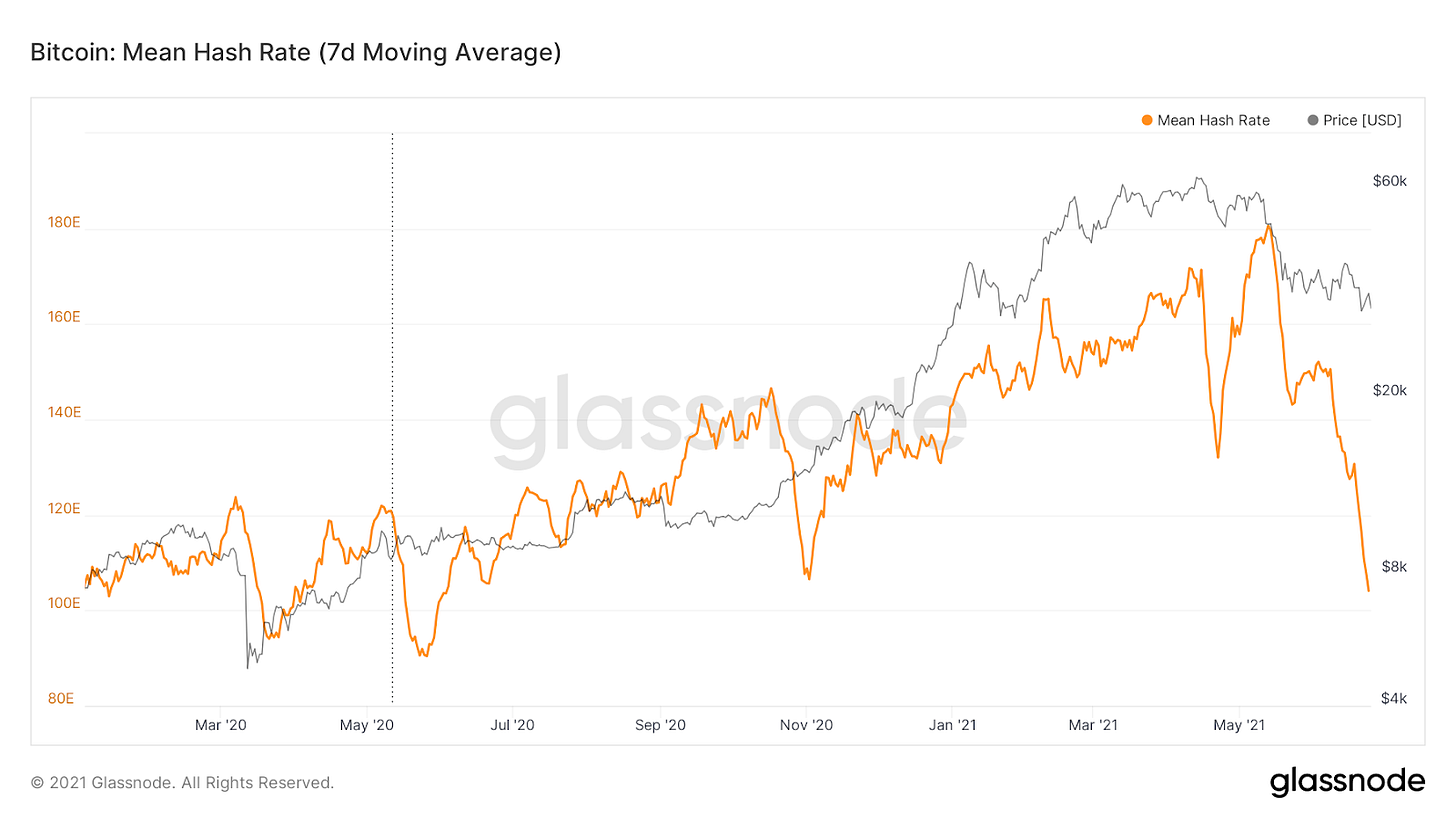

Since May 21st Bitcoin’s network has lost an additional 37% of its hashing power, a total decrease of 70% from its peak in April. This sharp drop slowed down block minting to a 10 year low, one block created roughly every 21 minutes. This is set to correct by the end of the week, creating the largest difficulty adjustment in Bitcoins history (estimated to be -%21). Meanwhile, miners outside of China are enjoying a much higher chance of mining a block.

Explanations for the ban

The first official explanation of the ban on May 21st was to prevent the systematic risk of crypto speculation and to decrease carbon emissions. On June 21st preventing illegal cross-border asset transfer was added in the PBOC’s official notice.

Capital controls: With an estimated 65% of Bitcoins mined yearly in China, close to $2 billions worth of capital can bee easy ‘smuggled’ abroad using locally mined Bitcoin. This ban may curb this practice.

Environmental: This reasoning is not completely coherent, as many miners in China take advantage of seasonal hydroelectric power, but this reason may apply to the majority of the miners in China who depend on cheap coal power.

Financial stability: Though this is the most impactful cryptocurrency ban in China’s history, previous crackdowns also came following a peak in speculation, which in the past ban practices such as ICOs.

Three other speculated reason for the crackdown:

Preparing for the Digital Yuan and centralizing power: The mining crackdown comes as Beijing prepares to debut the digital Yuan and the Apple Daily, Hong Kong’s pro-democracy newspaper, has published its last edition after a police raid.

Integrating the electrical grid: According to Nic Carter, China is trying to increase the integration of the Chinese electrical grid which would make miners buying power directly from power stations redundant. This reasoning was reflected in the shape the ban took in Yunnan, where they ended this practice without banning mining directly (yet).

Goodbye China

It’s a sad time for the Chinese mining and crypto industry which has created the majority of Bitcoin’s mining power for almost a decade. 8BTC News quotes an industry insider saying the quick ban is “Chinese miner's darkest moment''.

Network Effect

Bitcoin’s network lost 37% of hashing power sincfe the ban announcement. According to Zack Voell from Mining Memo, major Bitcoin mining pools, which mostly pool Chinese mining power, have lost over 50% of their hashing power in the last month , indicating mining machines going off-line

Since the ban was announced, Coinmetrics detected high levels of miners withdrawing funds from Bitcoin exchanges (perhaps worried about crackdowns), and a spike in mined Bitcoins being sent elsewhere (perhaps selling in order to fund the migration?)

Sichuan to Texas

Two prominent destinations for miners who are able to make the move abroad are Kazakhstan which shares a border with China, and North America.

On May 26th BIT mining announced it is investing $9 million in a new mining facility in Kazakhstan.

On June 19th the Chinese mining giant Bitmain hosted a meeting for the mining industry and featured a welcoming video message from the Governor of Texas. At the meeting Bitman announced it was building a mining facility in North America.

Three days later, InBlochain partner Eric Meltzer reported on Twitter that a large group of Chinese mining executives arrived in Texas. Carson Smith, the CEO of the SBI mining pool wrote “Many miners began looking for an exit to North America immediately after the announcement on May 21. One owner called at midnight to arrange to put tens of thousands of machines on a boat going to the US. ‘Where's the destination?’ ‘We'll figure that out on the way.’’”

Is it good for Bitcon?

Arthur Hayes and Tuur Deemester both noted this exodus from China may benefit Bitcoin’s image. Hayes speculated that new mining farms financed outside of China will be more compliant with environmental ESG investing. Demeester noted that the popular yet mistaken narrative that China controls Bitcoin is about to be violated. "How much money is sitting on the sideline waiting for bitcoin to show it can survive this stress test just fine?” he wrote.

Related news stories

May 16 Sichuan government instructs energy-intensive enterprises in the area to temporarily cut down their power consumption

June 16 Huobi exchange limits access to leverage above 5X, later bans derivative trading for Chinese customers

June 18 Sichuan province names 26 major mining operations that must shut down by June 20th. Electricity providers must cut supply by the 25th. Afterward crackdown will continue to smaller mining operations

June 20 F2Pool moves from china based AliBaba to AmazonCloud after reported ban

June 21 BIT mining announced it has delivered 320 miners to Kazakhstan, and plans to ship 2,500 more by July 1st to their new facility

June 21 PBoC orders Chinese banks to cut off accounts for crypto OTC merchants — reiterating 2017 banking ban

Bitcoin markets

Bitcoin is still stuck in a range between $41,200 and $29,200, and is likely to remain range bound while many traders go on summer vacation.

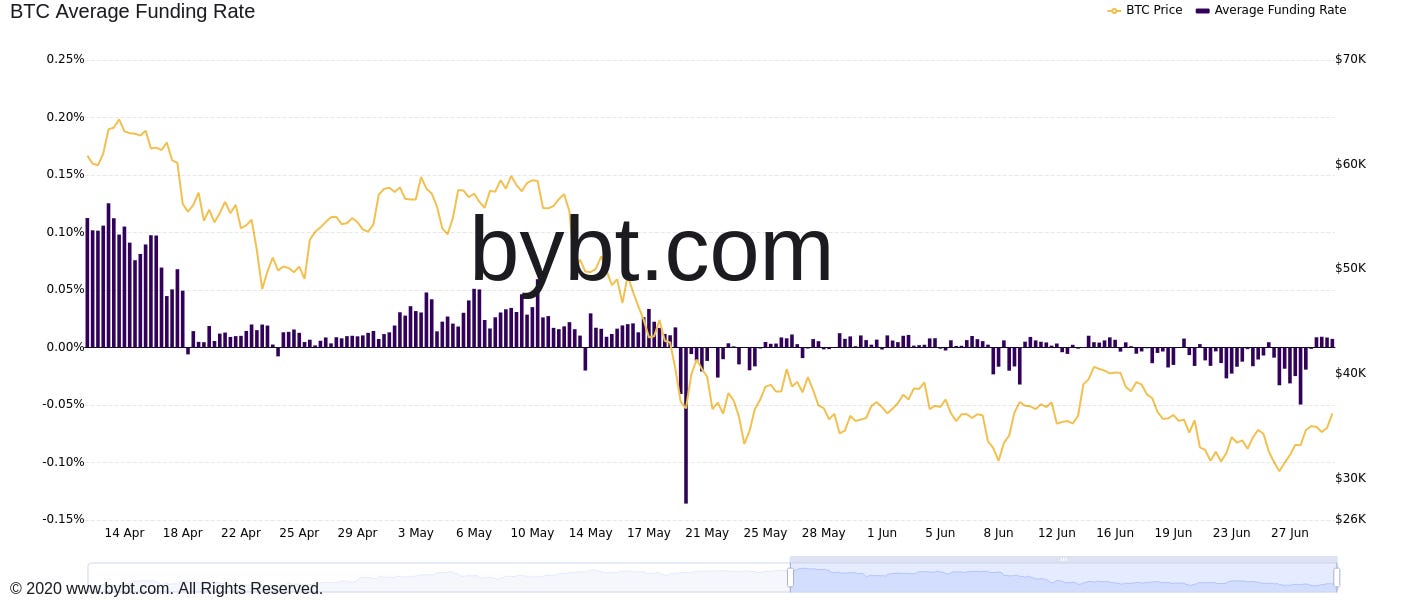

The biggest market event of late was one week ago, June 21-22, when Bitcoin dropped from almost $6,000 to a yearly low of $29,300 before recovering to above $30K, marking the most volatile moment in recent weeks. Fortunately, spot buyers came in at these prices, as indicated by funding rates in the perpetual contracts remaining negative, which the price recovered, indicating that the price move was not led by leverage speculation.

Bitcoin futures Open interest reached a yearly low of $11.47 billion on June 26th but since added on 2 billion worth of contracts.

In this state of slumber, active address have dropped to a 2 year low:

The rest of the crypto market has been suffering as well. FTX’s Altcoin index lost 65% in less than 2 months from its peak in March. It has since enjoyed a 32% recovery since the June 22nd low.

In a positive note, while the market is quiet, innovation continues: Bitcoins Lightning network has reached a new record of 1,500 Bitcoins hosted in the fast payments network, while the number of Bitcoins represented on the Ethereum network counties to grow as well, reaching a new high of 251,000 Bitcoins.

On the 27th the stablecoin market reached a new record market cap- over $108 billion American dollars represented and traded on open blockchain.

Our bet is still on a positive end to the year.

Team update

We're excited to take part in Tracer Dao, our newest venture into on-chain governance, with some of the top players in our industry!

News & links

Tanzania's president calls for its central bank to prepare for widespread use of cryptocurrency, Tunisia to decriminalize Bitcoin

John Mcafee, the software entrepreneur, libertarian and controversial cryptocurrency promoter has passed away

Crime: Africrypt exchange accused of stealing $3.6 billion, SAB bank denies connection. Ledger customers mailed fake wallets. The 'Cryptoking', illegal drug broker and black market Bitcoin salesman arrested in Mumbai

Ontario Securities Commission began proceedings against Bybit

Central Bank of Nigeria plans to launch digital currency by end of the year, Mexcian financial institutions may face sanction for using cryptocurrency, Thailand bans meme-coins, NFTS, fan tokens and exchange tokens

H-E-B, one of the largest private retail companies in the US, starts cryptocurrency ATM pilot

Bitmain present new Scrypt mining machines for Litecoin and Dogecoin

Video: Vice visit the Bitcoin Beach in El Salvador

Binance comes under regulatory scrutiny in Onterio, Japan and the UK

Soros Fund Management, with over $5 billion AUM, will start trading Bitcoin

☮ Sending our love from Tel-Aviv and San Francisco,

Efficient Frontier