Coin Liquidity: Battling for Decimal Points

On reducing spreads, battling for decimals with exchanges, and exceeding market-making clients’ expectations

It all starts with tick size. The tick size is the smallest change possible in the price of an asset on an exchange. The exchange sets the tick size by determining the number of decimals it allows.

One of the tick size’s effects is setting the bottom limit on the spread (For a quick definition of the spread, see this short video.)

A healthy spread is usually between 2x and 4x the minimum tick size.

The job of a market maker is to increase market depth and lower spreads. This ensures that markets are efficient and incentivized to trade.

Sometimes, in the case we’re talking about, a crypto exchange provides an asset with only 4 decimals when it’s traded at under $0.02. This means the minimum spread is outrageously close to 1%, which is… bad. It repels traders, especially day traders and algo traders, and makes the market less liquid.

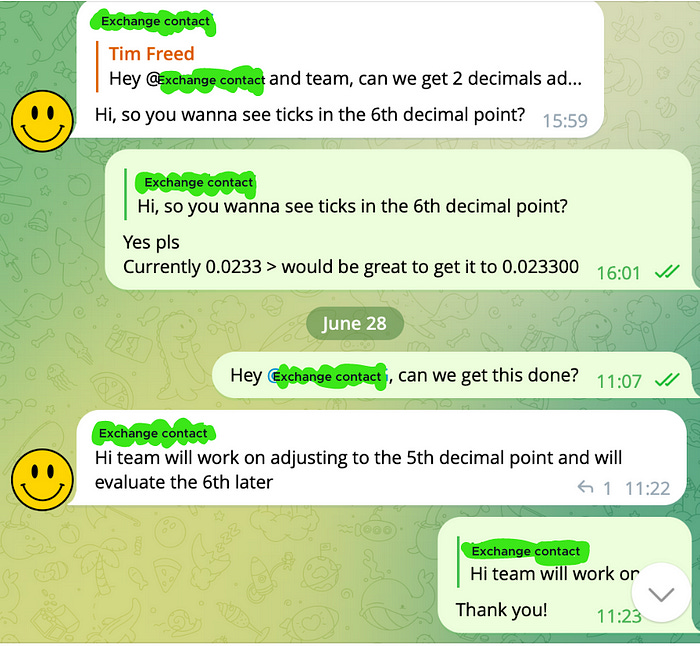

So, we contacted the exchange. Then, we contacted them again. I was even asked once, “Why are you speaking to us every week about this stupid decimal?” But eventually, they agreed, and the exchange gave their developer the request, and our asset got the extra decimal, and then…

Boom! The spread falls by 60%. Liquidity flourishes, and the universe is in harmony again. Kidding aside, this is a big win for this asset. Lowering the spread by more than 50% is a huge improvement for anyone trading it, for liquidity, and for its appearance in the markets.

There is a lot more to decreasing spreads than just adding decimals, and this won’t work for every token in every market. But with the right tech, liquidity, and traders, this is as easy a win as you can get in crypto.

Right now, we’re working on an issue with another exchange where mismatched decimals in two markets of the same asset are causing trading inefficiency.

We’re glad to be moving in the direction of higher professionalism. Successful market making isn’t only about good tech; you have to combine it with particular attention to clients and sharp, detail-oriented traders.

At Efficient Frontier, we thrive on attention to detail and top-notch client service. Join us for successful market making in crypto! If you’re interested in talking, please feel free to reach out anywhere or email us at sales@efrontier.io.