De-Fi Summer

An overview on the Decentralised Finance landscape. And following up on our last post: How accredited investors may lose money arbitraging GBTC

Red Hot Etherean Summer: The return of 2016

While the expression ‘decentralized finance’ describes many things, the abbreviation De-Fi is used to describe transactions that settle the state of financial instruments hosted on a blockchain. It includes activities such as experimental digital contracts for swapping synthetic assets, loan contracts, and even derivatives, mostly using set-ups running on the Ethereum network.

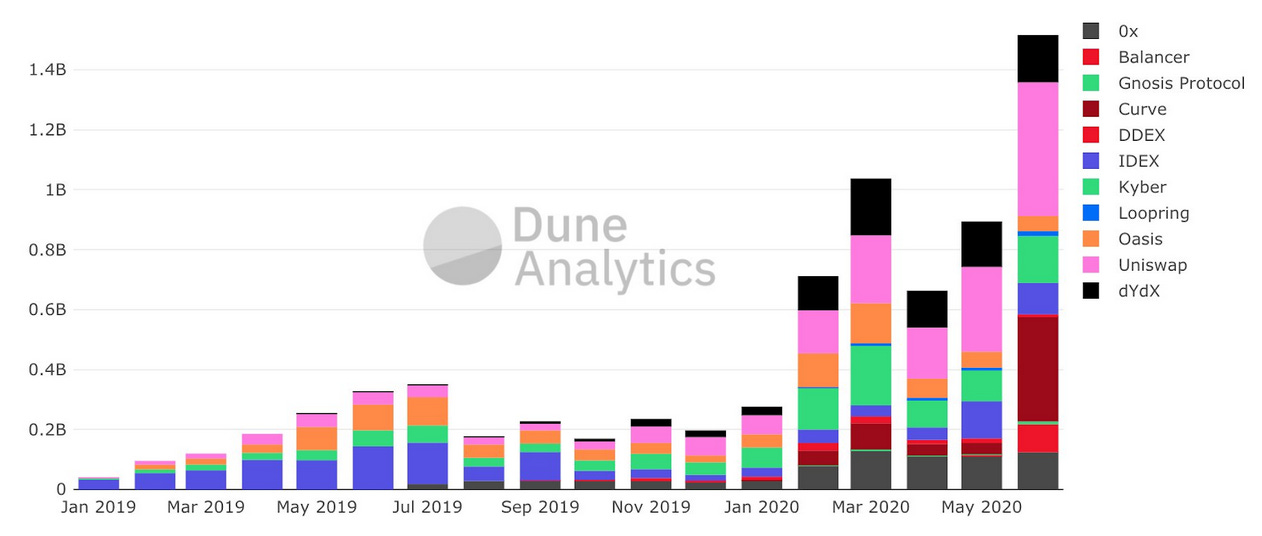

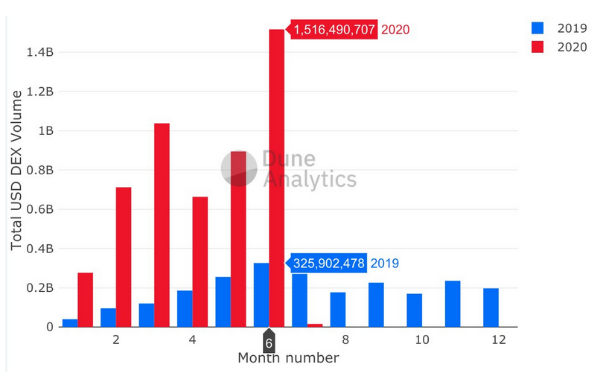

DEX monthly volumes. Source:Dune Analytics

June 2020 saw record breaking volumes in the non-custodial digital asset exchange (or DEX’s), creating a humble $1.516 billion in monthly volume.

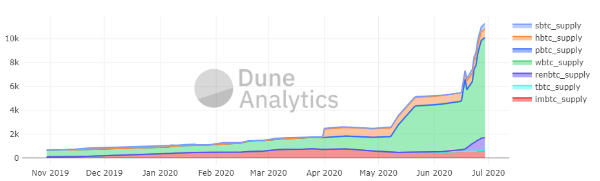

Market capitalization of ‘Synthetic Bitcoins’ on Ethereum. Source: Dune Analytics

This month we also saw growth in the amount of ‘Synthetic Bitcoins’ on Ethereum, led by WBTC (Wrapped Bitcoin), a centralized, Bitcoin backed ERC20 token. Bitgo, the creators of WBTC, promises to back each minted WBTC token with a real Bitcoin in their vaults. In this way Bitcoin’s value can be involved in Ethereum-based applications and financial activity, such as DEX’s and experimental blockchain-based derivatives.

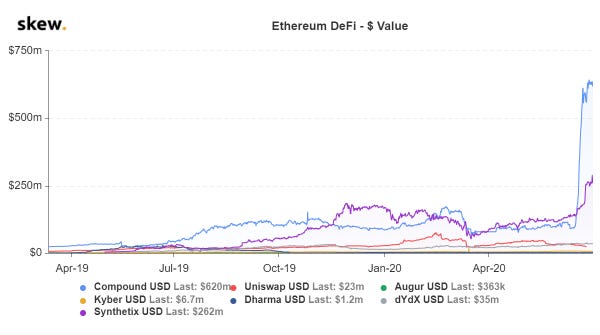

Source:Skew.com. Money currently controlled by De-Fi contracts.

De-Fi liquidity: the charts above shows the amount of money (denominated in USD) which is readily available for trading in a various automated De-Fi protocols. According to CEO of Three Arrows Capital, Su Zhu, in 2017–2018 Ethereum’s De-Fi programs were not useful enough. Today Ethereum hosts a plethora of stablecoins (USDT, WBTC, Dai and more) and liquid token exchange protocols, which allow swapping between any asset built or hosted on the Ethereum network. For example, exchange protocols Kyber and Loopring both ICO’d in 2017 but took several years to achieve useful volume levels. Use cases such as lending, distributing tokens to early users (‘liquidity mining’) and seeking profits for providing liquidity, made De-Fi in 2020 interesting to speculators.

Decentralized finance, and venture backed De-Fi tokens and products have a long technological road ahead of them if they truly want to create stability, usability, and decentralization. The official end goal is to provide benefits and usefulness to society, such as world-wide cheap pay-day loans. But as with anything involving exploding valuations of start-up stage ventures, especially with digital tokens transferred straight from venture capitalists to enthusiastic retail investors, caution is very much warranted. Much effort has also gone into gaming automatic semi-decentralized systems, to steal or squeezemoney out of them, taking tens of millions of dollars only in 2020. These two aspects of De-Fi clarify the large gap between dreams and reality. This summer De-Fi is sparking the imagination, encouraging experimentation, and as customary in cryptocurrency markets creating heavy risks and speculation.

Total USD DEX (decentralized exchange on Ethereum network) volumes in 2020 VS 2019.

Hotel Grayscale: the great hoarding

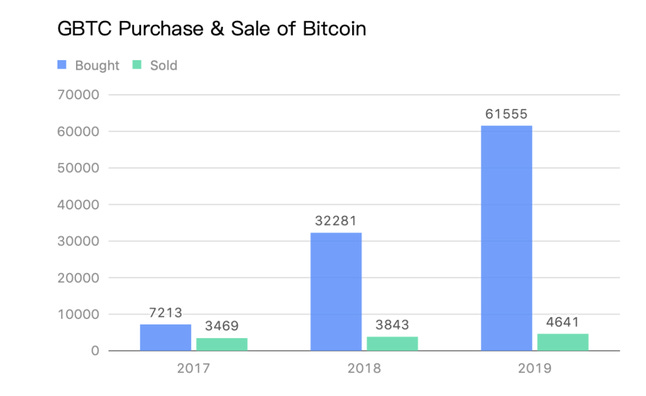

Following up on our last edition’s commentary on how funds are making millions arbitraging Grayscale funds, we see a need to explain “what we had gotten wrong”: an unlimited amount of Bitcoins and Ethers can be deposited in Grayscale’s GBTC and ETHE funds, but they can not leave due to current USA regulation, which allow the fund to sell real coins only to cover operation fees.

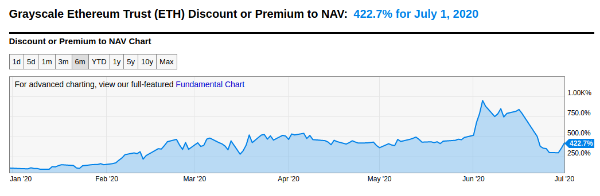

Today the only way out of an GBTC or ETHE investment is to sell its paper shares in the public, which is highly profitable. But as in any simple profitable condition, the more the opportunity is known, the more entities join the bet and eventually arbitrage it away. So if demand for shares drops due to unforeseen events or an approval of a competing ETF, while GBTC and ETHE are oversaturated with coins from hedge funds who borrowed money trying to catch the premium, this might cause the premium to go negative. In that situation, funds might be forced to sell their shares at a discount or in a panic, with no arbitrage forcing the shares back up.

Although the motives for locking 2.2% of Bitcoins supply in these funds are not institutional buying and holding it nonetheless affects the supply of coins which are locked in Coinbase Custody’s ‘hotel’ until regulators allow selling.

According to Avi Felman, a trader at BlockTower Capital, and CMS Holdings, ETHE’s premium recent 50% drop was related to Ether’s price spike. Around June 22nd, a large batch of ETHE shares was unlocked for selling and new supply reduced ETHC’s premium by around 50%. The very profitable sellers were happy to cash out and quickly bought real Ethereum in the spot market, to repay their lenders. This caused a short term strong impact on Ethereum spot price which rose by close to 4% on June 22nd.

Do I even have an option?

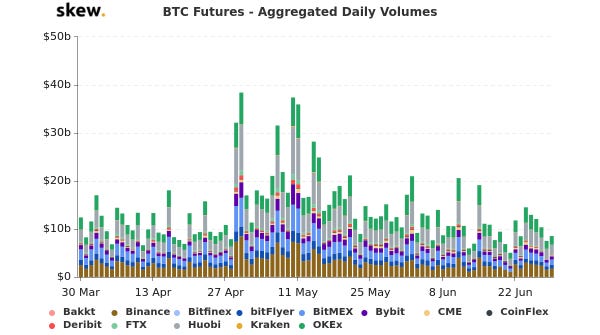

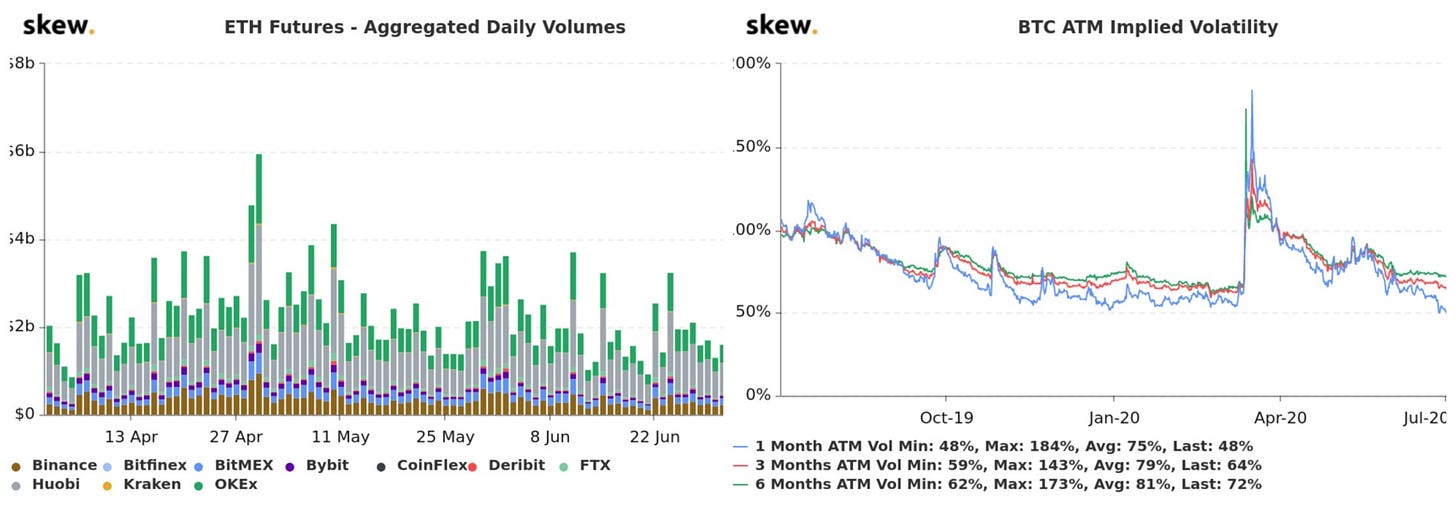

Bitcoin Futures trading activity hit an all-year low Sunday after slumping to just $5 billion.

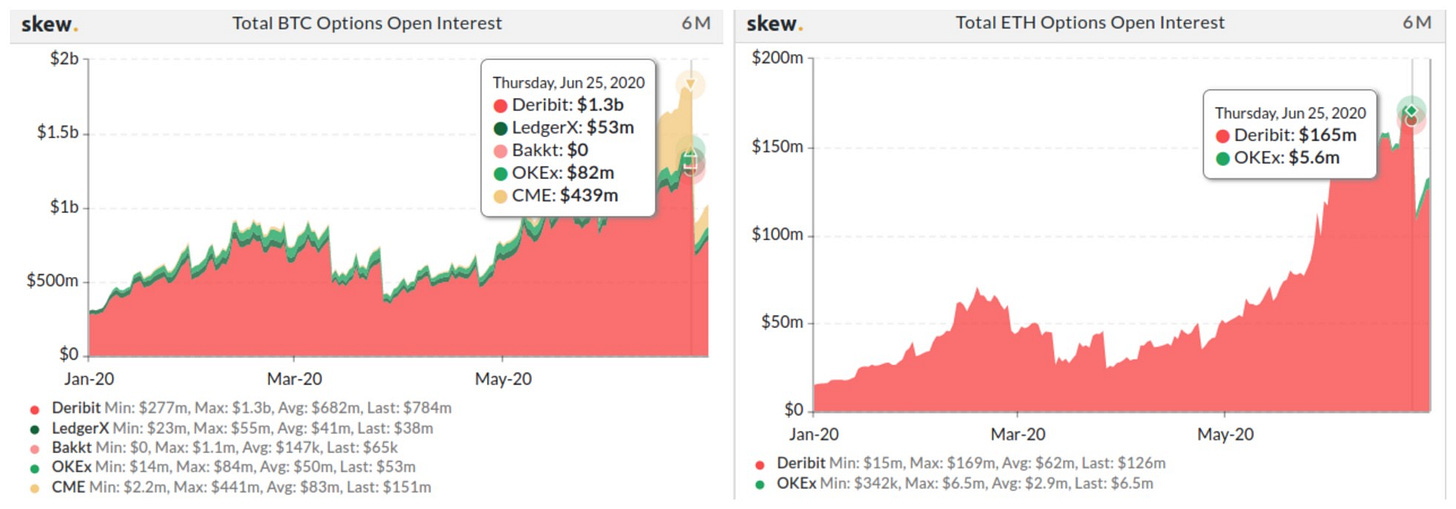

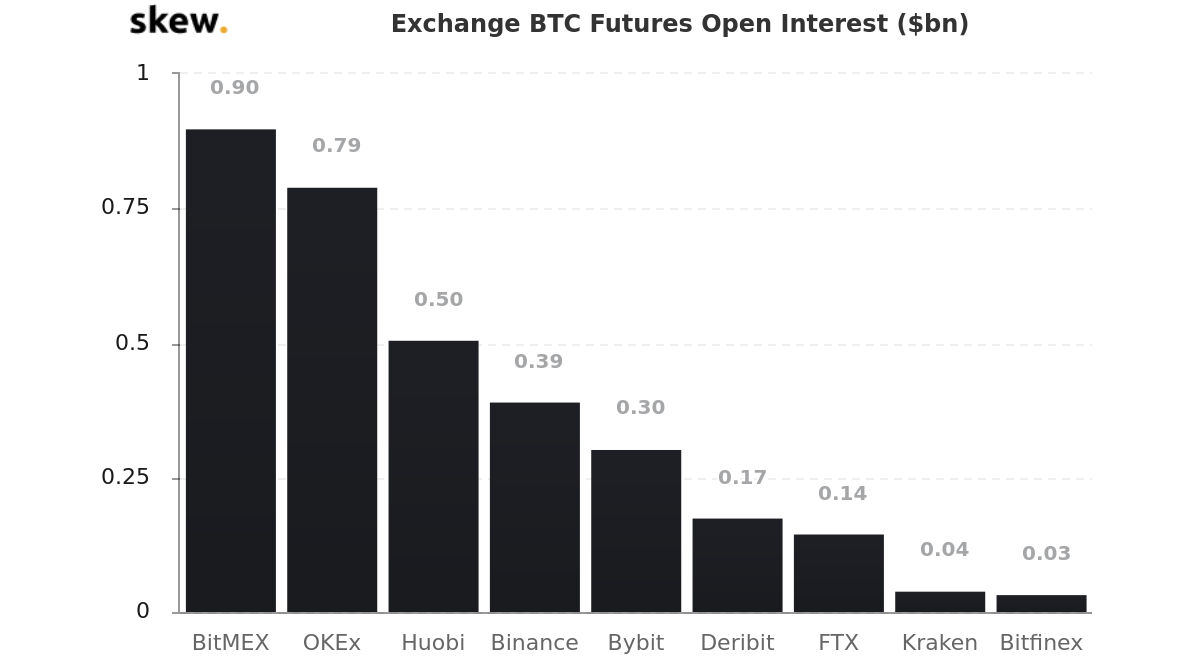

Surprisingly, the highly anticipated June 26th expiry of a record $1 billion worth of options showed little impact on Bitcoin’s prices. This is unusual as many markets, even regulated venues, very often experience price manipulation and volatility close to the expiry of high-interest contracts. This puts into question the accuracy of the OI calculations.

The spot and futures market as well as the low volatility tell the same story of a sleepy market:

And quietly, BitMEX has regained lead in OI, perhaps due to their growing effort to compete with incumbents as we mentioned here.

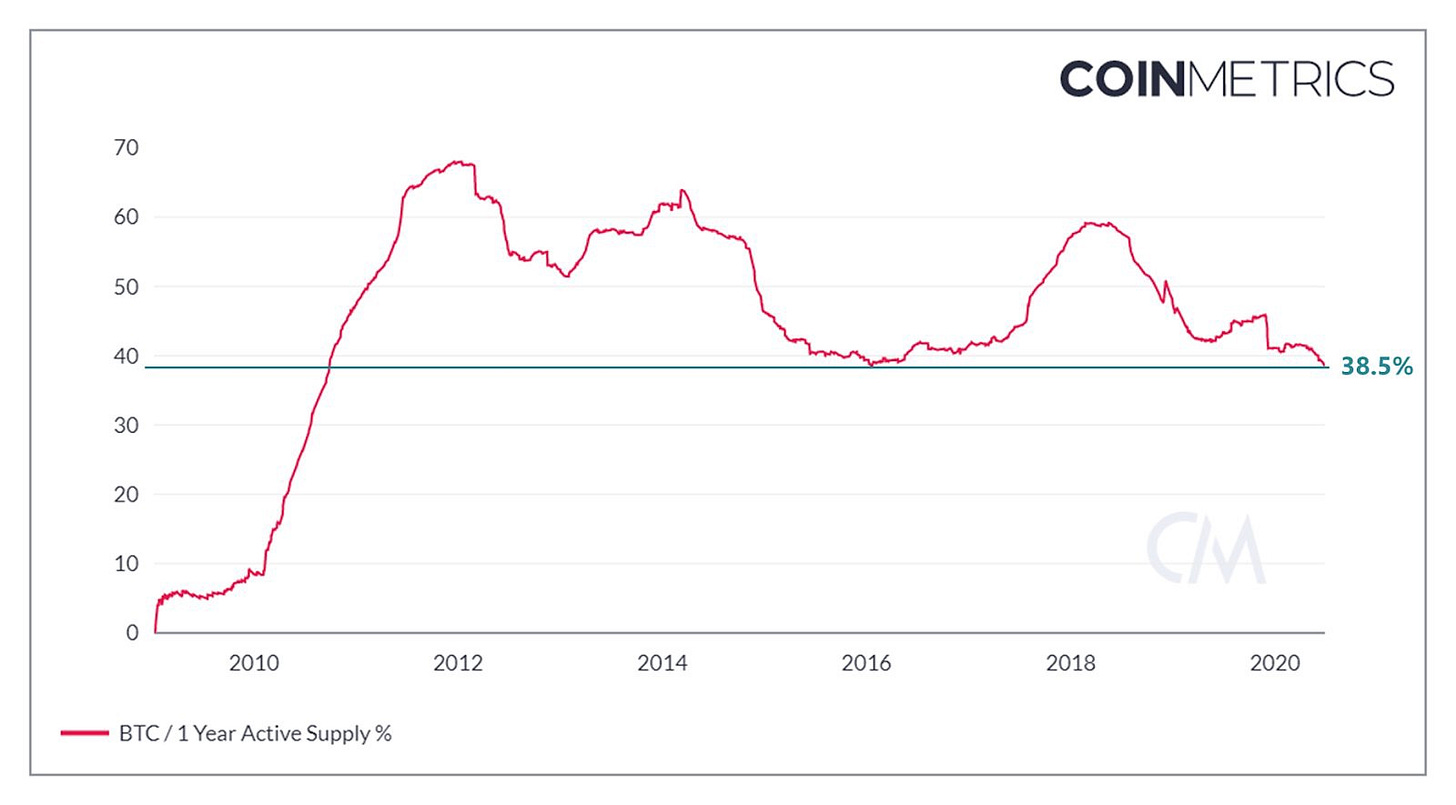

In conclusion: with idealistic excitement returning to Ethereum and a sleepy Bitcoin market, is it 2016 again? Only 38.5% of the total Bitcoin Supply has moved in the previous year, the lowest level since early 2016, according to CoinMetrics:

News and links

FTX published a new Monthly Digest

Bitfinex adds paper trading

Deribit Insights: A Comprehensive Overiview of Bitcoin’s Current State

Supporting development: OKEx and BitMEX grant $150K to Bitcoin Core developer, Kraken pledges the same sum to open-source BTCpay and Square Crypto announce UX grants.