How GBTC went negative

What do Google and the Iranian government have in common? And all the rest of the crypto news and market wrap

First, a quick update

After spending 10 days under 50K per-coin, Bitcoin reached a new record price this Sunday: $61,699, after a nerve-racking dip to $43,300, when many institutions sold down profitable positions, driving the GBTC premium negative.

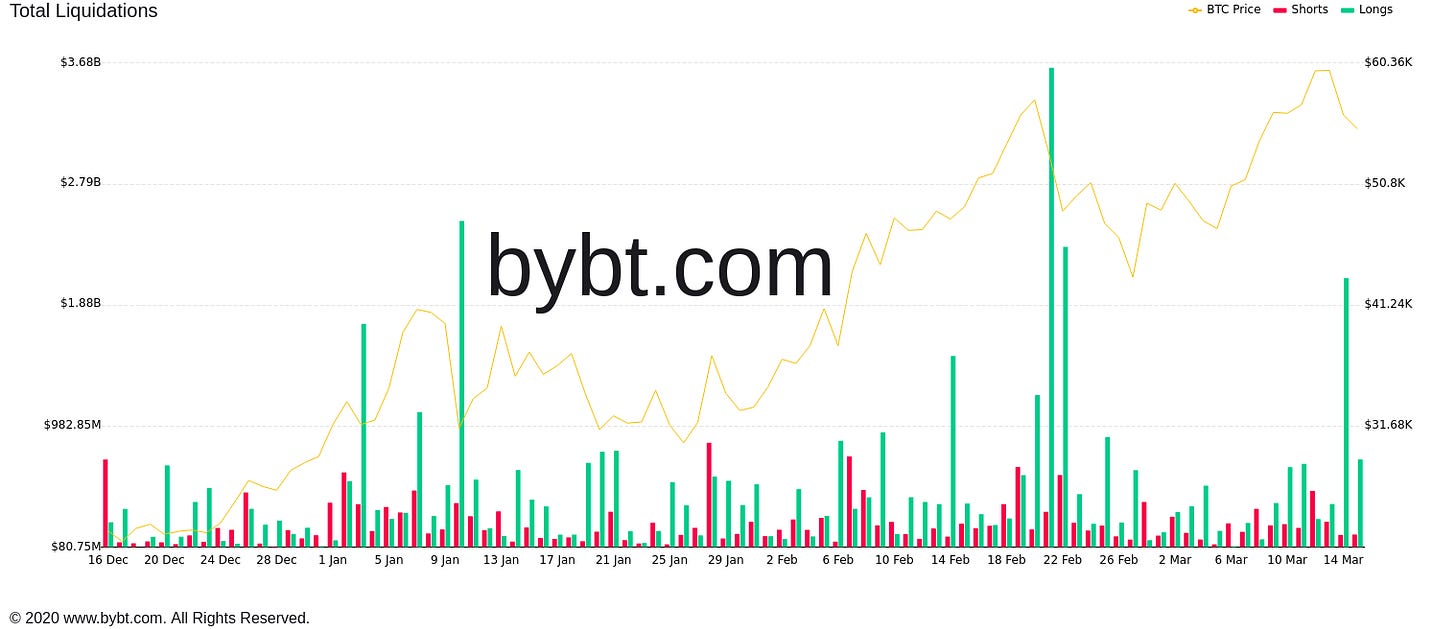

$2.08 Billion worth of long liquidations followed the descent from the new record back to the mid $50K’s where we are currently.

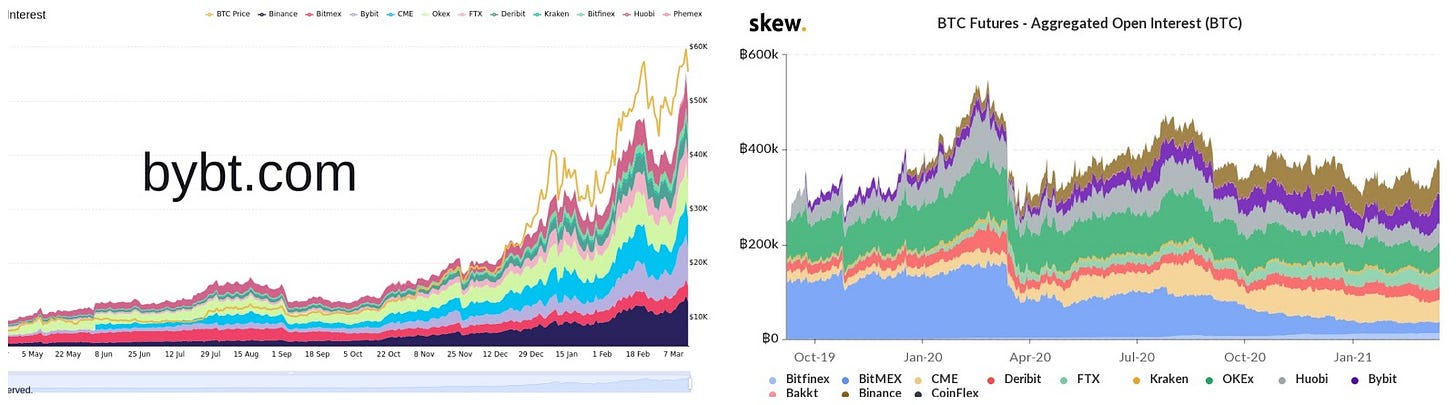

Dollar open interest broke new records with Bitcoin’s price, though an interesting chart from Skew (on the right) shows that open interest denominated in Bitcoin peaked in January. This price peak was also accompanied by a lower volume - around $150 billion a day across the leading futures exchanges.

Do institutions have weak hands?

Last week we found out that one of the largest pension funds for Israeli citizens, Altshuler Shaman, with $51 billion under management, invested in Bitcoin through Grayscale’s GBTC. Mr. Altshuler told Globes Magazine they decided to invest 0.3% of their fund in December 2020 when Bitcoin was at $20,000. According to Altshuler when the price doubled they sold ⅓ of their position and plan to sell off $50 million more in the future to cover their initial investment.

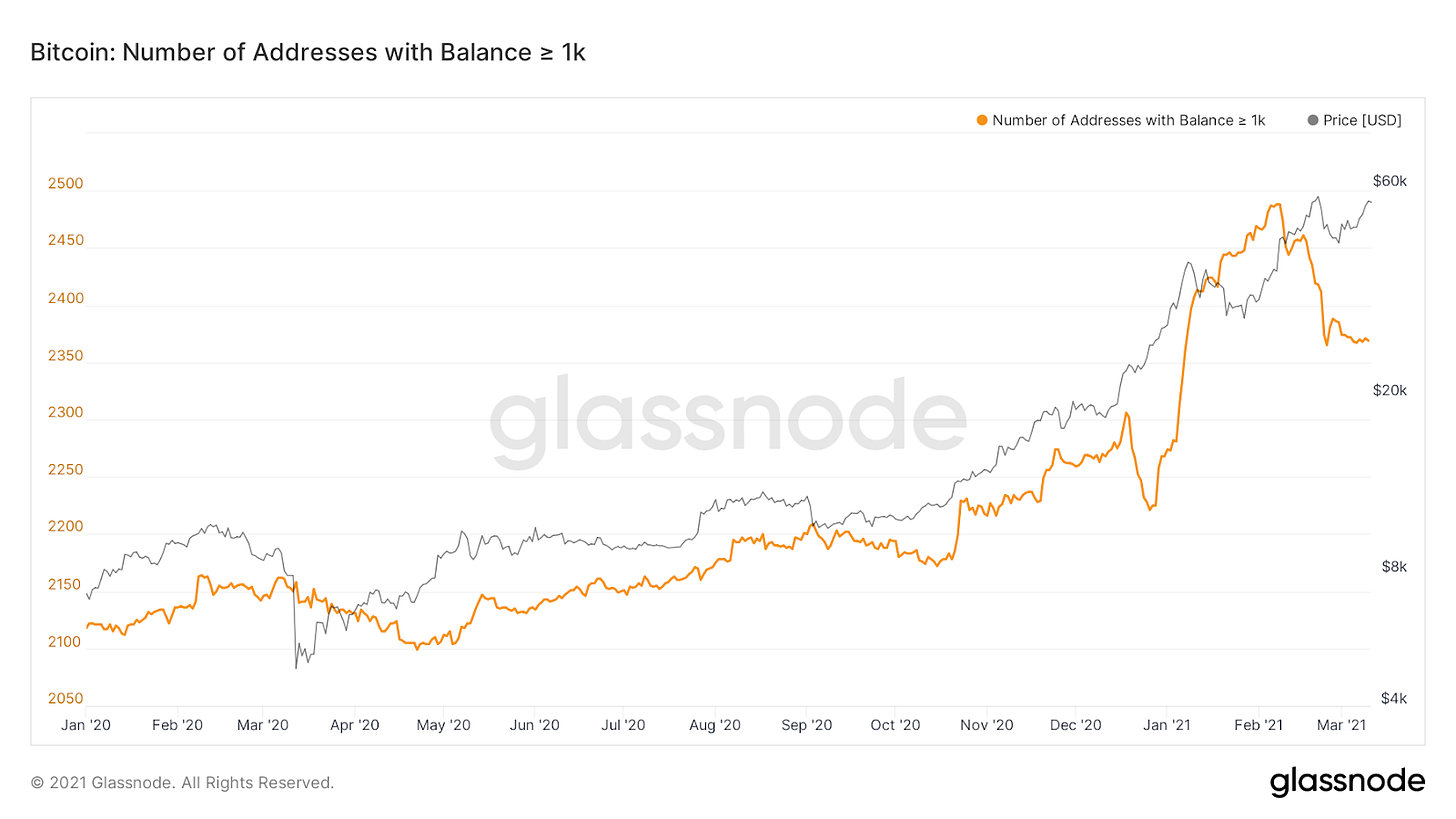

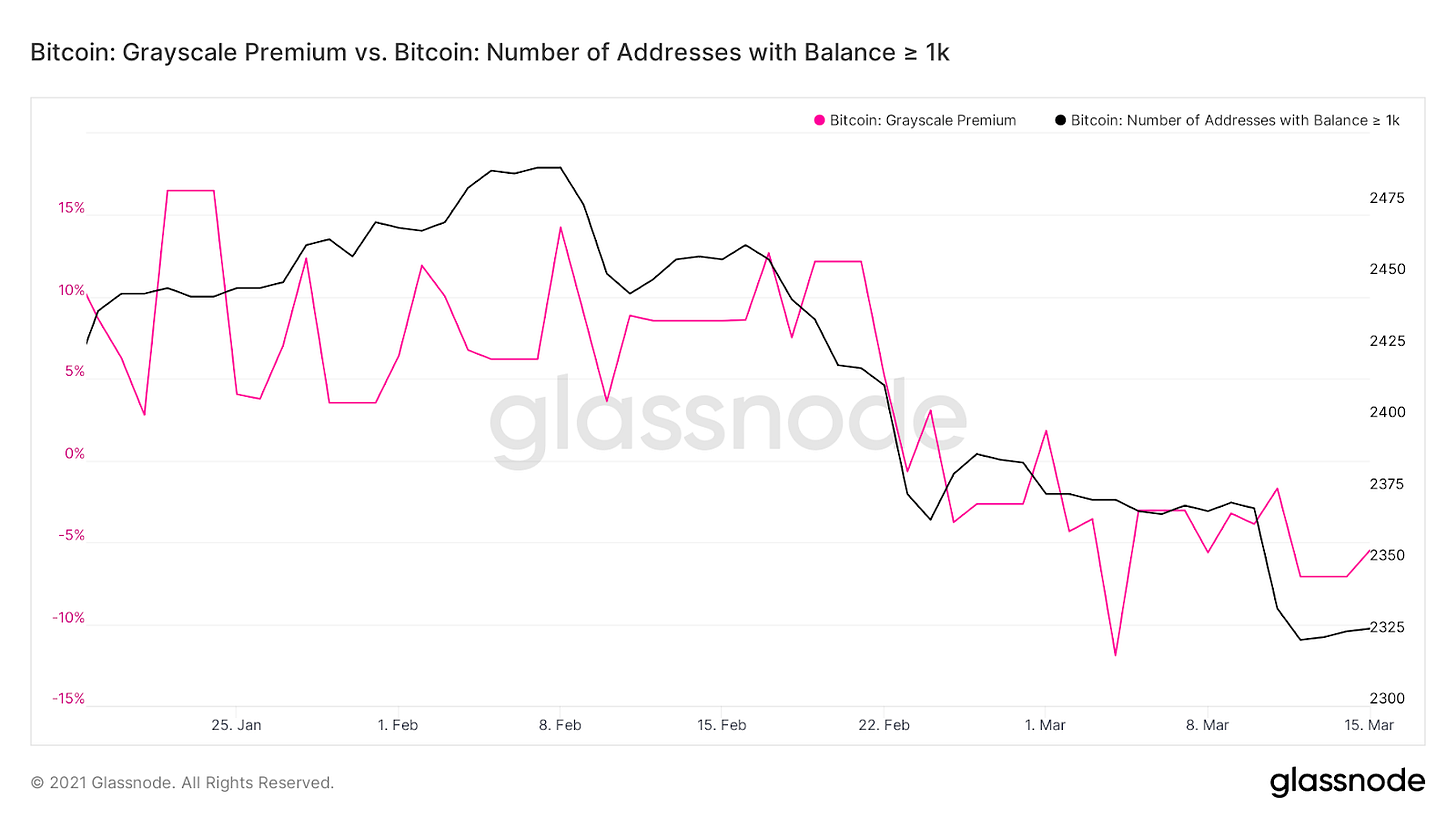

This sentiment seems to be shared by many other institutions. On-chain analytics (seen above) show “institutional size” Bitcoin addresses with over 1000 Bitcoins (currently over $56 million per-account) grew sharply since December - by 263 accounts, peaking as Bitcoin rose through $40,000 per-coin for the first time. As Bitoin price kept rising this February, the number of these bitcoin-rich accounts dropped sharply. Were these institutional investors taking profits like Altshuler?

"We decided to take profit on part of our position- to first of all bring back home the capital we invested," Ms. Atlshuhler candidly explained, giving insight into the mindset of large funds with a small percentage investment in Bitcoin. “They’re not necessarily entirely sold on it [Bitcoin], but they don’t want to get rid of it, they just want it risk free, so they’re just selling a bunch. That’s a thing I’ve heard from several sources in the last weeks.” said on this topic DonAlt in a conversation on the ZoomerJD podcast.

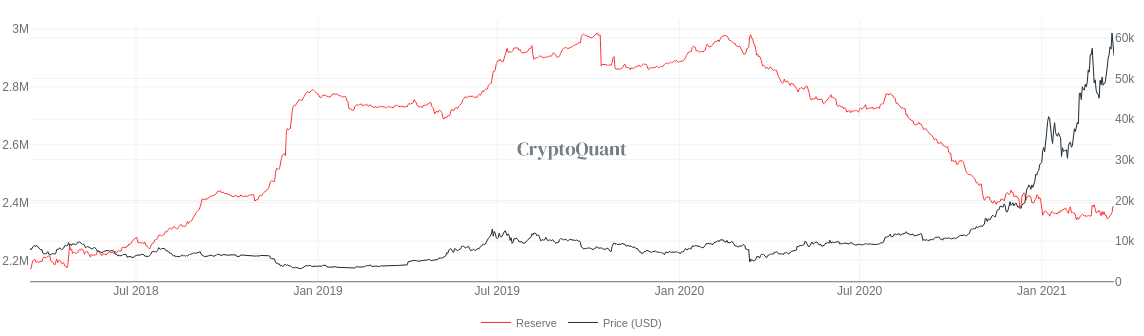

Many institutions did not choose to hold real Bitcoins, but like Altshuler Shaham, chose to invest in Bitcoin through Grayscale’s exchange traded GBTC fund or the CME futures. GBTC's unusual structure does not allow arbitrage with Bitcoin, which usually resulted in a high premium to the Bitcoin price. But in December Grayscale added to GBTC a supply of 94,000 Bitcoins (close to $500 million worth of shares) to its already large $32B billion on offer. As institutions likely hurried out of their positions, Grayscale suffered the results of this market inefficiency. GBTC reached -15% to the Bitcoin price on March 4th (and ETHE almost -10%). The Grayscale premium started its drop in tandem with the on-chain bitcoin-rich accounts, hinting that this is likely due to institutionals rushing to take profit when their initial investment doubled.

CME Bitcoin futures, also considered to reflect demand for Bitcoin exposure from institutional investors, had open interest sharply drop by 30% since February 21st, when Bitcoin’s price peaked at $58,000, losing $1.38 billion in open contracts by May 8th, before bouncing.

Art of marketing

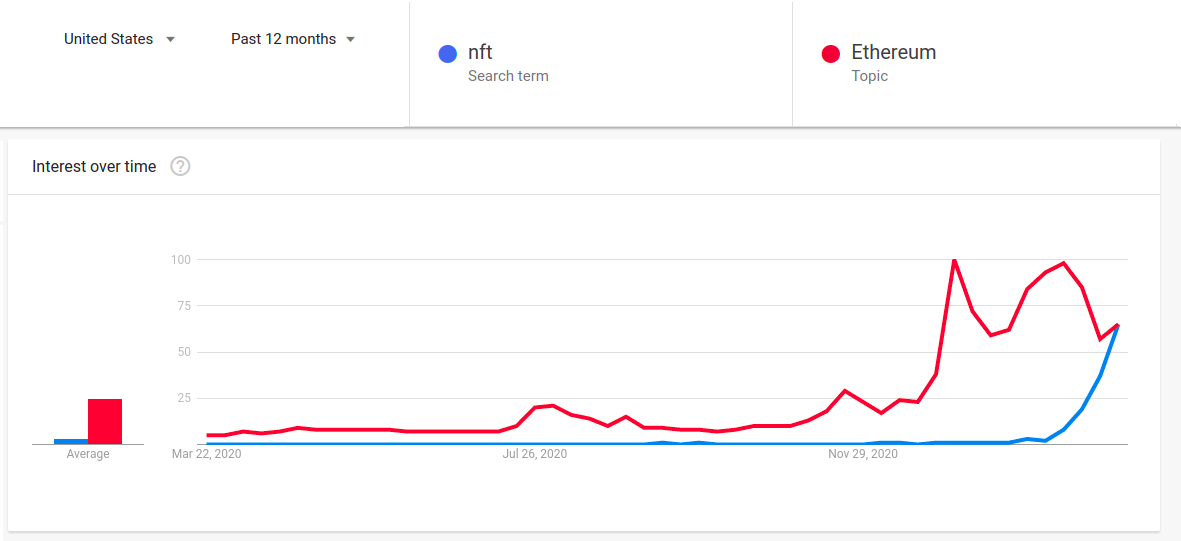

While institutions are buying, selling or integrating Bitcoin, NFTs (blockchain tokens representing images or files) are drawing mainstream public participation. After a NFT sold for $69 million last week, in the last 24 hours, multiple NFTs were sold for over $100,000, some representing fine art but mostly for collectibles - digital trading cards.

What do Google and Iran have in common?

Due to the abundance of breaking news , we’ve added this week an extra news section divided into categorizes

Companies

$6 billion Norwegian holding company Aker ASA invest $58.3 million into Bitcoin

Hong Kong-listed App company Meitu buys $40 Million worth of Ether and Bitcoin, then adds $50 million more

Rakuten “The Amazon of Japan” allows customers to fund accounts with cryptocurrencies

Google Finance has started featuring a crypto section

Government

Binance is being investigated by the US CFTC over concerns it permitted US residents to trade cryptocurrency derivatives

India proposes law to completely ban decentralized cryptocurrencies

US bill proposed to fully regulate cryptocurrency and to create committee to clarify the definition of a security for crypto

Iranian government think tank strongly recommends their government start a big mining operation.

Banks

Morgan Stanley will be the first US bank to offer wealthy clients access to Bitcoin

DBS in Singapore will be the first traditional bank to start a cryptocurrency exchange

J.P. Morgan bank recommends Bitcoin to clients as a diversifier and files an investment in a basket of cryptocurrency related stocks

177 year old Swiss Bank Bordier to provide Bitcoin services

Citi bank writes massive report on Bitcoin, says it has potential for international trade but is still at a tipping point

Other news

BlockTower raise $25 Million for DeFi fund

Outlaw update: Three DeFi protocols hacked, scammers create fake Digital Yuan website. Tether threatened with 500 BTC ransom note

BitMEX founder Arthur Hayes to surrender to US authorities, John McAfee faces prison time, Hacker tries to sell software exploit as an NFT and is banned from website, NFT website hacked

Bitcoin mining in Inner Mongolia, based mostly on non-renewable energy, will be banned in April 2021 due to Chinese Government’s green initiative

Etherum’s July hardfork update ‘IP1559’ will burn network transaction fees instead of awarding them to miners

American retail giant Walmart to offer fintech banking services

Edgy comedian Tim Dillion takes on NFTs

Team update

We’re very glad to announce that Alameda Research has invested $2 million in Efficient Frontier!

Coindesk won’t stop quoting Efficient Frontier’s BD Manager Andrew Tu

The Efficient blog

The ultimate guide to decentralized derivatives part 2: Synthetix

Everything you need to know about one of the most popular and complex on-chain synthetic protocols- Sytnhetix.

Sending our love from Tel-Aviv and San Francisco,

Efficient Frontier