Double Bubble

The 4 biggest themes of the last weeks in the fast paced cryptocurrency world which is quickly converging with reality (and a quick defi and Bitcoin markets overview)

The pace of change, the volatility and other fun factors make following the cryptocurrency world a bit disorienting at times. Lately news at large has been disorientating as well, and adding to this mix, cryptocurrency and the ‘outside world’ are quickly converging. Mainstream acceptance is exploding while the need for inflation and sovereignty hedges seem the most needed they have been in our lifetime.

So here’s a list of themes we made to wrap our head around

1)Regulators concerned by the borderless freedom of crypto

According to Investor Erik Townsend, Bitcoin poses a serious threat to the government's monopoly on issuing money. But he believes that since enough institutional investors are now invested in Bitcoin, at this point it’s “politically inexpedient” to ban it.

This Thursday morning Yahoo News’s headline story features a loosely threaded narrative that tried to link Bitcoin usage to right-wing extremists and racist websites. It also floated a speculation that last week's storming of the capitol building was possibly somehow funded with Bitcoin.The article concluded with a call for increased scrutiny and regulation of cryptocurrency.

This Wednesday a video of nervous sounding ECB (European Central Bank) chairman Lagarde, was shared by Reutuers: “For those who thought it [Bitcoin] might turn into a currency, I'm terribly sorry, but this is an asset that is a highly speculative asset, which has conducted some funny business.” she continued “ It has to be regulated… it has to be agreed upon at global level...because if there is an escape, that escape will be used.” she said, and with more than a hint of urgency to her voice called for strong compliance to the FATF regulation, echoing our ‘regulators’ panic’ theme from our last newsletter.

As we noted last time, some regulators are increasingly nervous about Bitcoin and are somewhat shocked by Bitcoin’s viability and ease of usage.

2) Regulators welcome cryptocurrency into supervised banks

Last monday the US federal banking regulator published an interpretive letter saying that these financial institutions can participate as nodes on a blockchain and store or validate payments, meaning blockchains are awarded the status of a “payment network”. The letter followed the OCC decision to allow banks to transact and custody stablecoins.

One of Bitcoins’ many new surprising proponents, former Federal Reserve chairman Kevin Warsh approves: “I think that Bitcoin does make sense as part of a portfolio in this environment, where you have the most fundamental shift, for example, in monetary policy, since Paul Volcker.” he added “I guess if you’re under 40, Bitcoin is your new gold… every day it’s getting new life as an alternative currency.”

3) Wall Street & big business let Bitcoin into their hearts and pockets

“Bitcoin is a journey, not a destination, and everyone is on their own path. Every morning when I study Bitcoin, I find myself deeper in awe, humbled by the power, and potential, of its unstructured simplicity. The more I learn about Bitcoin, the more I realize how much there is to know, and how much I want to know. There’s beauty in Bitcoin. If you study Bitcoin intensely, with humility, and… [be] mindful of Wallace’s deep wisdom that sometimes ‘the most obvious, most important realities are the ones that are hardest to see’” wrote Stone Ridge investment’s CEO in a recent letter to their clients. Praise Satoshi.

"Our default reaction is to be deeply dubious when we hear 'this time it’s different,' and we point to a history of speculative manias and financial innovations that left behind significant carnage. It’s this skepticism that reduces the value investor’s probability of losing money. However, in a world where so much innovation is happening at such a rapid pace, this mindset should be paired with a deep curiosity, openness to new ideas, and willingness to learn before forming a view. " Howard Marks, founder of OakTree (an asset management firm with almost $140 Billion AUM), wrote on the topic of Bitcoin, in his latest investors newsletter.

CFA (Chartered Financial Analysts) institute published an investment guide for bitcoin, blockchain and cryptocurrency for investment professionals, while BitWise’s new survey showed the number of financial advisors allocating to crypto in client portfolios rose 49% in 2020, from 6.3% to 9.4%. 17% of advisors who do not currently allocate to crypto say they will either “definitely” or “probably” start an allocation in 2021, up from just 7% in 2020.

4) Bitcoin’s cycles VS the money printer

After rising from a low of ~$4,000 in 2020 to manic heights of close to $42,000, people are wondering if this Bitcoin cycle is over. After all Bitcoin did have an unbelievable run-up after the halving. Others are calling for a 2013 type ‘double bubble’, where Bitcoin experienced two distinct periods of strong price growth due to growing understanding and adoption, as it is experiencing today. But a unique difference in 2021 is increasingly realistic inflation fears fed by Central Banks money creation and monetary policy, which draws investors to Bitcoin for secular reasons, no matter where it is in its halving and hype cycle.

Bitcoin timewarp

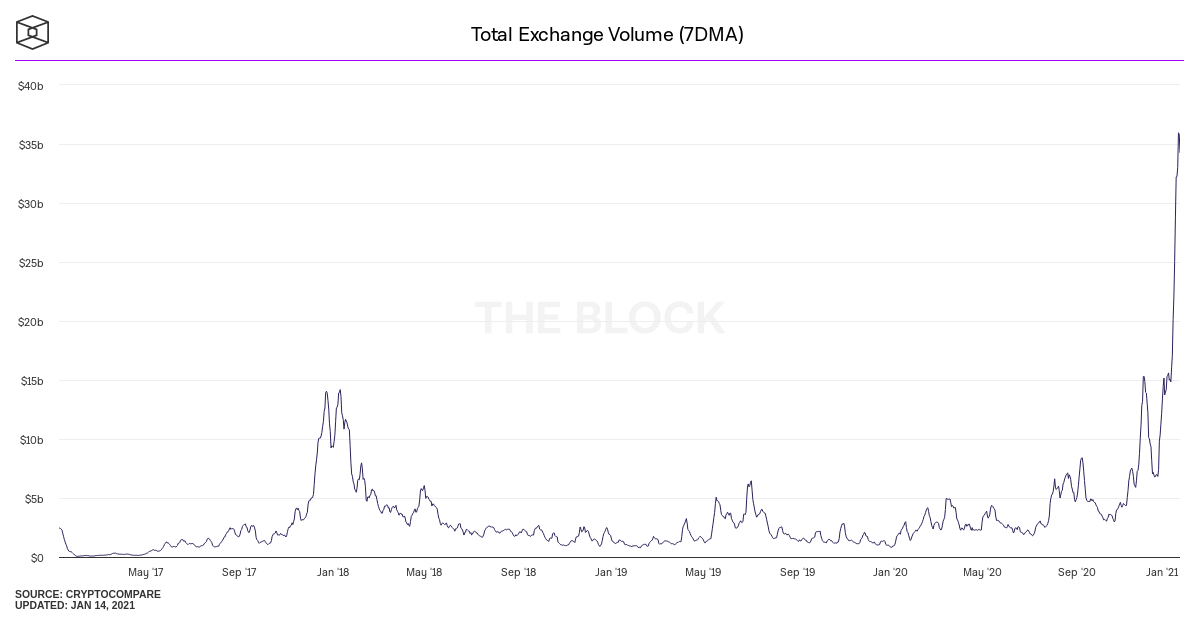

10 days ago on Saturday, Bitcoin’s price reached a new record - $42,000. Bitcoin’s price spent the next two days slipping until last Monday it crashed by more than $8,000 (25%), reaching close to $30,000. Panicked sellers created a new record spot volume on Coinbase and Binance. That was despite the fact that $30,000 per coin was hit for the first time only 17 days ago.

“Coinbase reached $9.56 billion in daily exchange volume — about a 57.9% increase from its $6.05 billion previous peak in January 7, 2021,” wrote The Block.

From that low, the price climbed up until re-touching $40,000 and currently trading in a range above $35,0000.

And not surprisingly, as seen above, Bitcoin futures and options volume and open interest broke to new all-time highs with the price as well.

Ether-Fi

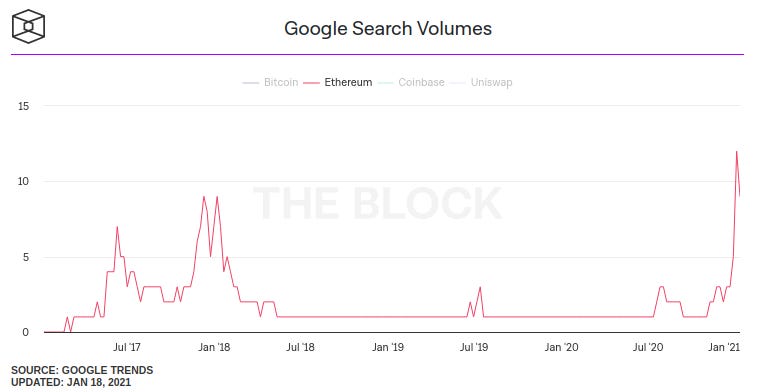

Ethereum transactions have reached their all-time daily highs, with TheBlock showing over 1.2 million daily transactions, clearly coming from on-chain trading and De-Fi activity. This activity stems from a limited but growing number of addresses, now close to 500K unique addresses. This is while Google Searches for Ethereum hit all-time highs last week, as well as the amount of dollars held in De-Fi apps on the Ethereum blockchain, the current equivalent value of 6.9 million Ethereum tokens.

News& links

Popular EU Trading app eToro, temporarily limits customer buying of Bitcoin due to shortage

Canaan miners release immersed liquid cooling solution

End of an era: UK orders unregulated cryptocurrency businesses to shut down, crypto derivatives ban goes into effect

Indian cryptocurrency exchange raises $15 million.Fidelity increases investment in Hong-Kong Bitcoin broker OSL

Finnish Customs to sell $75 million worth of Bitcoin from 2016 crackdown, while German authorities seize servers of another major dark-market.

European officials crawl closer to CBDC; Goldman Sachs announce cryptocurrency custody

Russian lawmakers pass crypto bill

Fiat fun: Have UK citizens hoarded $67 Billion in cash? Unexplained $1.3 Billion uncovered in Vatican bank transfers to Australia

Team update

Sharing our latest quotes in Coindesk:

“‘On a technical basis, things have been overbought for a while,’ said Andrew Tu, an executive for quant trading firm Efficient Frontier. “The overall trend is still upwards and this seems unlikely to change, though the pace may not be like it was during the holiday season.”

“‘Andrew Tu, an executive for quant trading firm Efficient Frontier, sees the $36,000 price level as “resistance,” an area where bearish traders seem primed to hit the sell button on bitcoin. “Right now bulls are challenging the $36,000 resistance. It failed to get past $36,600 earlier during the afternoon Asia hours,” Tu told CoinDesk. “When the U.S. East Coast woke up, the market started bidding the price upwards again.’”

“Altcoins are surging ‘in ways that we have not really seen since 2017,’ Andrew Tu, an executive at quant firm Efficient Frontier, told Shen.”

“‘We have seen [altcoins] pump – both before and after [Monday’s] correction – in ways that we have not really seen since 2017,’” Andrew Tu, an executive at quant firm Efficient Frontier, said.

Bitcoin’s market capitalization hit a new record high on Jan. 8 but has dropped since then, evidence that some traders may be taking some profits from bitcoin and plowing them into altcoins, according to Tu.

“Andrew Tu, an executive of quant trading firm Efficient Frontier, pointed to the inverse relationship between the U.S. Dollar Index and bitcoin as a macro example. The index, also known as the DXY, is a measure of the greenback versus a basket of other fiat currencies. ‘The rise in DXY was simultaneously accompanied by a drop in BTC,’ Tu told CoinDesk. ‘On a fundamental level, the economy looks weak, thus probably driving a risk-off move into dollars.’”

Sending our love from Tel Aviv and San Francisco,

Efficient Frontier