Efficient Frontier October 2023

All eyes are glued to the courtroom as we listen with angst to the testimonies against Sam Bankman-Fried. The crypto world is speculating and hoping he pays the consequences, but what really interests us is the impact on the market. There was widespread fear regarding liquidating FTX & Alameda assets. We will continue to cut through the FUD & provide analysis of the market implications for our partners as we did here.

Note from our CEO

Efficient Frontier’s HQ is in Tel Aviv and obviously things are not as usual. The events of the past week have been profoundly unsettling. Together with our friends in the Tel Aviv crypto startups scene, our Crypto Aid Israel initiative so far has raised over $170,000, to help the families who lost loved ones or had to leave their homes.

To contribute through this effort, please go to cryptoaidisrael.com (beware of copycat addresses).

As an international company serving clients from many different locations, we are dedicated to keeping up our level of service and continue to earn the trust you’ve placed in us.

We appreciate you care and trust.

Sincerely,

Yohai Rayfeld

Chart of the Month

Ethereum ‘Whales’: The chart above displays Ethereum's price in black since October 2019. The blue line represents the number of Ethereum addresses holding over 10,000 ETH, as recorded on the blockchain. These addresses are considered large, or ‘whale’ investors.

In the red square we marked a recent decoupling between the number of ‘whale’ addresses and the price of ETH, showing a decrease of 145 ‘whales’ since February 2023. This sparks the question: Where are they going and why?

Blogs and feeds

EF Blog: Industry upgrade

On the evolution of crypto exchanges over the last half-decade from the viewpoint of HFT trading.

X/Twitter Feed: Chiming in again on the market making discussion. A short insight into daily market-making operations.

Podcast: Navigating the crypto ecosystem with Andrew

Andrew Tu, our VP of Sales, was interviewed on HashTalk. A rare chance to hear Andrew’s expert view on our industry.

EF Blog: Market making 101

Following recent online discussion, we answer the question that confuses many internet users: What the heck is market making?

Team update

Conferences: Our Co-founder, Roei Levav, attended ETH Milan.

Kudos to Tim Freed, Head of Client Services and Growth, for spearheading our involvement in CryptoAidIsrael.

Commentary: Fear of FTX’s Liquidations are Overblown

FTX liquidators published a new summary of the bankrupt exchange’s holdings, valued at $3.5 billion. The initial news triggered a quick sell-off, but this has since recovered for good reasons. The liquidators' sales of Bitcoin and Ethereum may reach up to $100 million per week, totaling $752 million. However, it appears that stricter controls will be applied to the smaller-cap coins, possibly aimed at minimizing market turmoil.

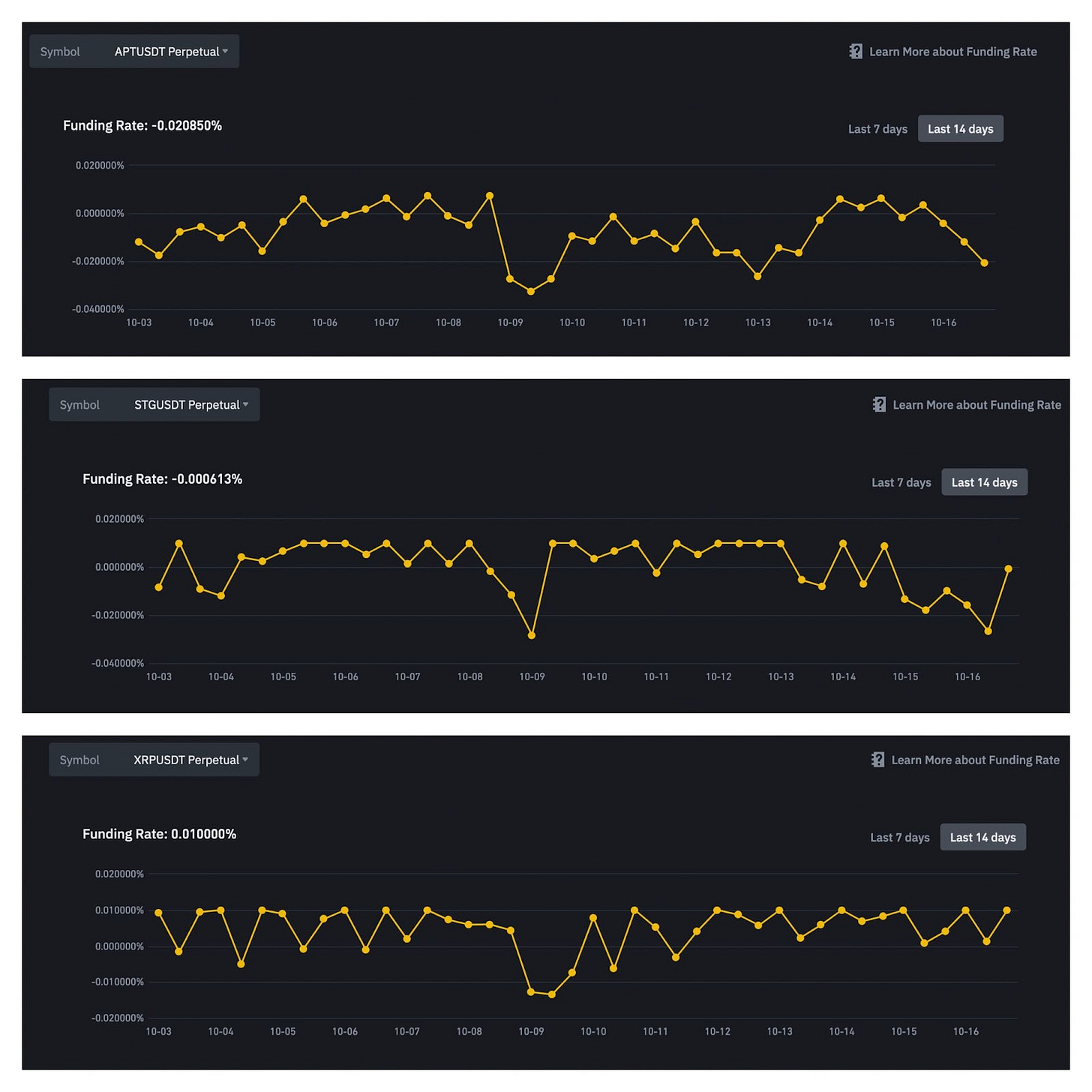

Traders’ choices confirm this assumption. The price of shorting Ripple, Solana, Aptos, and Stargate Finance on Binance’s perpetual contracts barely budged since the publication of FTXs holding and until today.

Open interest has drifted upwards, which could express a measured shift of the liquidators from spot to future. This is a likely first step in seeking liquidity to gradually offload Galaxy’s positions.

Nevertheless, the situation is grim for tokens like BitDAO, with $49 million in tokens awaiting liquidation. With a maximum market depth of $23,000 at 2% from the price on SushiSwap. Galaxy Digital, the official liquidators, face a grim task. One of the best options for tokens in this predicament would be to sell them back to the DAOs and foundations that created them.

Taking a closer look at the perpetual contracts, since the announcement, negative funding on Aptos has risen from around -0.015% to approximately -0.02% today. These changes are still marginal. The same applies to Stargate Finance, which has $46 million in assets for sale, and Solana, with a total of $1.1 billion in tokens, including over $300 million available for liquidation. Since the Galaxy Digital announcement on August 25th, funding for Solana has shifted from marginally positive to marginally negative.

When selling smaller-cap coins commences and becomes meaningful, it will be clearly signaled by a shift in the funding rates.

The fake story of the BTC ETF being approved gave us a little taste of what it could be like if and when it does eventuate. We are hoping for better times ahead in both markets and in the world.