Entering the greed zone

Where are we in Bitcoin’s bull cycle? And will we know when the top is in? Using the objective sentiment indicator MVRV we got some answers. Then we looked at the state of the state crypto derivative

Rebooting perspective: almighty realized cap metric

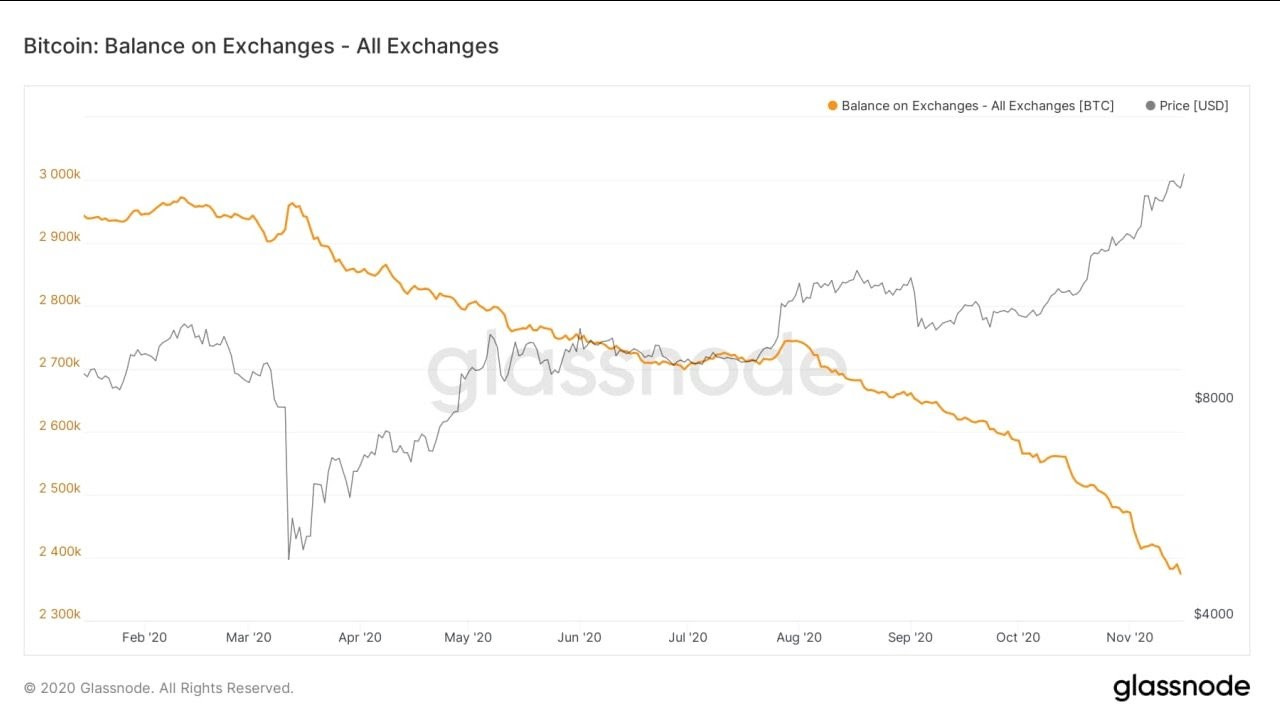

With this massive Bitcoin run up, re-calibrating the long term perspective is called for. To get perceptive, let’s look at MVRV (Market Value to Realized Value), realized value and MVRV Z-score. All these related metrics use on-chain information unique to our industry to create objective sentiment indicators.

Realized value looks at the blockchain and Bitcoin’s price history to check at what dollar price each coin was last transferred on the blockchain. This shows its psychological fiat value, which is often the price it was bought at. A coin which moved on the blockchain yesterday at midnight is valued at $18,400, a coin that last moved on January 1st 2020 is valued at $8,300. Averaging the realized price of all 18.5 million Bitcoins gives us an estimated realized market capitalization. Different companies adjust this metric differently but everyone agrees it’s breaking records. According to GlassNode Bitcoin’s realized value or price basis passed a record $7,000 last week.

Relative Unrealized Profit/Loss Metric or MVRV takes the realized price and calculates the ratio between the realized price and the market price, and maps the ratio into sentiment zones. LookIntoBitcoin’s chart currently estimates a 60% profit per- coin on average, putting us at the bottom edge of the ‘greed’ red strip. As you can see above, previous price cycles had Bitcoin’s price go further into the greed zone, accompanied by strong pullbacks before it established its final push ( For more detailed explanation of MVRV click here).

Encouragingly, the MVRV Z-Score chart above, which calculates the standard deviation of the MVRV, shows that while Bitcoin is far from the capitulation zone (last met during the March 12th crash) we’re still far from the top red box of ‘extreme greed’. The significance of the red box in the MVRV Z-Score is that it correctly pinpointed the last two cycles blow-off tops within two weeks.

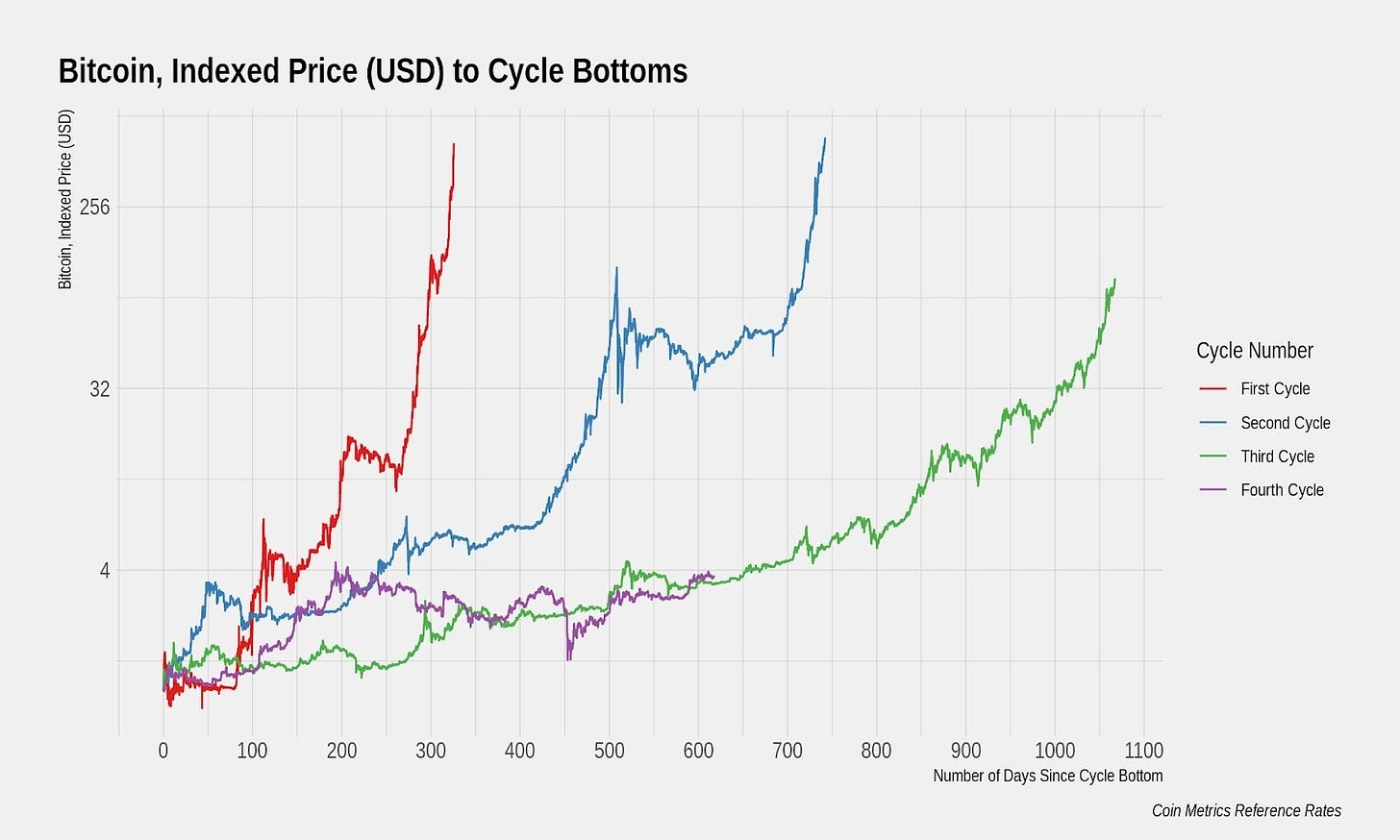

The above chart from Coinmetrics showed the pattern of the last three bitcoin price cycles, from the bottom of the cycle to its top.This graphic builds expectations for a slower but still very profitable cycle, rising several hundreds of percent higher than the last fiat currency record price.

As these metrics become more trusted and popular, it’s feasible that they could be gamed. A large market manipulator can move coins to subdue these on-chain sell signals. We recommend using at least 2 more indicators to decide what’s going on.

We are experiencing the 4th bitcoin price cycle, each period culminated in extreme price run ups. Even magic internet money can’t just go up in a straight line. Be ready for the strong pullbacks on our journey to the extreme greed zone.

All-time high charts only edition

As this mad year crawls to a close, Bitcoin has enjoyed its most consistent price uptrend in its history. All the following metrics hit records in the last couple of days:

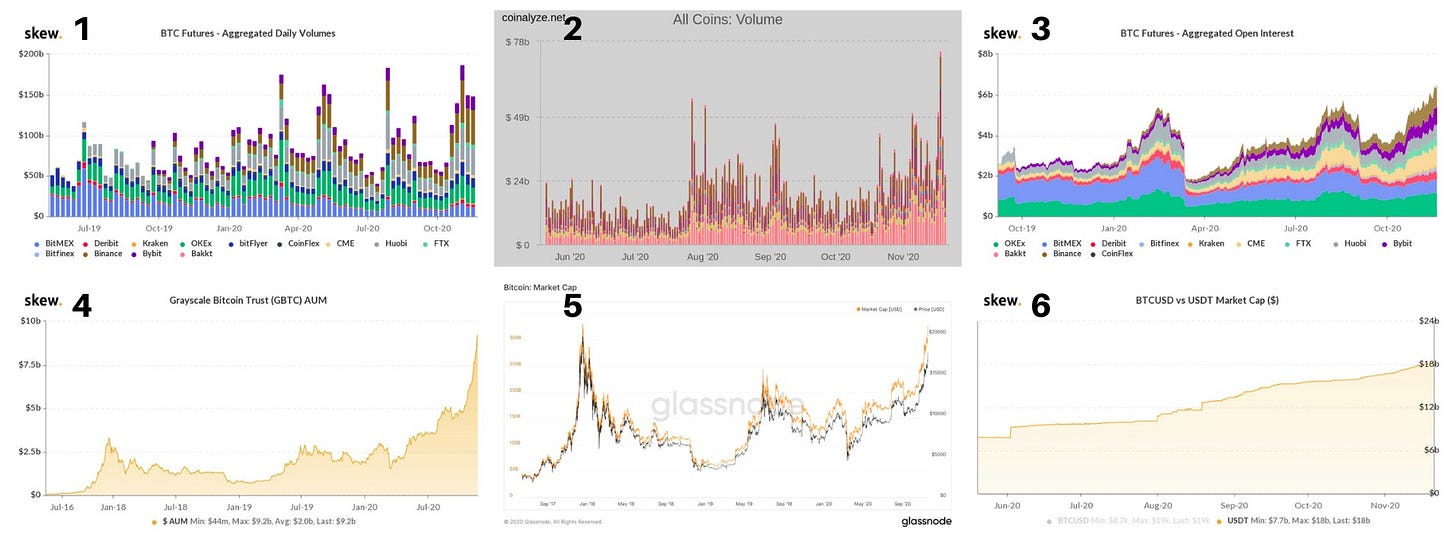

(1,2) On November 18th daily volume of Bitcoin contracts recorded a record $57 B and all cryptocurrency contract totaled at $73.9B.

(3) Total OI of Bitcoin contracts and all cryptocurrencies reached records of $5.3B and $9.6B respectively.

(4) Institutional: On November 16th the CME’s OI for Bitcoin futures touched a record $1 billion.

(5) Grayscale ETN is now holding a record of $9.7B Bitcoin in its one way fund.

(6) The market cap of Tether $USDT is at record highs.

CoinMetrics founder Nic Carter’s new post shares more metrics making new records, including volume of Silvegate Bank’s settlement network and amount of crypto native loans.

“To sum up, today’s market is far more mature, more financialized, more surveilled, more orderly, more restrained, less reflexive, more capital-efficient, and more liquid than the market that powered the prior bull run in 2017. Positive catalysts like a Bitcoin ETF appear to be plausible in the not too distant future.” Cater wrote.

Meanwhile as we’re writing, Ethereum total futures and perpetual contracts OI also hit all time highs of $1.8B, breaking their August records.

As decentralized coins keep being accumulated, Efficient Frontier’s team wishes you a pleasant and successful week.

News & links

1. OKEx announced they are resuming withdrawals on November 27th

2. Circle’s USDC will aid Venezuelan doctors suffering from currency controls

3. Vietnamese Ministry of Education will upload university and high-school certificates to TomoChain

4. Opinion: Analyst who called last Bitcoin market top in December 2018 is optimistic

5. Postmortem of $20M flash-loan attack on Pickle Finance

6. Ms. Alex Botez beats Vitalik Buterin in chess- live streamed on Twitch