Fiat update — what are central bankers up to in 2020?

In this edition we will cover: news and charts from the cryptocurrency markets, the central bankers special plan for Helicopter Money, and address

First, back on planet Bitcoin

Panic buying: The top news for Bitcoin this week includes Bitcoin starring on the cover of the Hong-Kong based Apple Times after the arrest of its publisher by authorities, and Fidelity, one of the world’s biggest asset management firms, starting a new cryptocurrency fund.

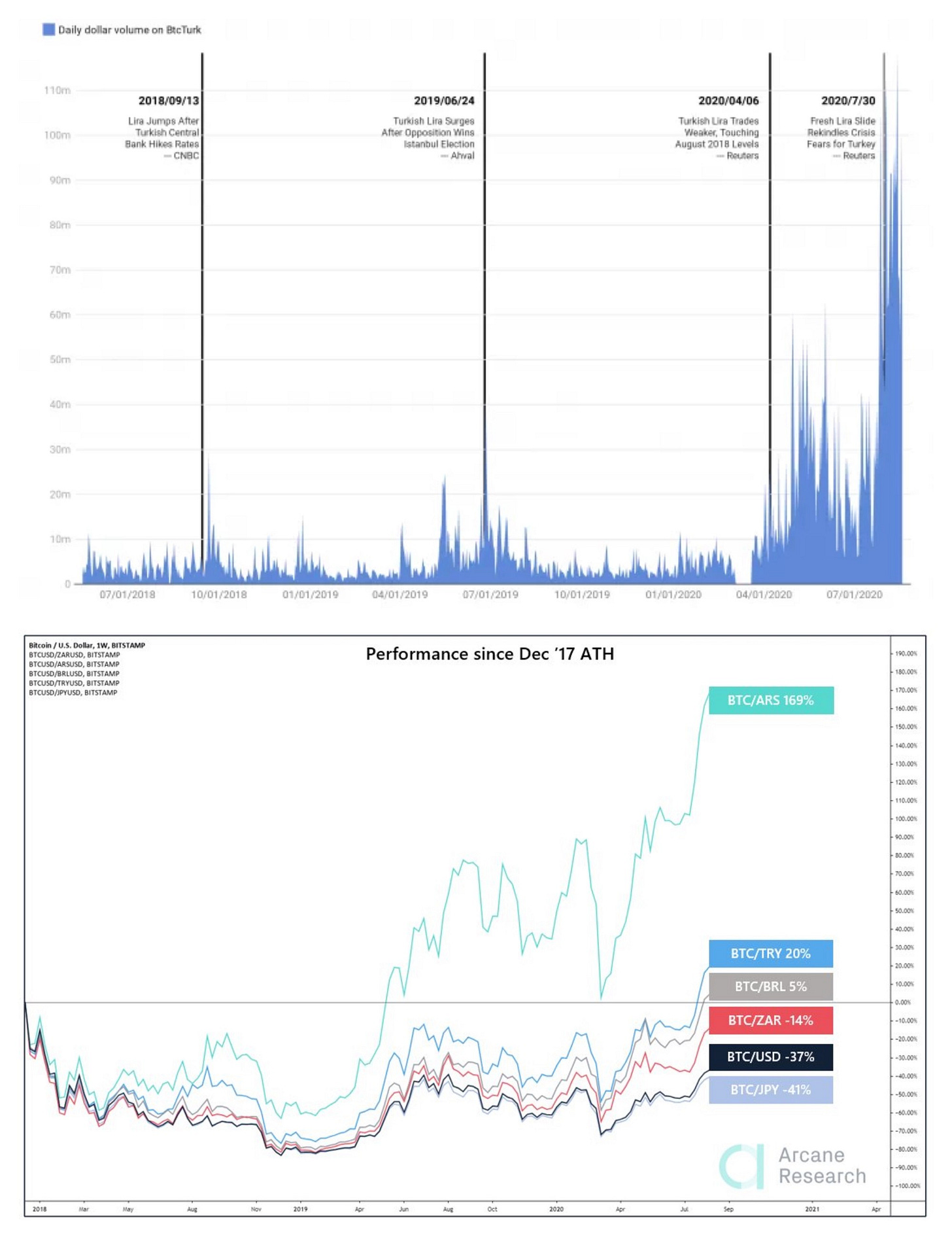

Meanwhile local currency panic in Turkey, Argentina and Brazil has pushed the price of Bitcoins locally to all-time highs, with Bitcoin purchases breaking records in Turkey. The chart below shows the volume in a major Turkish Bitcoin exchange Btc Turk since 2018:

Sources:Coindesk and Arcane Research on Twitter

The above chart shows how the high inflation in various world currencies affected the price of one Bitcoin. The currencies above the gray line have surpassed their all-time low against 1 Bitcoin.

Meanwhile, the S&P has surpassed its December 2019 all time highs, though the aggregate price is led mostly by a few giant corporations. The market share of the top 1% stocks in equity markets is at an all time high of 53% of the monetary value of the American equity markets, according to chart site FRED.

Source:tslombard

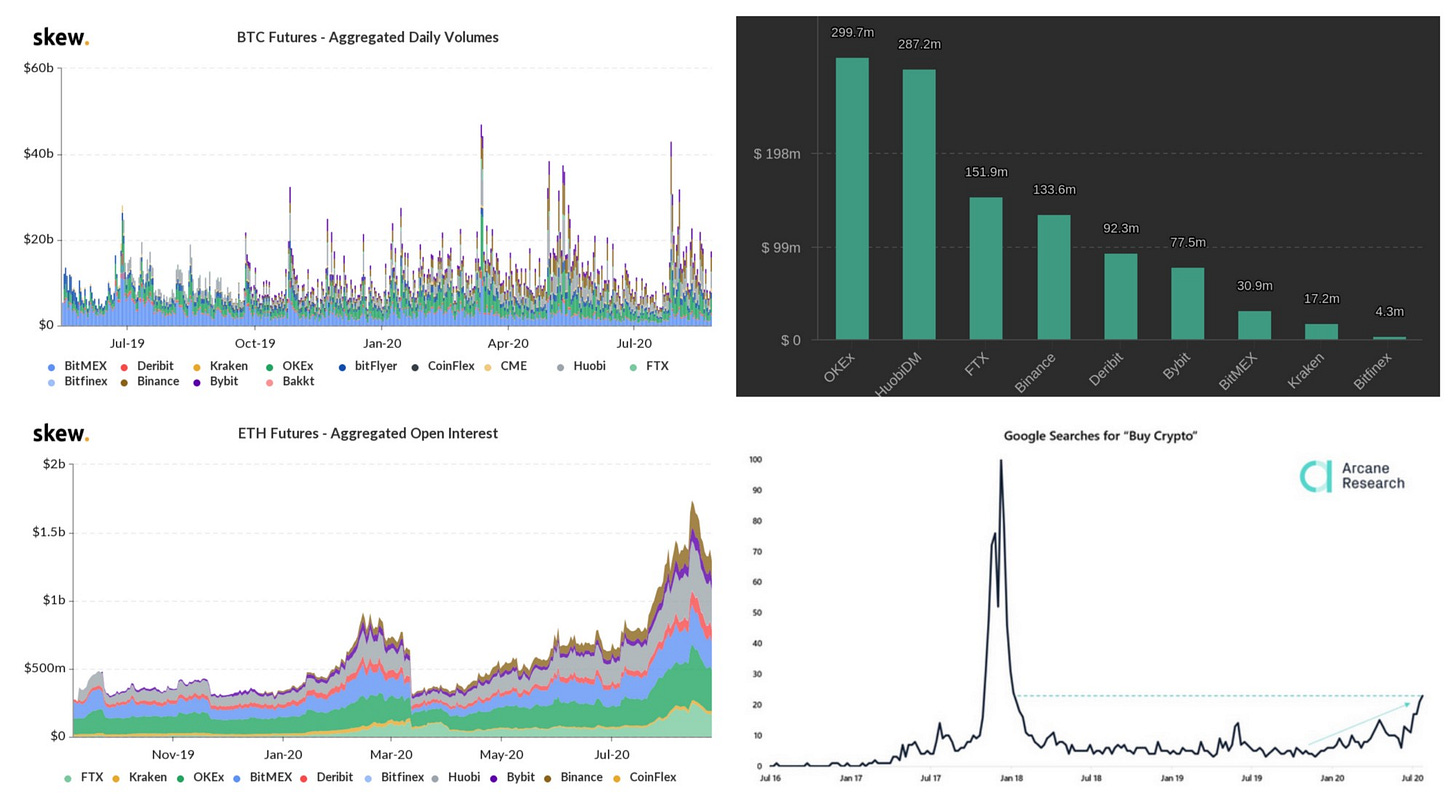

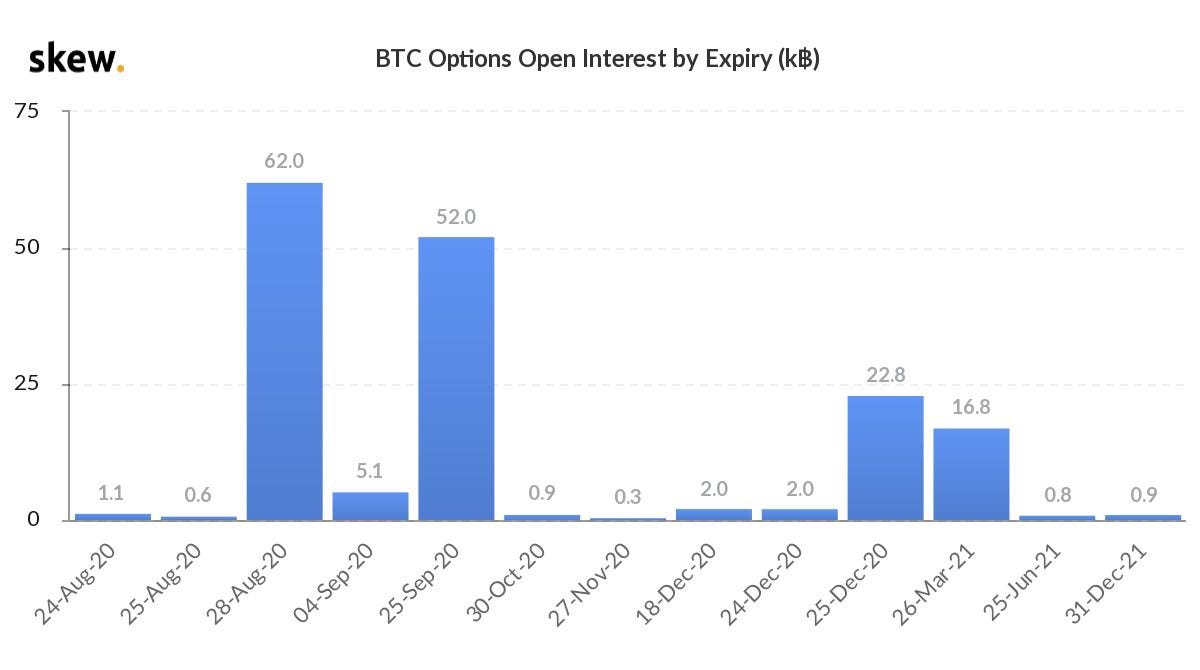

The Bitcoin futures markets have hit yet again all time highs of open interest this week, with the optimism displayed in the futures prices curve somewhat muted compared to the ecstatic mood we saw two weeks ago.

While google searches for the keywords “Buy Bitcoin” are modestly rising, the attention is clearly on Ethereum and other smaller coins. This follows the pattern of Bitcoin’s last bull cycle where smaller coins ran up before a bigger move in Bitcoin itself.

Ethereum open interest also broke its records with strong trading volumes as well. The top venues for the Ethereum futures according to Coinalyze are OkEx followed by Houbi.

Sources:Skew, Arcane Research and Coinalyze

Google searches for “buy crypto” as seen in the chart on the bottom right, have shown a spike to a level last seen in early 2017.

If this isn’t enough good news for our small sector of the economy, it seems as if Tether USDT transactions have broken new records too. According to OKEx’s estimate, Tether’s average daily value transferred this month was estimated to be $3.55 Billion daily, while PayPal moved ‘only $2.46 Billion for its consumers in the entire Q2 (3 months). For more information on Tether see our article here.

Tether’s market cap has also reached all time highs had as passed 14 billion electronic dollars

And back to the futures market competition: it’s interesting to note the CME’s regulated futures are taking a growing percentage of the market.

The CME reached a peak close to $1 billion in open interest on August 17. Today it stands at $633 million in open interest putting it in 4th place after OKEx, BitMEX, and Huobi (though this is not reflected in the above chart). The green bars show open interest in cryptocurrency futures contracts including Bitcoin, Ether and other, which excluding Bitcoin are now close to half of the market.

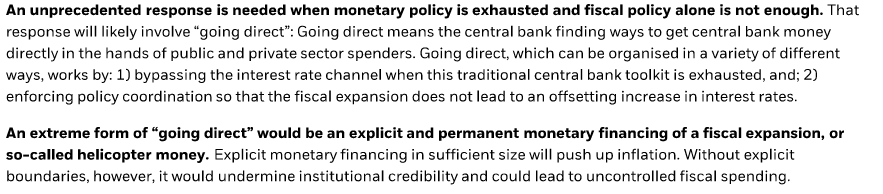

The ‘helicopter money‘ whitepaper by BlackRock

According to Luke Gromen of FFTT advisory, the actions of central banks since the economic crisis catalyzed by the covid-19 shutdown, follow the recommendations of a white paper titled “Dealing With the Next Downturns” which waspublished last August by BlackRock, the world’s leading asset manager with over $6.47 Trillion in managed assets. This economic game plan was created by some of the world’s most distinguished central bankers and can be read here on BlackRock’s website. The game plan includes printing ‘helicopter money’- giving newly minted money directly to citizens on a permanent basis, without clear details on limiting inflation. Luke Gromen believes this game plan will come to fruition: “This pivotal and profound white paper lays out the game plan… Powell [the current Federal Reserve chairman] is basically following the game plan.” According to the document, in the next crisis we will need to take the ‘direct‘ option worldwide, and take the cap off the inflation genie, according to Gromen.

Excerpt from Dealing With The Next Downturn

This paper was written by leaders in the world of central banking, including the well known Stanley Fishcer who served both as the vice chairman of the US Federal Reserve and as Chairman of The Bank Of Israel ( and also somehow pulled off becoming deputy manager of the IMF after serving as Chief Economist of the World Bank). Other authors of the paper include Philipp Hildebrand, who headed both the Bank of International Settlements and the Swiss National Bank, and Jean Boivin, former deputy manager of the Bank of Canada who also represented Canada in the G8 and G20. In other words, these people are leaders in the central banking world, and their plans are not just academic ideas but meaningful policy guidance.

The bottom line: According to Luke Gromen, a move to permanent helicopter money and MMT are not unfounded, and seems to be in due course with the professional central banking game plan and therefore high inflation is extremely likely.

Is your grandma holding shekels?

The time is ripe to make sure your loved ones are not sitting on too much fiat cash! It’s time to reach out and remind them of the importance of diversifying with gold, silver, appropriately priced real estate, quality stocks, self sustainability, learning useful skills and of course cryptocurrency, for the less faint of heart. Sustainable investments could increase the chances of a safe retirement, while staying in cash may turn out to be extremely detrimental.

The bottom line: Make sure especially your older relatives and friends are not over-exposed to fiat currency devaluation.

IMF WTF

Speaking of the IMF, many of us saw this week the IMF video that went viral on Twitter, explaining cryptocurrency to the public.

So what does the IMF really do? and why do they care about cryptocurrency?

The IMF was founded in 1947 with the purpose of supervising the USD gold standard, following the famous Bretton Woods agreement in 1944, which made the gold backed US dollar the world’s reserve currency. The IMF monitored and decided exchange rates between different countries, especially when trading between non-gold backed currencies and gold backed currencies. The IMF also had the power, working under the UN, to create its own currency, the SDR. The SDR is a ‘stablecoin’ based on a mixed basket of national currencies, originally created in order to help interbank liquidity for countries that did not want to be exposed to the gold dollar. Almost 30 years after its foundation, in 1973, the dollar left the gold standard and with the Bretton Woods agreement falling apart, the IMF lost its practical purpose. The IMF pivoted and similar to the World Bank started offering loans to third world and other under-developed countries. Today it has 186 members and promotes monetary exchange between the members. It also uses its statues to study the international economy and offers recommendations.

Nobel prize winner Joseph Stiglitz, the former head economist of the World Bank, said that the IMF’s loan packages and their terms hurt poor countries’ economies, democracy and world economic stability, and that IMF’s programs lack transparency. And indeed, the loans offered by the IMF were conditional to privatization, budget cuts to social services, lower vat and removing of regulations. In practice many poor countries ended up with bigger debts than they started off with, after receiving the IMF loans. Due to the lack of clear success of the IMF to improve economic stability using its loan programs, it may be looking to pivot once again, perhaps to the digital currencies.

Though this week’s IMF’s video did not mention Bitcoin or Ethereum by name, it praised many aspects of cryptocurrency technology. The video went on to note the risks of anonymity, loss of passwords, lack of scalability and the price volatility in decentralized cryptocurrencies. “but if we can counter the risk, this new technology, or some variation of it, it could completely change the way we buy, sell, save and invest. It could be the next step in the evolution of money” the video concluded.

Could it be that the IMF may be creating its own international ‘stablecoin’ digital currency? Volatility and the risk of password loss are inherent in decentralized cryptocurrencies, meaning the IMF are favoring a more centralized, perhaps delegated cryptography based network- a digital currency that moves safely over the internet but is not necessarily open source, thought it may be somewhat permissionless. So should we expect an IMF ‘genesis block’ in the coming decade? Stay tuned!

The bottom line: The IMF was founded to supervise the gold standard and moved to offering development loans to poor countries when the gold standard ended in 1973. The IMF’s loan programs have created debatable results; thus the new interest by the IMF in digital currencies may signal a third iteration of the IMF’s purpose. The IMF expresses in their new video interest and support for creation of new international digital currencies, and we think they may support or even supervise their creation in the coming decade.

News & links

1. Deribit suffered a 4 hour outage.The Cryptocurrency market’s biggest options exchange was down early last Thursday morning due to technical problems

2. Hackers steal information on 1,000 customer from Crypto Tax reporting service website

3. Dreams of a Peasant: The must read new traders digest by Arthur Hayes, BitMEX’s CEO

4. Deep dive: Everything to Know about CoinFLEX’s Deliverable Perpetual Swap, Repo Market, Spreads, and FLEX Token

5.Get informed on cryptocurrency trading’s history: Wolong- the art of deception

Want to work with the professionals at Efficient Frontier? We’re hiring.