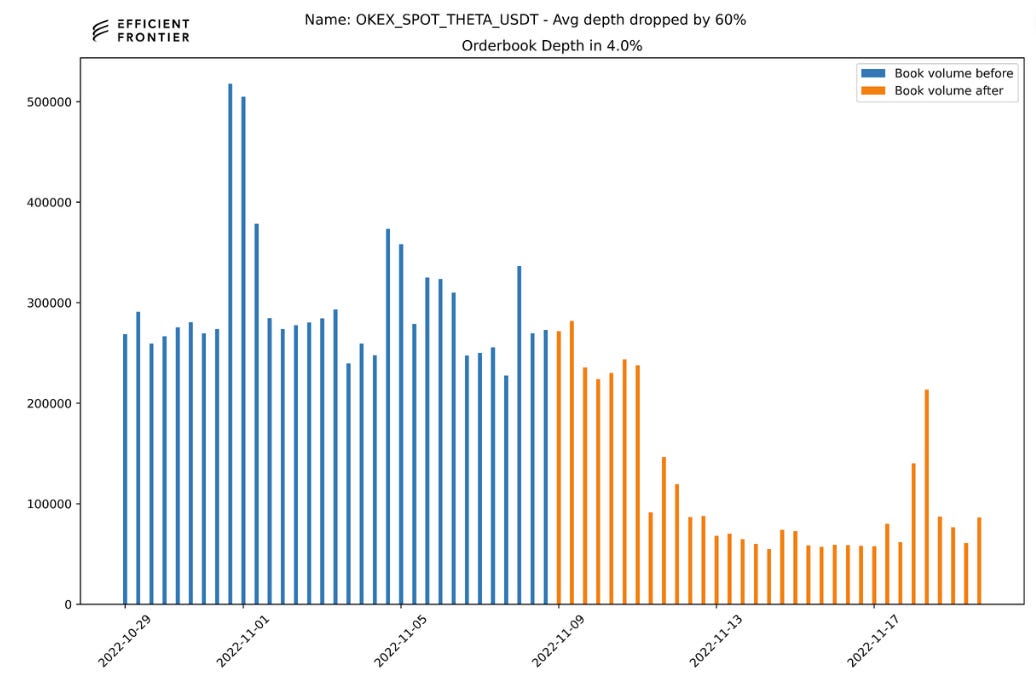

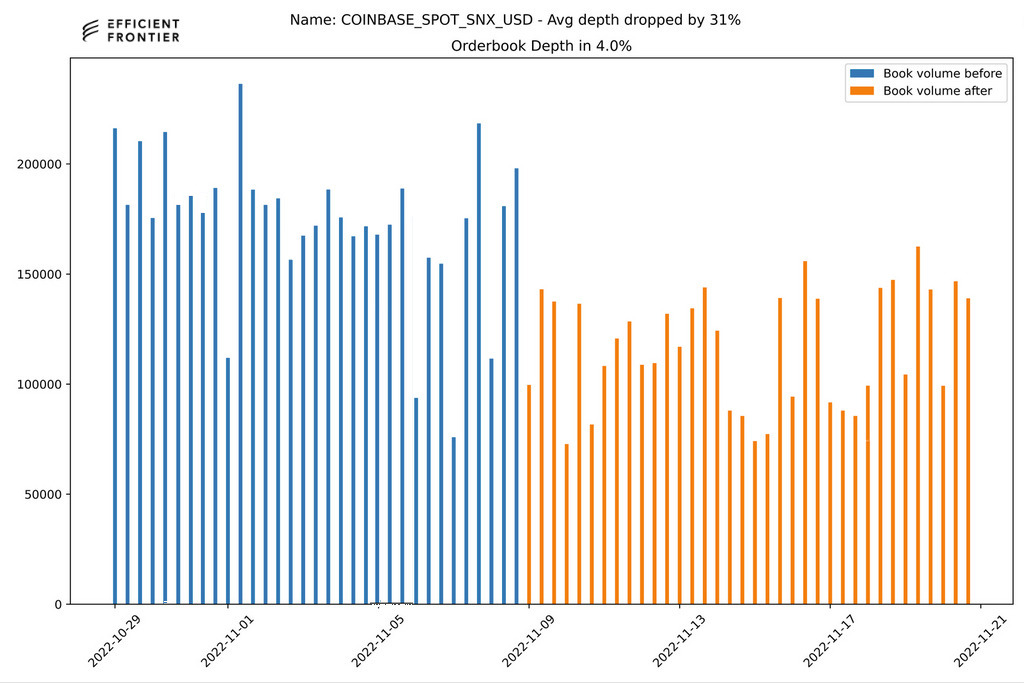

Five charts showing the drop in crypto liquidity

Crypto liquidity provider explains impact of recent fallout on markets

As the crypto market awaits the verdict on DGC and Genesis lending, our data documents the sharp drop in market liquidity following the shut down of Alameda and FTX on November 8th.

Market depth, the amount of money bidding in an exchange order book, has taken a hit across many crypto markets. We've analyzed several markets depth at 2% (money bidding at a distance of -2% or +2% from the market price) with some dropping by 50% on major exchanges since November 9th.

The ‘dry up’ started on November 9th, one day after FTX closed its doors and a day before it was announced that Alameda Research was winding down. Alameda Research served as a market maker for many projects, so their absence has impacted liquidity. We’ve seen this first hand, as some of their former clients approached us.

Concerns of additional exchange shutdowns is also a big factor. Most market makers, including Efficient Frontier, have minimized their capital on exchanges, aiming to decrease exposure to further contagion.

The lower the market depth the less money it takes to move the price. The result is increased risk of price volatility which means increased risk for liquidity providers. Market makers manage this risk by decreasing their presence in the order books. This creates a vicious cycle of low liquidity because reduced liquidity in an order book increases the chances of high volatility even more.

For more information visit efrontier.io