Inflation for beginners and central bankers

Special inflation coverage, news on institutional accumulation of crypto and an comprehensive overview of the sleepy summer Bitcoin markets

Inflation has been in the news lately, as mainstream outlets have reported high year-over-year inflation figures, officially 5.39%, and 13.38% according to the 1990-based Alternate basket.

The crypto crowd associates price rises with monetary inflation, which is blamed on QE, ‘helicopter money’ and the 0% reserve banking system resulting from the Covid-19 crisis.

In the public discourse price increases are associated with supply chain disruptions due to the Covid-19 crisis, the blockage in the Suez Canal and the Colonial pipeline showdown.

Meet M2!

We would like to focus more one money supply creation rather than the short-term crises we have been experiencing:

M2 is the amount of local currency in a country: physical currency and all bank deposits. Bank loans as well as central bank money supply expansion create a rise in the amount of currency that is available, as seen in the M2 figures.

The inflation discussion usually focuses on the US dollar but the ‘race to the bottom’ is a multi-decade global phenomenon. According to data from tradingeconomics.com, the total amount of local currency (M2 - representing bank deposits and cash) in the European Union, China, Japan and many other sovereign nations has been skyrocketing.

Over the last 10 year the amount of US dollars in the United States has grown by 120%, while the Chinese Yuan has multiplied by a staggering 330%. Lagging behind are the European Euro with 75%, and the Japanese Yen which grew by ‘only’ 46% since 2011.

But don’t let this figure for the JPY distract you. Since 1960 the number of JPY in the Japanese banking system has increased by 138 times, or 13,800%, while American dollars in the US have grown by 72X or 7,200%% since 1959!

It is important to recognize that M2 in Japan and the EU have increased less than in the US and China over the last decade due to how money supply is created. Put simply (and naively), in strong economies, commercial banks lend more and cause increases in money supply. Because the Chinese and American economies are strong, banks lend more capital to the market, resulting in more M2 money supply entering the wider economy.

Which way is up?

Adjusting asset prices to the growth in M2 shows a different picture of reality:

When we look at the price of gold compared to the M2 expansion, it looks much less volatile. Perhaps we should start comparing Bitcoin’s price to commodities such as gold.

“You then get yourself into this really gigantic mess that nobody politically wants to be responsible for by implementing sound monetary policy.” said economist Tuur Demeester. “It’s starting to get weird because we have so much dollar inflation, right? So, what does it even mean to dream of a $300,000 Bitcoin two years or three years down the road? How much inflation are we going to have had by then? 50%?”

Markets wrap

The 1 trillion club

Despite some fund outflows, anecdotal news stories show institutional investors are interested in crypto market and show signs of quiet accumulation.

American investment management giant Capital Group with $2.3 trillion AUM buy a 12% stake in MicroStrategy

Bank of America, with $1.7 trillion in AUM to launch Crypto research team

Fidelity, with $10.4 trillion AUM, is planning to hire 100 more people for its crypto business to serve the growing demand from institutional investors

Oppenheimer and Goldman Sachs publish price targets for Coinbase stock

Bitcoin’s sleepy summer

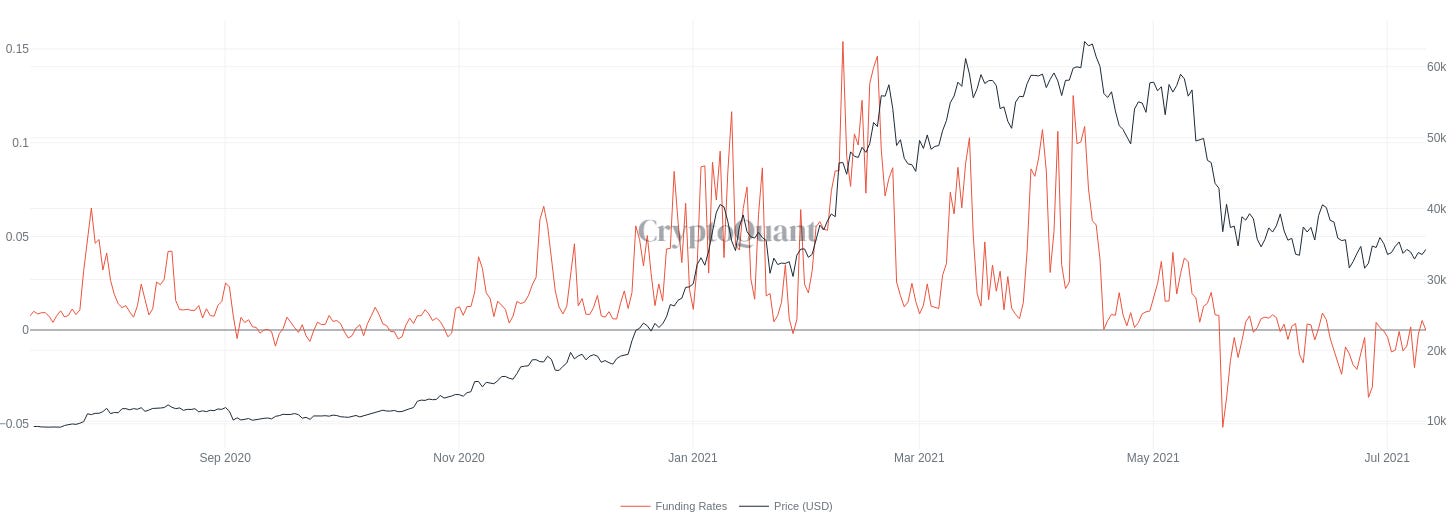

For the last two weeks Bitcoin has consolidated between $36,600 to $31,700. This concludes two months of a tightening trading range and decreasing volatility. Trading leverage remains low, indicated by low futures funding rates and basis, as directional traders await a breakout from this range.

Binance futures contract basis, which reached a staggering 41% yearly premium on April 14th, has been in low single digits for two months and perpetual contract funding rates have been low to negative.

According to CryptoCompare, over June spot volumes decreased by 42.7% while total derivative volumes decreased 40.7% .Last weekend saw a new yearly low in Bitcoin trading volume.

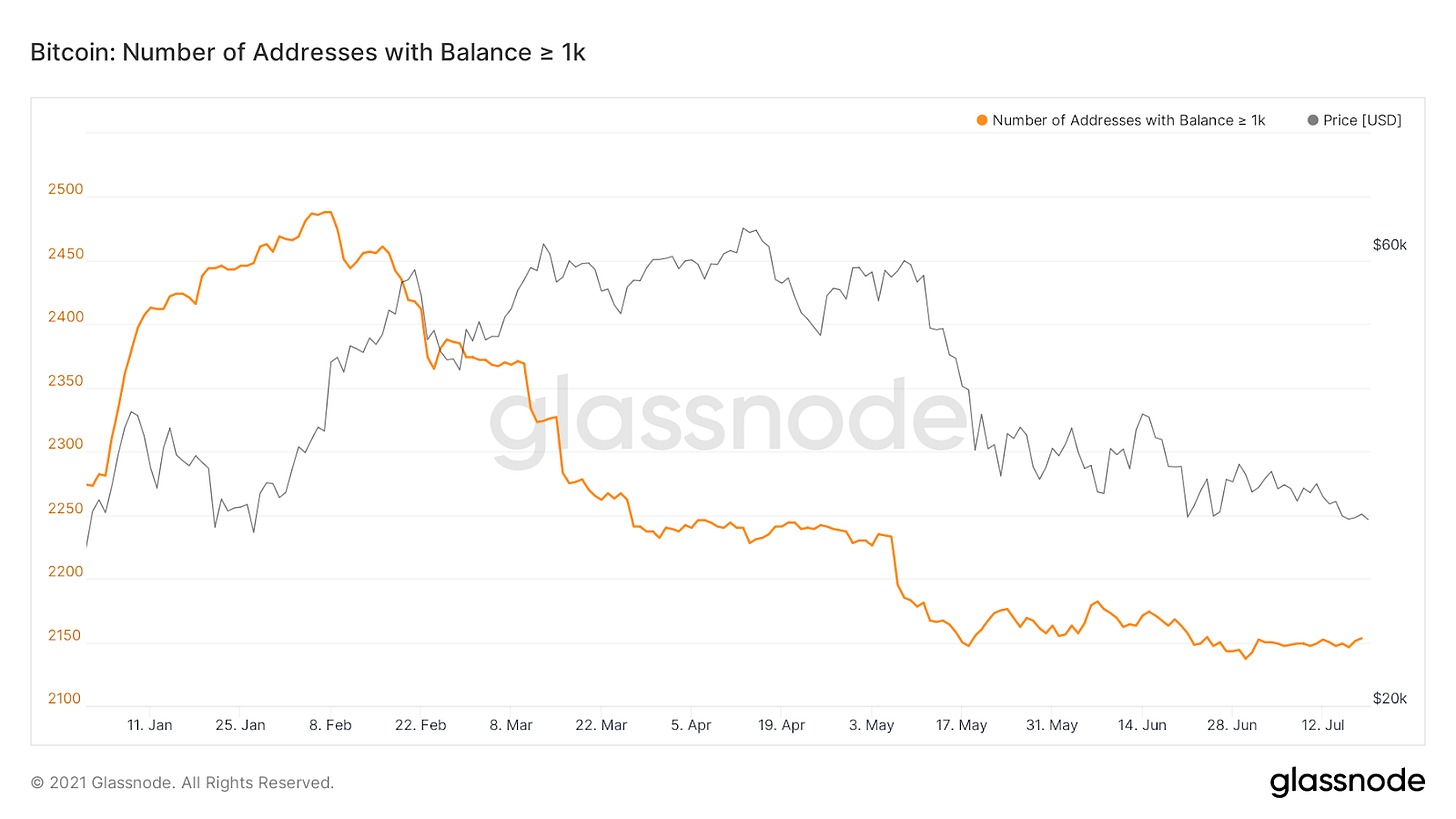

One of the clearest signals that the first phase of this market cool-down has ended is the closing gap between the institutional associated CME futures and the retail oriented off-shore exchanges, indicating that retail excitement has been completely washed out of the market.

Mining

Chinese secondary market flooded with GPUs after mining crackdown

New Kazakhstan law will tax miner for electricity consumption

GBTC Talk

A new unlock of GrayScale’s GBTC shares is expected to take place in the coming weeks, leading to discussion of its possible effects on Bitcoin’s price. Unlike an ETF, GBTC’s shares are impossible to quickly arbitrage with BTC.

Due to GBTC’s unknown futures as it applies for an ETF status, few entities are able to estimate the value of the GBTC’s shares.

Despite this discussion, GBTC’s premium is known to reflect market sentiment, rather than predict it. “The fact that the market is so focused on something like this just shows the lack of real catalysts or market moving events right now,” wrote QCP.

News & links

Despite the market cooling down, news hasn’t slowed down.

Going mainstream

News which would be exciting just one year ago, is becoming increasingly commonplace:

Ethereum ETF and carbon offset Bitcoin ETF to be listed in Brazil

Visa crypto branded cards spent $1 billion in 2021.

Tetra Trust to become first Canadian regulated cryptocurrency custodian.

Diamond hands: Sotheby’s auction house to accept cryptocurrency for rare diamond

The U.K. Advertising Standards Authority to study crypto scams

Crypto.com pays $175 million to sponsor UFC Mixed Martial Arts fighting league

First Midwest bank reported holding GBTC Bitcoin trust shares

Australian online broker SelfWealth to add cryptocurrency

Regulation

Regulators and law keepers around the world are scrambling to regulate the formerly wild-west market

ByBit to shift to full KYC

Russia implementing law to allow confiscation of illegally obtained cryptocurrency

EU to implement rules enforcing information collection on cryptocurrency transfers from exchanges

Illegal activity

Secret mining farm inside a power station shut down by Ukrainian police

Ransomware criminals demand a total of $70 million from 200 American firms recently compromised

Former Bithumb exchange chairman arrested for $100M fraud

True Crime podcast investigates the disappearance of QuadrigaCX CEO (the Canadian cryptocurrency exchange)

UK seized $400 million in cryptocurrency and arrest woman suspected of money laundering

Markets and more

Circle to go public in SPAC deal

Mr. Robot: World Economic Forum prepare for worldwide cyber attack

Exchange Mercado Bitcoin Becomes Brazil’s First Crypto Unicorn With Softbank Round

Smart contract auditing firm Certik raised $37 million

ShapeShift exchange to shut down and shift to decentralized organization

The Myths of the DAO:Does a real decentralized DAOs exist?

Arthur Hayze’s new blog explains why leverage in crypto creates less systematic risk

☮ Sending our love from Tel-Aviv and San Francisco,

Efficient Frontier