Efficient Frontier August 2023

Institutional Liquidity + Our newsletter are back

Yes! Efficient Frontier is up and running in your inbox again! Welcome to our August newsletter, with everything we’ve done in the last month and some fresh market intelligence.

Note from our CEO

A bit of what I've been seeing. Recovery in crypto markets is apparent beyond price action. During Q2, we've had a meaningful uptick in the number of deals we closed compared to 2022, with significantly more deal flow. As the crypto bear market is starting to retreat, we decided to add new developer and sales roles.

We're grateful to be in a strong position after almost 5 years in crypto. We're looking forward to the rest of 2023 and are keeping our eyes open for opportunities that will bear fruit for us and our partners in the coming bull run.

Yohai Rafield

CEO, Efficient Frontier

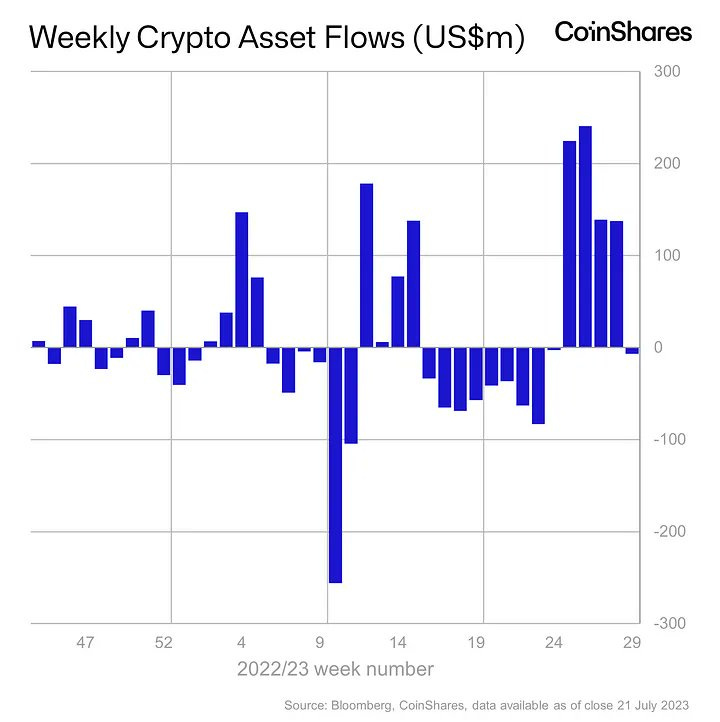

Chart of the month

Over the last month Coinshares reported the highest inflow to stock exchange-traded crypto funds since 2021. That’s $736 million in five weeks. We’ll let your make your own conclusions (hint: “Institutional liquidity”.)

Blog and feeds

If you’re interested to learn more about how we help our customers and the huge power of decimal points, Tim Freed, our Head of Client Services and Growth, shared this in our blog:

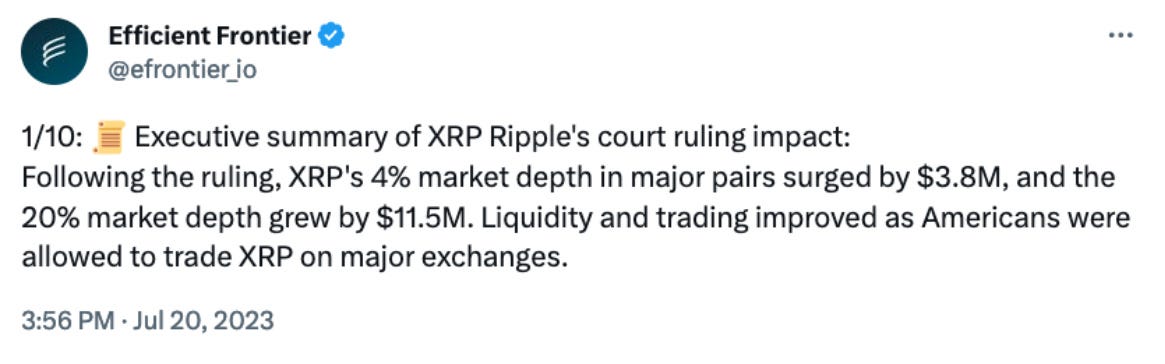

You’re welcome to join our daily updates on Twitter/X, including our no-nonsense executive summaries.

Join our broadcasts on Telegram, where we shared our 5 Predictions for the Next Bull Run!

Team update

To unwind from surfing the waves of the crypto market, we took the team on a beach and surf day. We’re glad to report we’re better at trading than surfing, though some did show potential.

Commentary: The outlaw future of DeFi

The hottest topic of the month was the inflection of CeFi vs DeFi and the regulation battle. We’re coming up to an interesting split between fully regulated crypto activity and ‘darkfi’ outlaw crypto. Why and how?

First, we’ll look at the numbers informing our forecast, and in the second section we’ll elaborate on how we see this story playing out.

Rise in non-KYC DeFi market share and surveillance awareness

A) On-chain (DEX) traders’ percentage of total crypto trading volumes has been growing since it started. It now stands at 14.9% of centralized exchanges’ spot volumes. This is a meaningful share of the market, especially considering each Ethereum transaction costs dollars, not cents. In May 2023, for example, DEXs moved $65.5 billion worth of assets.

There are two reasons Americans are increasingly turning to DEXs:

Banking on-ramps like Binance US and FTX US are no longer available while DeFi remains open for business.

DEXs provide access to thousands of tokens, many of which may be considered unregistered securities, banned by regulated exchanges.

B) International usage of privacy mixers and unregulated crypto activities is on the rise, as evident from the latest numbers shared by Chainalysis and CoinJoin.

These activities take advantage of crypto’s decentralized features, which were originally fostered by the cypherpunk movement, and will likely be increasingly utilized.

C) DeFi has become the sole means for Americans to access speculative financial products like 100X leverage and memecoins, which have gained significant traction.

On-chain open interest in perpetual contract DEXs has grown to $360 million, about half of it solely from the relatively new GMX on-chain derivatives exchange.

D) In the bigger picture, as economies become increasingly cashless, crypto and permissionless finance will play a more central role.

Who’s going to the ‘dark side’?

Today the next logical step for the SEC could be to target DeFi activities. Will they request Uniswap Labs to KYC the frontend?

This poses a crucial fork in the road: RegFi or DarkFi?

RegFi is Regulated DeFi and crypto with full KYCed user interface

DarkFi is KYC resistant crypto and DeFi. Likely run by anons and/or offshore. It includes KYC resistant clones or gateways to popular DEXs and applications.

While it is impossible to regulate the Uniswap protocol itself, the front end could be a target. The implications of such actions on the broader DeFi ecosystem are uncertain but noteworthy.

Meanwhile Bitcoin is being primed by Wall St. to be one of the next big asset classes. The more Bitcoin gets regulated, the more mainstream, fully regulated demand will grow (with eventually even conservative asset managers like pension funds allocating to it).

The more strict the regulators will be, the more DeFi and crypto will have to choose increasingly consciously which side of KYC regulations they want to be on. The distinction between RegFi and DarkFi will only grow.

The rising demand for DarkFi will put the decentralization of its technology to the test. Non-KYC activity and DarkFi will either be battle-tested and become stronger or vanish altogether.

RegFi and DarkFi represent two sides of the same coin (pun not intended). Ironically, they may end up fueling each other’s growth. That’s the event horizon we envision. What comes after that is for sci-fi to predict.

The crypto industry is evolving and we’re at an inflection point. Let’s keep building and keep our eyes open to the bigger picture.

Until next month,

Efficient Frontier