Is Tether the next CBDC?

What a month! Ethereum ETFs got approved, the U.S. presidential candidates came out with strong pro-crypto views and Trump notably started accepting Bitcoin. SWIFT announced an international CBDC network and Wisconsin's state pension fund invested in IBIT and GBTC. Where is this all leading? Read on.

Note from our CEO

Dear partners and network,

I am pleased to share a few excellent updates. First, we’ve seen healthy growth in trading activity and volumes, have ramped up activity in a new major exchange and also enjoyed a significant expansion in new partnerships.

To support this expansion we're looking to fill around 10 new positions in our back office, sales, DevOps, and customer success. You’re welcome to send talented and motivated people our way.

On a completely different note, recently we've bid farewell to Tim Freed and Alon Ohayon, two central figures in our company. Both were instrumental in guiding us through the bear market. I wish them both fulfilment and success in their upcoming ventures.

Best regards,

Yohai Rayfeld

Team update

We’re thrilled to welcome two talents. Joining our trading desk is Data Analyst Eden Abramov who holds a magna cum laude degree in financial mathematics. Tom Shanaider is joining as an Account Manager after doing blockchain research at KPMG. Welcome!

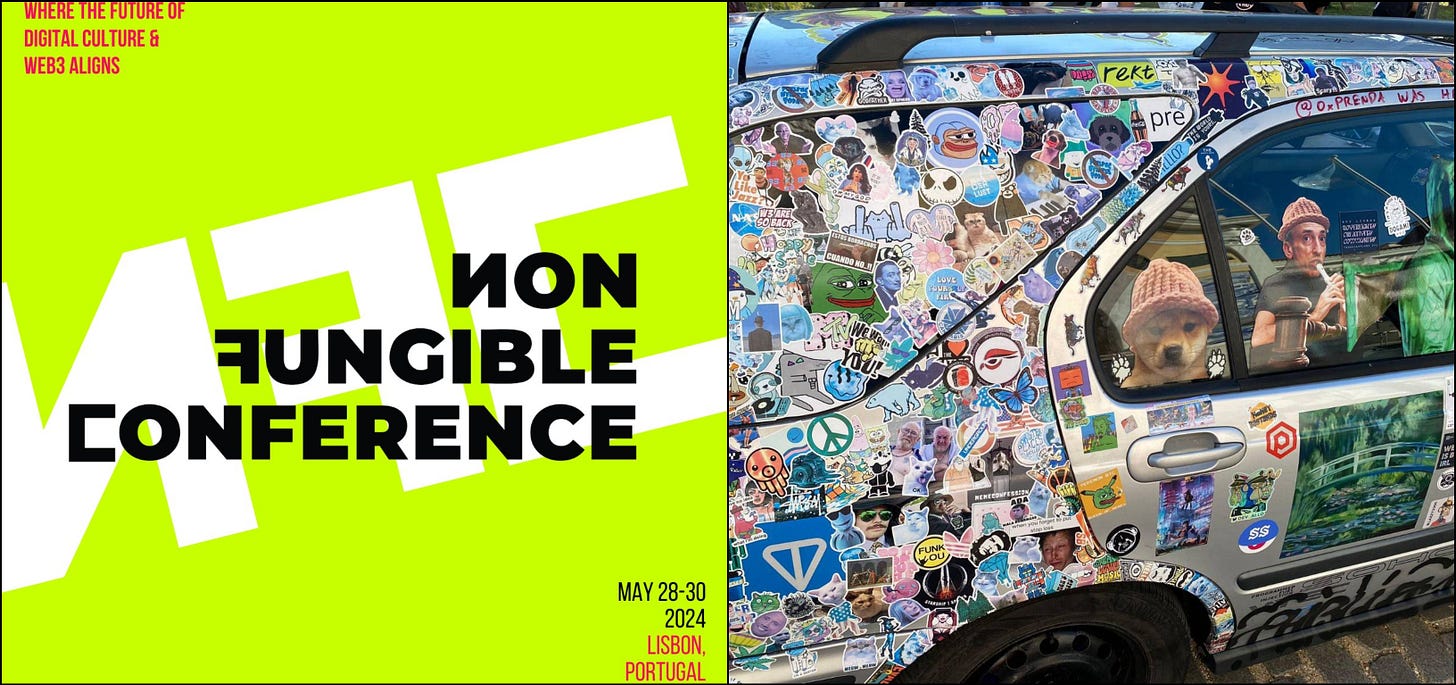

Conference: Zach Reingold our Head of Ecosystem had a great time at NFC Lisbon.

Last week our research department went on a team building outing in the desret. Anyway, several HFT trading secrets are hidden in the image below, can you find them?

Who are you going to trust?

The US won't issue a Central Bank Digital Currency (CBDC).

The issuing of electronic currency directly from a central bank (CBDC) is dangerous. It replaces bankers with bureaucrats, allows instant and personalised monetary policy, has built-in state surveillance and is controlled by an independent non-elected bureaucracy. It's a mystery why electronic sovereign currency cannot be issued by a country's treasury or even post-office.

That said, there is a need to replace the slow and antiquated international SWIFT system with something, as its current network isn’t much faster than when it launched in 1977. So for now CBDC is the buzzword.

In this new multi-polar world if the US dollar wants to stay on-top it needs an upgrade. The head of the Federal Reserve, Jerome Powell, stated several times they are not planning on issuing a CBDC. For good reasons: why would international traders trust a system where they’re one click away from confiscation or freezing.

In 2021 the inter-bank SWIFT network expelled Russia and the US confiscated Russian businessmen's Swiss bank account. The United States is wise enough to know launching a CBDC would be even less appealing for anyone who has a shaky relationship with the US.

Now some extreme, but warranted, speculation;

Technologically, Bitcoin is the next generation of the SWIFT network. Its ‘game theory’ innovation and decentralized record keeping is unbreakable even if its cryptography may be cracked eventually. It’s a truly trusted, transparent and fast international money network.

Even if a bug is found or after quantum cracking, the distributed system could likely be reset and become trusted again. This could not be said for tech companies or banks, which are protected by similar cryptography.

In a world free of power struggles, 195 countries would likely opt for settlement between foreign currencies on Bitcoin due to its transparency, reliability and relative speed or maybe create a delegated proof-of-stake controlled blockchain of their own, where each country held a node, with equal voting rights. Unfortunately, this is not on the menu right now.

Back to today, Tether USDt, founded by Brock Pierce in 2016, is a Bahamian company that issues the USDt token- a US dollar token running on open-blockchains like Etherum, Bitcoin and Tron. Jumping from $1.8 billion in 2018 market cap to over $110 billion today, settling x dollar a month, and it’s not slowing down. It allows people, even in countries where the dollar is sanctioned or limited, like China and Nigeria, to use and exchange the US dollars.

We ourselves at Efficient Frontier, being a crypto-native trading firm, have moved tens of millions of dollars across borders in minutes using USDt Tether, as it’s the most convenient method for us. We understand from our own experience its huge advantage.

Is the United States government also aware of Tether’s value?

The US has shut down and even seized several offshore crypto exchanges over the years and it seems like there’s nothing they can’t do if they set their mind to it. Lately Binance exchange was fined $4 billion dollars for avoiding American anti-money laundering and securities regulations. The same government allows Tether USDt to continue to operate from Deltec Bank bank in the Bahamas.

USDt brings the dollar to the global black market, and it’s also arguably one of the reserved currencies of the crypto space, along Bitcoin itself. Despite that, Tether had few restrictions and no real audit, serving as a backbone of off-shore crypto-markets like Binance.

Tether’s USDt solution seems workable for an international sovereign currency in the internet age- controlled by a commercial entity, backed by the United States as a currency, easily moved, open-source so you don’t have to register to use it, and automatically confirmed transactions on the blockchain unless you get into some serious trouble.

On one hand all transactions are public, on the other hand, it’s hard to control who uses it. It’s kind of perfect.

Will the US government allow tether to grow from today’s $111 billion into trillions? Will it introduce a more official USD open-blockchain token once Bitcoin becomes generally trusted? And what would this mean for Bitcoin as a settled settlement layer?

Tell us what you think.