LiteCandle

Lining up for a technological revolution

Market overview

Ending almost two months of steadily rising prices, the last weeks took the price of Bitcoin from $47,000 back to $47,300, in a very volatile route.

After the price peaked at $53,880 on September 7th, in the late morning EST, cascading liquidations created a $5,000 price drop in less than 30 minutes, with the maximum daily loss at almost $10,000, when it crashed to a low of $43,300 before recovering.

The market is still in recovery mode after this crash created $3.2 billion in liquidations across the crypto markets.$1.23 B of total liquidations were in Bitcoin positions. It’s interesting to see that market participants are becoming increasingly accustomed to sharp price movements coming from leveraged position liquidations.

Though this crash happened not long after El Salvador instated Bitcoin as a legal tender and coincided with Coinbase sharing its dramatic dispute with the SEC, the price is ultimately more influenced by the state of the market and positions of traders.

September 6th also saw an all-time record for Open Interest in Ether’s perpetuals and futures contracts, passing April 2021’s record of $11.6 billion by $20 million, according to Bybt. Ether’s token price came close to its former record, reaching $3,950 per token, while the number of Tweets mentioning Ethereum was the highest on record.

Following last Tuesday's crash, the small cap market lost 19% over the last week, according to Arcane Research, finishing the month at -3%.

Despite the turmoil, a very bullish long term sentiment is is seen above in the yearly low in Bitcoin’s and Ether’s put/call ratio,

Lite markets

As the crypto markets recovered from their recent shock, another spout of volatility came through this Monday, at 9:30 EST, when a fake press release circulated, claiming Walmart will begin accepting Litecoin as payment. In the 20 minutes between 9:30 EST and 9:50 EST, Litecoin gained 34% and Bitcoin gained 7.8%, while for comparison Ether gained 4% and BNB 3.7%.

This quick price rise stopped shortly after Reuters and LiteCoin’s official Twitter account picked up the fake story (later retracted) and prices returned to previous levels.

On-chain

Two interesting on-chain number we’ve noticed latley:

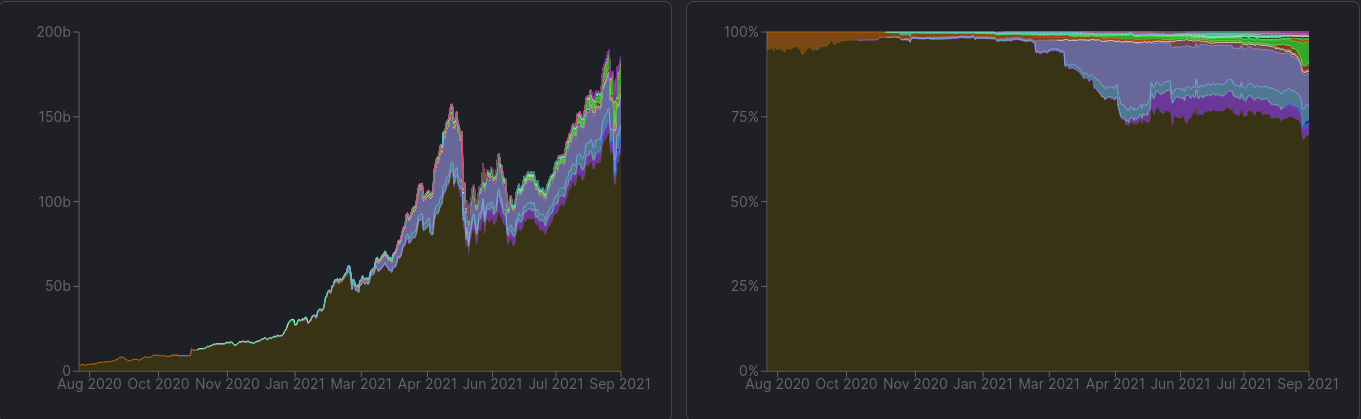

The total number of assets hosted in De-Fi apps broke new records last week - a record $183.6B in assets are now hosted on-chain across all major blockchains with non-Ethereum chains starting to get off the ground.

The number of Bitcoin’s on exchanges, reflecting the number of coins available to retail buyers, reached a new yearly and 3.5 year low as well, with 2.64 million Bitcoins or 13.2% of current supply.

Lining up for a technological revolution

A reminder that despite unstable prices, we are taking part in a technological revolution:

Adoption of Bitcoin and other cryptocurrencies is continuing to trend higher and the consequences and power of this technology is becoming more defined every week. The long awaited split between compliant and non-compliant crypto is happening before our eyes, as the industry becomes increasingly professional (and taken seriously by regulators).

In September 2017, four years ago, crypto futures and options markets were just starting out. Only four traditional hedge funds were known to trade Bitcoin while professional financial services in cryptocurrency were close to non-existent.

The following facts would be amazing to image only four years ago, in 2021:

* 80% of today’s Bitcoin transaction are of $100K or more per transaction, 30% of transaction are above $1 million (with some smaller transactions moving to L2)

*The head of the SEC has taught a course on cryptocurrency, and is being lobbied on Twitter by the crypto space’s biggest public company.

* USD based Panama introduced a bill to allow cryptocurrency and DAOs in its banking system

With all the growth and institutionalization of crypto, the promises and challenges of the cryptospace are more real than ever. We’re more excited than ever about the promise of this industry and its potential impact on society.

News & links

FTX exchange buys American regulated crypto derivatives exchange LedgerX

Ukraine legalizes cryptocurrency

Mr. Robot reports: Regulation and surveillance on crypto (and traditional) transactions keep ramping up, as western CBDC experiments ramp up

Nic Carter’s insightful tweetstorm on Texas‘ mining convention

Sending our love from Tel-Aviv and San Francisco,

Efficient Frontier