Memecoin craze: what we’ve learned

It’s no longer too early for the real use cases of cryptocurrency tech to shine so the next few years are going to be very interesting.

In the last 6 months, after Bitcoin rose from $42k to $73k, many altcoins were left behind.

MarketVector’s Memecoin index jumped to a high of 300% while Coinbase’s index of major Altcoins only reached a peak of 134%. The divergence is even more extreme in small caps.

There are 3 main reasons for memecoins outperforming altcoins and major opportunities hiding behind these issue:

1)Investors are disillusioned with technology projects

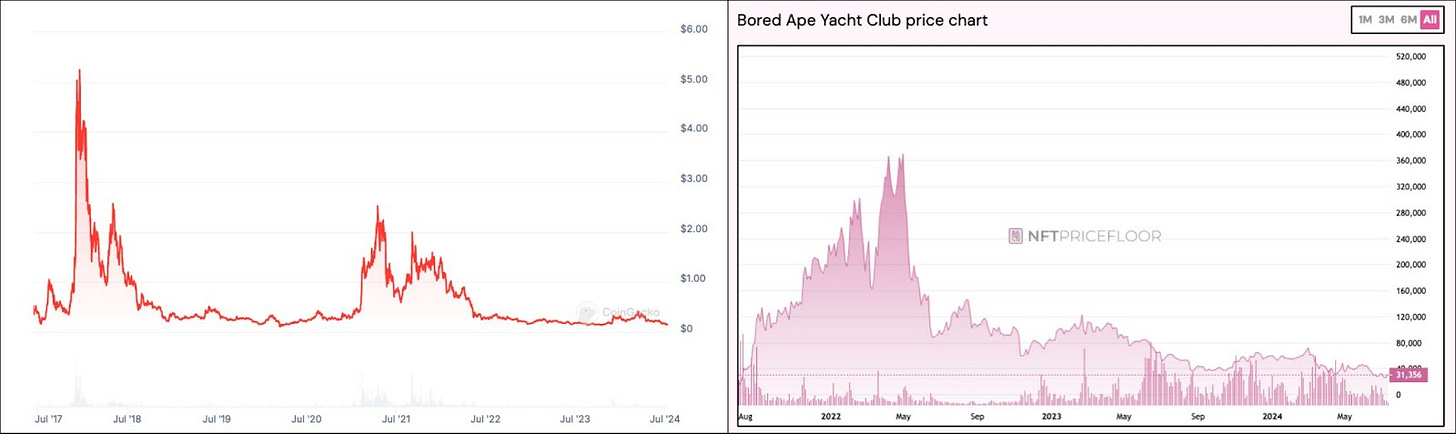

For the last 7 years, the new cryptocurrency world cycled through a succession of buzzwords, and misunderstood and premature narratives like Blockchain for Everything, DeFi and NFTs.

This buzz fed two bubbles (and crashes) of altcoins in 2017 and 2021, losing tens of billions of dollars for people who believed the stories. After being fooled twice, no one believes the crypto tech promises without proof.

Memecoins are teaching this market a lesson about coin distribution, technology and hype. Beyond Bitcoin devotees, even popular trading podcasts like 1000x share their thesis that “nothing is real so you might as well buy memes.”

2) SEC enforcing security laws

On the other side of the spectrum, Uniswap token represents a DEX with over $1 billion in daily volume with over $300,000 a day in fees to liquidity providers. However, there’s no link between the token and the protocol's popularity due to the issues around security laws. Profitable infrastructure like this is prevented from naturally sharing its profits with token holders. Speculators today take this into consideration.

3)VCs’ easy profits in the spotlight

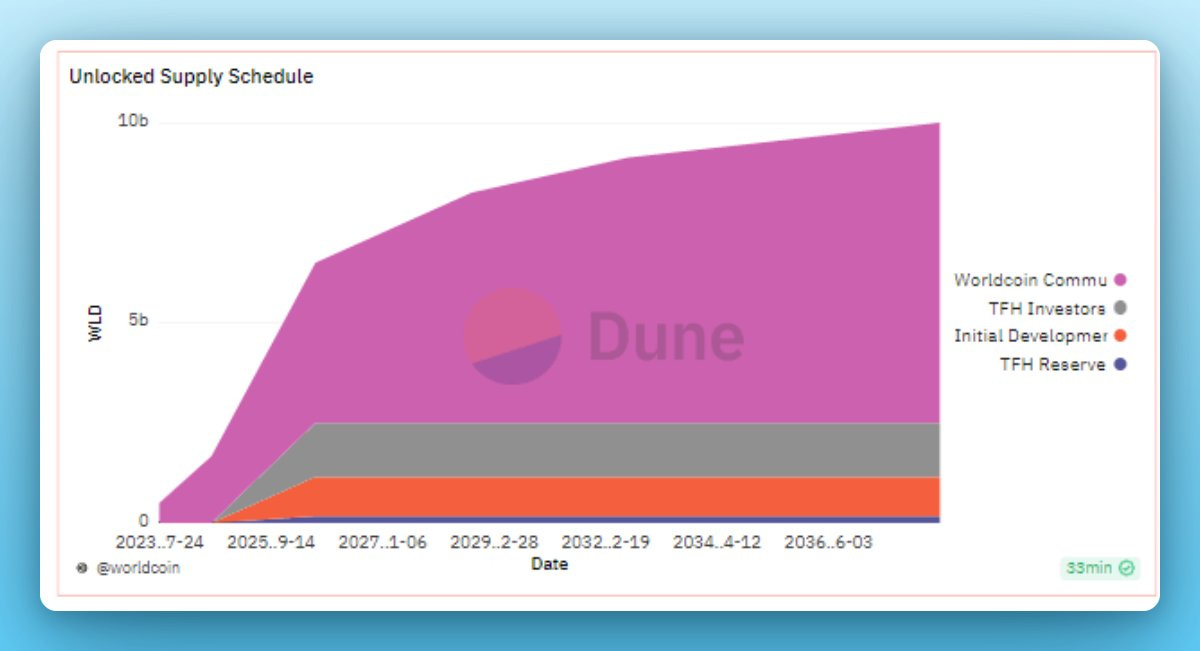

In 2024 the crypto space, at last is aware of “how the hot dog is made” when it comes to funding token companies. VCs and founders usually get a big part of the total market cap of a token, for dirt cheap compared to the public.

The VCs and founders are fully incentivized to promote the project to the retail public while quietly selling their tokens for millions, hundreds of million and sometimes even billions. When the hype dies down they just move on to the next thing.

Today the profiteering role of crypto VCs is scrutinized and analyzed on social media, projects are nicknamed ‘VC coins’ and pages like VC Printer track the unlock dates and amount of coins in the hands of founders and VCs.

Memecoins on the other hand are usually being launched at tiny marketcaps with around 10% distribution to founders and 90% available to the public on launch. This doesn't necessarily lead to a fair distribution, but the very low market cap on launch offers a better opportunity to random people on the internet. Disillusioned speculators rather enjoy this pure casino atmosphere, especially when they don’t believe tech or utopian stories anymore.

Welcome to the futuristic casino

Today, the regular gambling industry generates 30% more revenue than the gaming, music, and movie industries combined.

The cryptocurrency ecosystem represents part of the next generation of global gambling entertainmet.

Profitable infrastructure around this ecosystem continues to expand and presents many opportunities for those interested in being part of this futuristic casino. For instance, pump.fun allows users to generate memecoins on Solana, earning approximately over half a million dollars daily.

Decentralized exchanges (DEXs) and other platforms are also an integral part of these expanding activities.

Crystal ball predicts success

As usual the crypto industry herd is going too far, and have definitely thrown out the baby with the bathwater. Real crypto projects and tech do exist and can be built; for example Arweave, which happens to be one of our partners. Anyway, networks like Arweave are completely undervalued.

The disillusionment with fake or useless tech and lack of profit models is a sign the industry is maturing. Energy and resources will start going in better directions. It’s no longer too early to build real infrastructure and applications for the cryptocurrency world. Builders will, of course, need to think carefully about what they're creating. The crypto industry isn’t used to thinking carefully about anything, so that’s probably the biggest challenge.

Now is the best time to build a real innovative technology or service company in the Bitcoin and altcoin space. It’s no longer too early for the real use cases to shine so the next few years are going to be very interesting.