Passport to Tether-land

While Tether seems to have flippened Bitcoins on-chain transactions we shared what marker makers and institutional traders are thinking about the future of the cryptocurrency space.

First, an overview

According to BBWW, Bitcoin Latest 30-Day Estimate volatility was 1.49% and it’s 60-Day Estimate 2.01%:

Bitcoin is experiencing its 13th low volatility episode in its history, so we hope you’re not into numerology. BVOL, the FTX Bitcoin volatility token has been dropping accordingly:

Though someone seems to have bought some in a panic on Tuesday

In lock step, Bitcoin futures volume has steadily been dropping, as the lack of volatility forces traders elsewhere to find returns.

If everything seems boring, does that actually make it interesting? We think so. The longer Bitcoin is stable, the bigger the expected move when the market does move. Would it be ludicrous to assume that Bitcoin has actually stabilized over the long run? Absolutely.

Entities that control over 1000 Bitcoins are on the rise for the first time since 2016:

“The recent incline in whale dominance, while seemingly small on the scale of bitcoin’s existence, is still the largest sustained increase in almost a decade.” GlassNode attempted to provide an explanation in their new post. This might be meaningful as accumulation by big accounts signals confidence from professional investors and lowers the supply of Bitcoin to the market. In the long run, assuming the same trend, this will likely lead to pressure towards the upside for Bitcoin price.

Tether flippens Bitcoin’s on-chain trasncations

One of the most astonishing and interesting facts of this year in crypto is the huge growth of monetary value transferred with Stablecoins.

Source: The Rise of Stablecoins

The amount of daily dollar value being transferred using stablecoins has currently eclipsed Bitcoin! (at least according to on-chain information). This means that while Bitcoin’s price hasn’t picked up, and transaction volume is stable, the amount of value moving around thanks to open-blockchains has more than doubled this year.

Stablecoins market cap passed $10 billion this week while Bitcoin’s market cap is close to $170 billion. The amount of value transferred is due to the high velocity of money for Stablecoins, as seen in the chart below.

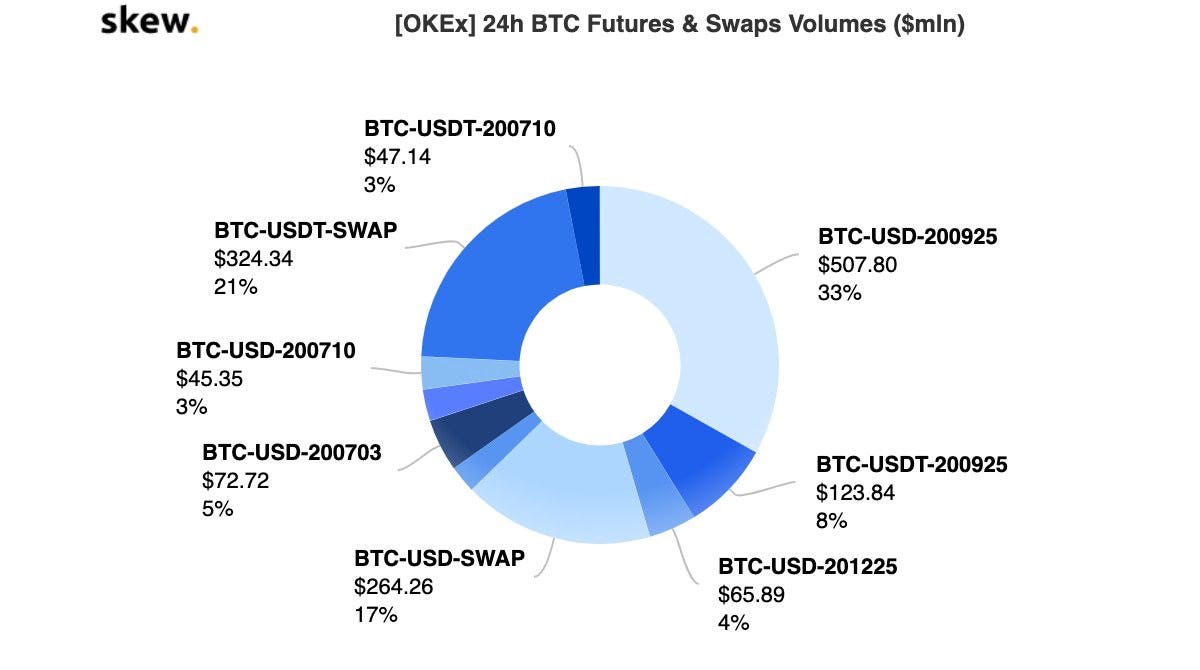

According to Skew, a growing number of BTC/USD contracts are using Tether (USDT) as collateral instead of Bitcoin. On Tuesday, the volume of USDT collateralized futures on OKEx surpassed Bitcoin collateralized contracts for the first time.

Though USDT has its own risks, using a stablecoin as collateral will help mitigate crashes such as ‘Black Thursday,’ during which the cascading crash was intensified because the BTC/USD swaps were collateralized in Bitcoin, as our CEO Roei Levav explained in this Thursday’s Binance trading panel (info in our Team Updates section).

But with all this development, the worries we wrote about last month are resurfacing since last week’s appellate court greenlighted New York Attorney General’s Investigation of Tether and Bitfinex.

Institutional Landscape: More changes on the horizon

Things have been changing, but a lot more is yet to come. As Darius Sit from QCP summed it up in a recent panel, “It’s not amateur hour anymore.” Since 2018 more sophisticated market makers with experience in the traditional markets have joined cryptocurrency markets, making them more liquid. This encouraged larger institutions to enter the space, thus further improving liquidity and at times helping to stabilize prices.

From Amazon Web Service to where?

Cryptocurrency exchanges were built for retail traders. Algo traders and HFT market makers running many orders between many pairs often find it challenging to work with the current exchange infrastructure. The exchange overloads during March 12th crash and made clear the need for more stable setups in the entire cryptocurrency exchange space. During the crash many leading exchanges experienced overload, preventing market makers from coming in and stabilizing the market.

“I hate to say it. But just exactly like traditional finance, where there are brokerages that handle all the retail flow, and then the brokerages have seats with the exchange, who directly connect with the exchange on the same rack in the same data center. That seems to be a lot more scalable than having millions of retail connections all over AWS, everything going through Cloudflare, so there’s another extra jump…maybe we don’t need to reinvent the wheel.” Explained Galois Capital Co-Founder, Kevin Zhou.

Lately more exchanges have been offering co-location of servers with the exchange, which is beneficial for traders depending on low latency, but that still doesn’t immediately solve the overload problem. Another interesting solution was offered by Willy Woo, who suggested to “cut silicon”-produced specialized computer processors to speed up the capacity of exchanges matching engines. While it’s difficult to predict the direction that exchange infrastructure will take, it is clear that there will be changes coming. We have already noticed significant improvements in exchange infrastructure on the venues we’re trading on and anticipate this will trend will accelerate.

The ideal prime broker

Big investors in the fiat world are accustomed to prime brokerages — brokers, usually banks, that bring together all the services an institution would need to trade (i.e. buying and selling in any possible market, lending, custody, execution and more). Today there’s a race in the crypto space to create or become such an institution, mostly by acquisitions, as we covered in our news section last month. The inspiration behind this is:

A) Belief it will draw institutional investors to the space.

B) Continuing the maturation of the cryptocurrency markets structure amd interest in emerging as its leader.

Kyle Davies from Three Arrows Capitalsuggestedthat because prime brokers need a network effect to become useful, a successful prime broker may grow organically around a service everyone is already using, such as perhaps FireBlocks who are leading the industry in moving around cryptocurrency for traders and already have an impressive list of clients.

Big fish awaiting small lake regulation

With hedge funds and prop funds coming into our markets and with the growing flow of talent into our industry, there is a clear maturation of the market participants. “It has become too hot for them [the traditional prop funds / hedge funds] to ignore. In the global market you are seeing a negative interest rate environment and it’s harder and harder to generate yield, this [cryptocurrency market] is sort of a little untapped island for them and they’re gonna come hungry very very soon.” said Darius Sit, the founder of QCP Capital. What is stopping many is lack of clear regulation and infrastructure, such as a prime brokerage. But this is a catch because prime brokerage may have trouble establishing strong banking relationships while clear government regulations are still lacking.

The lack of regulatory clarity and the still relatively small market size still are barriers between the cryptocurrency markets and the traditional prop funds. Kevin Zhou suggested “I think the real competition is yet to really come. There are a lot of smart people out there…one of the reasons they haven’t come full force into crypto yet is just because the market isn’t big enough for them.” These traditional prop funds are incredibly sophisticated and will be a major force in the market, making it more difficult for the crypto-native funds to generate alpha.But for now, while we still can, we can enjoy the familiarity of a small and growing industry and established advantages.

News and links

BitMEX moves to new holding company 100X group, CEO Arthur Hayes explains

Tey Elrjula for Coindesk: I’m a Syrian Refugee. This Is How Bitcoin Changed My Life

Japanese bank SBIacquired a $30MM stake in cryptocurrency OTC B2C2 .

Weekend reading: Progress As a Myth — The Thielian Moment