Peaks and Valleys

Welcome back to Efficient Frontier’s biweekly newsletter! After a quick market overview we’ll talk about what the future of finance is going to look like.

The last two weeks included two highly volatile days for the Bitcoin markets. On Saturday November 27th Bitcoin dropped from around $59,000 by almost $6,000 to a low of $53,600, though the drop triggered only $0.3B in futures liquidations.

Following 6 days of relative calm with Bitcoin unsuccessfully trying to break through the $60,00 mark, this recent Friday a series of liquidations was triggered after Bitcoin broke below last week’s low. A few hours after the initial breakdown, a flash-crash was triggered. From 00:21 to 00:28 New York time, Bitcoin’s price dropped from $48,600 to $41,600, then quickly bounced above $46,000 and has since drifted upwards, currently at $50,320.

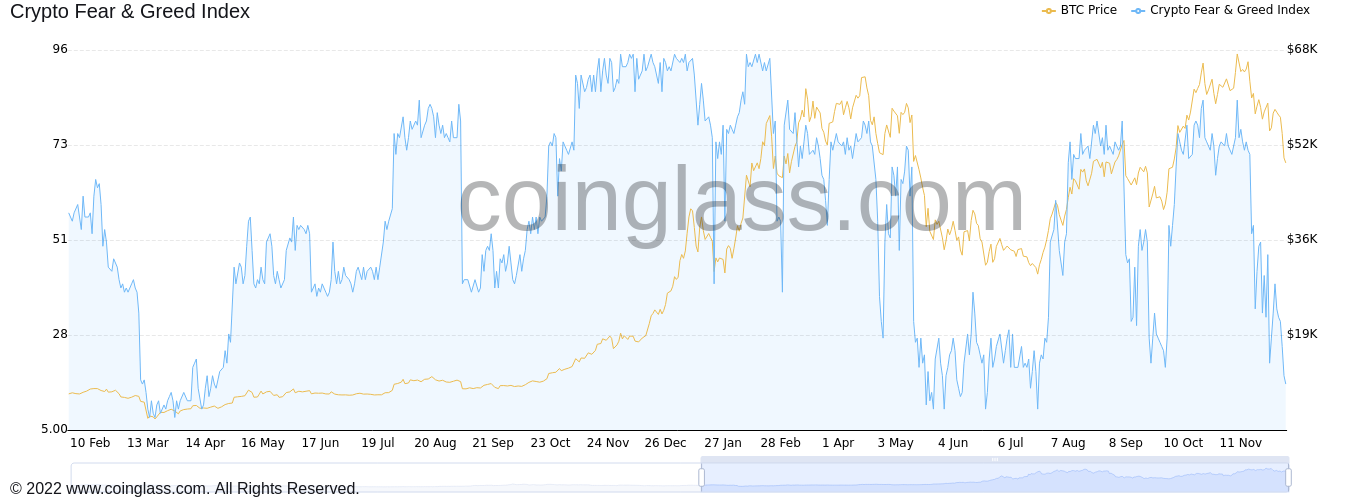

These events gave a good scare to market participants and Bitcoin’s Greed and Fear index reached a four month low on Monday.

Friday’s price action triggered $846 million in Bitcoin liquidations, out of a total of $6.58B worth of contracts closing, shrinking Open Interest by 25%.

On-chain analytics estimated $3 billion in on-chain loss taking on December 3rd, a 5 month high.

CrypotQuant aggregated perpetual contract funding rate is still slightly negative, making shorting more expensive than going long.

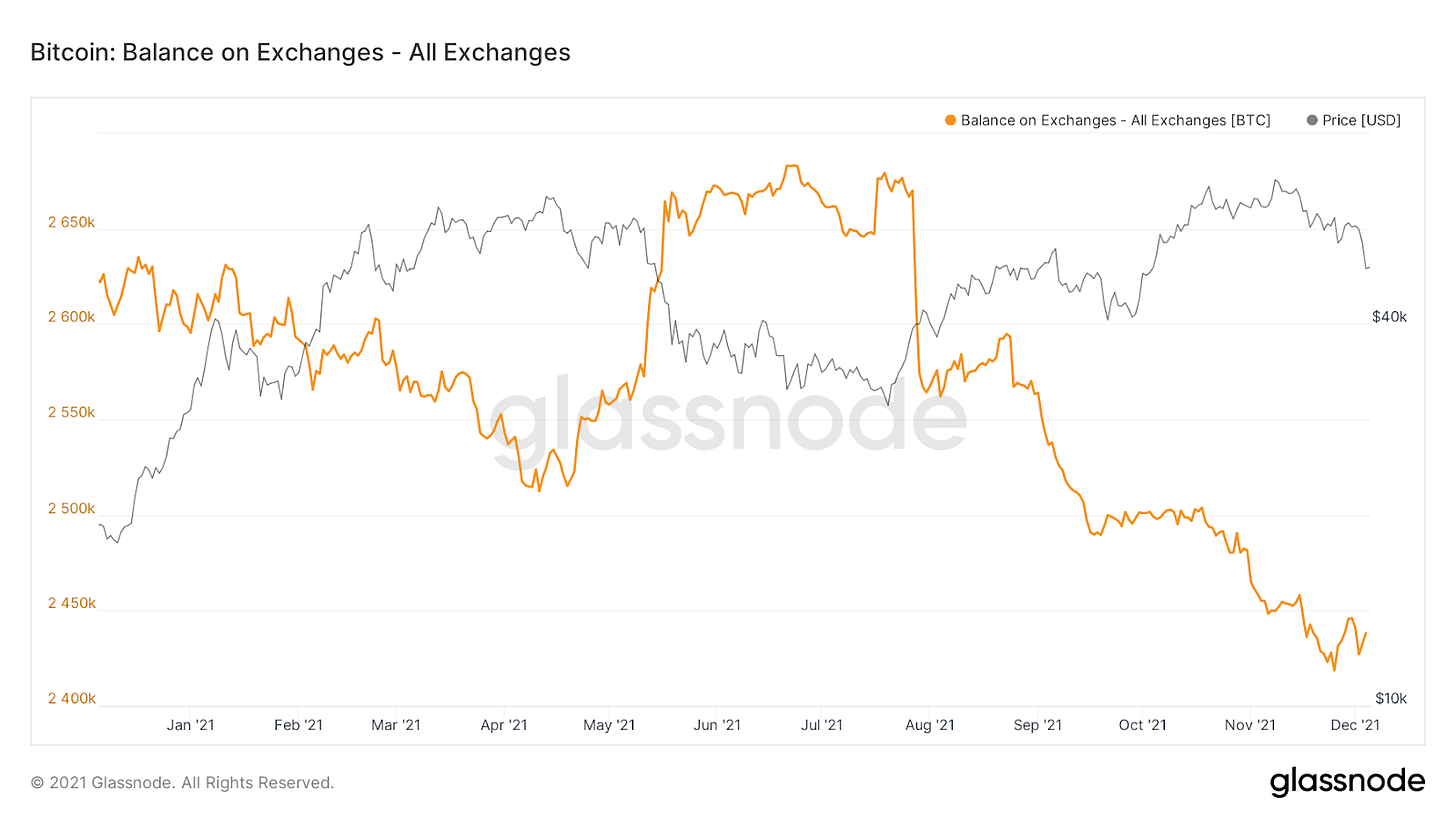

Unlike April, this sharp drop from ATH was not accompanied by a large flow of coins into exchanges

Record VC Funding

"The [amount of] money flowing into the space is monstrous. The building going on by some of the most talented people on the planet is like nothing I've ever seen.” Investor Mark Yusko told Blockworks.

According to PitchBook, $27.4B worth of venture capital flowed into the cryptocurrency space in 2021, more than 4 times 2020’s $6.5B.

Can this number go higher in 2022? It’s hard to imagine, though EY found 1 in 4 hedge funds expect to increase their cryptocurrency exposure in 2022, so who knows.

The real future of finance

There are two technological paths for digital money: Open source money i.e. decentralized cryptocurrency. The other option is a completely state controlled CBDC, pioneered by China and being examined by central banks around the world as a viable option.

No matter what we’ll be using, money is changing.

“In the bigger picture, we're clearly having a transformation of what money is and how we interact with money, and what assets we monetize as we preserve value from one system to another,” said Lyn Alden to RealVisionTV.

Today we’ll review two particular visions of the future of money and finance using the open source systems.

DAOs and finance

A DAO is an organization which uses cryptocurrency’s digital signature tech and transparency to manage and control a shared pool of capital.

In Arthur Hayes' recent inspiring article, he shared his vision for the effect of DAOs on finance and markets:

Hayes sees the DAO as the evolution of the original vision of a limited liability corporation. In the near future, DAOs will organize to fund and manage businesses in virtual and physical reality. Doing business with unprecedented transparency they will be more trustworthy and have lower margins.

DAOs can issue bonds and debt, as well as create fractional lending banks where depositors and investors are able to view (in real time) the health of the bank. DAOs will issue credit cards, mortgage back securities and other products.

DAO-centric financial activity will have the advantage of transparent accounting and balance sheets, lowering the risk for investors and business partners. DAOs will also be able to offer lower interest rates and margin due to the available history of market participants.

DAOs are already making a real world impact. Last month a group named “The Constitution DAO” organized through social media, raising $40 million from thousands of people to bid in Sotheby’s auction of an original copy of the US Constitution. Other examples include PleasrDAO and FreeRossDAO.

Stablecoin banking

According to an IMF paper by Bitcoin evangelist Caitlin Long and IMF economist Dr. Manmohan Singh, regulated stablecoins on open blockchains are the right choice for an upgrade of the dollar denominated financial system, to replace current forms of banking collateral.

Dr. Singh is an expert on rehypothecation - the reporting of one financial asset as if it is owned by multiple institutions. According to Singh, due to rampant rehypothecation throughout the banking system and lack of systematic transparency, today’s dollar banking system has a very high level of leverage (20X or more) and an unknown level of risk. This is allowed due to the long settlement times in the US banking system.

The paper explains that stablecoins solve both these problems, lowering settlement time (which allows lower leverage) and providing transparency, while being technologically superior to other closed-network solutions. The paper concludes that the financial system will be much more stable if banks will issue stablecoins with FDIC insurance or even use stablecoins issued by the Federal Reserve, to replace current forms of collateral and tech.

Team update

We’re glad to share that Efficient Frontier has closed a new funding round with some of crypto’s leading investors. A huge thank you to our new partners!

Animoca Brands, Kyber Ventures, ICON Foundation, Starkware, INX, Hillrise Ventures, BitMart, Cadenza Ventures and Alameda Research.

News & links

‘Bullish’: new institutional crypto exchange funded by Peter Thiel, Galaxy Digital and Block.one to go public in SPAC

WisdomTree's US spot bitcoin ETF proposal denied, launches 3 crypto ETPs in Europe.

IMF issues detailed warning on El Salvador’s usage of Bitcoin, while locals struggle to adopt the technology

CitiGroup hiring 100 people for its ‘crypto division’

FTX.US exchange seeks to raise $1.5 billion

Video: US Congress to hold hearing with executive from Coinbase, FTX, Paxos and others

Sending our love from Tel-Aviv and San Francisco,

Efficient Frontier