Planet KYC

Happy new year! In this edition we'll review the Bitcoin markets and summarize the cryptocurrency regulation frenzy that took place during the holiday season

It’s been an exciting couple of weeks, with mixed news such as a large advisory stating they sold half of their Bitcoin holdings and the OCC who just announced they will allow banks to use and issue stablecoins.

It’s started

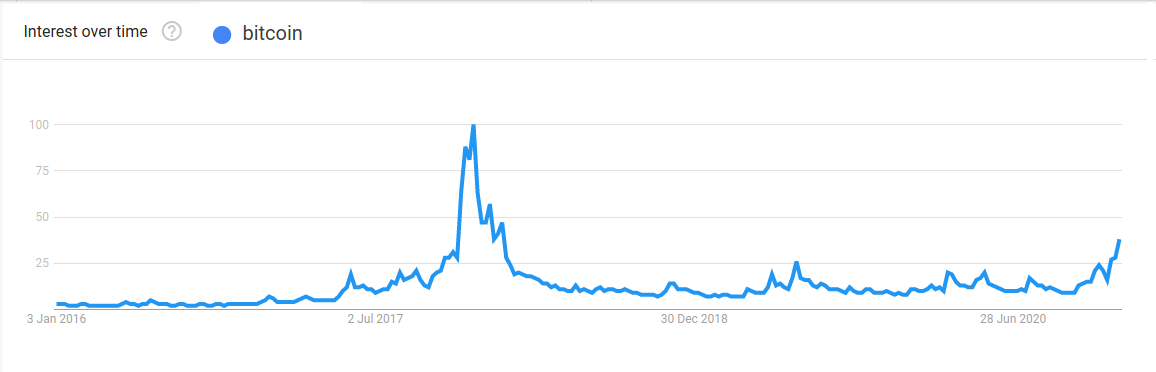

If you believe Bitcoin will keep to its parabolic history, the famous Google Trends chart is encouraging: It’s at last showing extra public interest in Bitcoin, at 42% from the 2017—Bitcoin-mania peak:

Have the traders slowed down? According to CryptoQuant, they haven't, yet. The calculated funding rate, which correlates with the amount of leverage used by Bitcoin traders across popular exchanges, was at a yearly record high before yesterday’s correction. Interestingly, during Monday’s price crash the funding rate continued to rise to a new yearly record, coming down to previous levels when the price recovered.

Above: The orange line shows aggregated funding rates across exchanges. The black line shows the Bitcoin price. The top image shows a zoomed in chart. Source: CryptoQuant

CME Bitcoin perpetual contract trading reached a record of $1.6 billion open interest on December 28th, a day after Bitcoin’s price broke above $27,000 for the first time, with a record volume of $2.6 billion. The leading exchanges in total reported on December 28th total record $11 Billion in open interest in the Bitcoin perpetual contract, with reported $370 B in trading volume, accoring to Skew.com.

Feeling greedy?

The last time the MVRV Z-score greed level was this high, it was late November 2017 and early 2018, not quite THE TOP, but getting close, and of course according to the linear MVRV, Bitcoin is deep in the greed zone.

Source: LookInToBitcoin.com

The all time Coindays Destroyed chart does not show an extraordinary amount of old coins moving, meaning large long time Bitcoin holders are still holding on to their coins.

Source: Blockchair

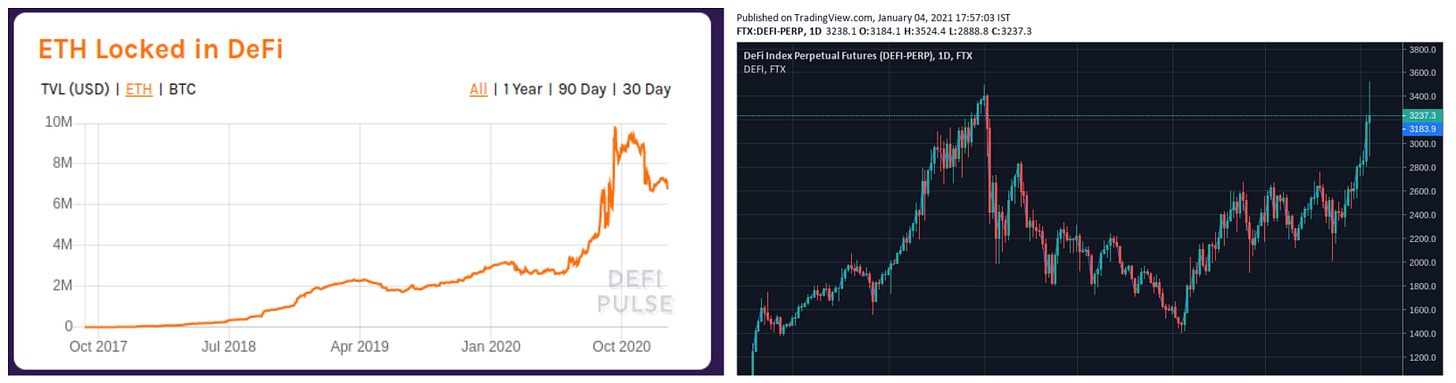

DeFi Growth

Price-wise DeFi tokens are still catching up with Bitcoin, but the world of on-chain applications is growing. 6.8 million Ether are being hosted in on-chain applications, comapred to 5 million coins on August 31st, which was one day before the ‘DeFi Summer’ market crash.

‘Tis the season for KYC

The trend of increased regulation and crackdowns on cryptocurrency usage has been accelerating during this holiday season. Here’s a quick summary of what’s been going on:

December 2nd: Unstable Act

The Stable Act, presented to the US Congress on December 2nd, seeks to have anything from Maker DAO’s Dai, to BigMacCoin to even PayPal apply for a banking licence. It also would criminalize miners transmitting unlicensed stablecoins. According to CoinCenter’s Jerry Brito and Peter Van Valkenburgh, it is unlikely to pass, due to its broad intentions and the fact that it was presented by a non-mainstream section of the Democratic party that does not have enough influence to pass this law. “I think a lot of the motivation for this bill is Libra, so if something like Libra re-emerges, it will get more juice behind it,” CoinCenter explained.

December 7th: G7 requests cryptocurrency regulation after linking ransomware to WMD!

On December 7th, 11 days before the new FinCEN reporting rules were proposed, a press release by the US Treasury reported Secretary Munchin's online meeting with G7 central bankers and treasury ministers (G7 is a intergovernmental organization of 7 countries: Canada, France, Germany, Italy, Japan, UK & USA). According to the press releases the only topics discussed were the global need for economic recovery and the need for cryptocurrencies to be further regulated.

This is an interesting follow-up to the October G7 press release issued on the topic of ransomware. “The COVID-19 pandemic has expanded opportunities for ransomware attackers…[and] If employed by a state-sponsored or linked actor, ransomware payments could offer a possible profit source to finance the proliferation of weapons of mass destruction,” they wrote. The official text reached its conclusion: “The fact that criminals often demand that ransoms be paid in virtual assets is of particular concern to the G7 and magnifies the need for all countries to effectively and expeditiously implement the FATF's standards on virtual assets and virtual asset service providers.“

December 18th: Improper rule-making by departing US government

15 days ago a new rule by the US Treasury Department was presented for public comment. The rule would have cryptocurrency exchange and custodians report to FinCEN (The Financial Crimes Enforcement Network) all withdrawals of over $10,000 worth of cryptocurrency (a rule applied to cash withdrawals since 1970). But it also requests that any user wanting to send more than $3,000 to a personal wallet, will have to provide the identity and physical address of the wallet's owners, to be reported to FinCEN. This type of information collection would apply only to cryptocurrency.

Coincenter, a Washington D.C. non-profit dedicated to promoting pro-cryptocurrency law making, explained why this rulemaking could be overturned in court: Normally new rules are presented with at least 30 days for the public to comment. As part of the democratic process of government, the creators of the rules need to consider and respond to the public comments before finalising the new rule. In this case, only 15 days were given for the public to comment (including only 8 work days due to the holiday season). According to CoinCenter, the only legal reason to shorten the public comment period is national security. The regulators did claim that national security is the reason for the shortened comment period, but urgent rule changes connected to national security are routinely presented without any time for public comment due to their sensitivity. According to CoinCenter, never before were new rules presented with only 15 days for public comment. With the Congress adjourning on January 4th, the end of the given comment period, it’s clear the departing government is just trying to push this rule through at the last minute. Meanwhile, CoinCenter got 7 Congress and Senate members from both parties to protest this process to the Treasury Department.

According to CoinCenter, the USA FinCEN money laundering and terrorist funding regulations are usually mirrored by the G7’s FATF rules. This is why it’s important to them to prevent this ruling.

December 24th: Hong Kong Bitcoin Association appeals to lawmakers requesting to prevent the ban on retail investors from buying and selling cryptocurrency, after proposed new rules in November.

December 31st: BitGo fined $99K for breaking sanctions dating back to 2015

On the last day of 2020, The US Department of Treasury published on their website that they have arrived at a settlement with BitGo, fining them $99,000. The fine is due to BitGo's wallet users allegedly making 186 transactions to the Crimea region of Ukraine, Cuba, Iran, Sudan, and Syria between 2015 and 2019.

January 1st: Monero goes dark

Four days after the current biggest online ‘black/dark market’ said it will no longer accept Bitcoin and will be using Monero instead, the US based exchange Bittrex announced they will be delisting Monero, ZCash, Dash and Grin on January 16th. This is assumed to be due to difficulty or perceived difficulty in compliance and tracking of these coins’ transaction history.

January 5th: Yes to stablecoins! As we finalized this newsletter, news came out that the OCC has permitted banks to use and host stablecoins to assist customers.

Conclusion: Today’s leaders may be suffering from a fear of original cryptocurrencies. While many governments are promoting the creation of centralized digital currencies (CBDCs) which could increase their control of financial activity, governments seem to fear that Bitcoin could quickly ‘get out of control’, swiftly trying to implement strong regulation.

News and links

Arcane Research December thoughts: ”The wheel is in motion and cannot be stopped.”

Cryptocurrency industry figures try to predict 2021, Coinmetrics writes a 2020 review.

Simplex partners with Visa, licensed to issue cryptocurrency credit cards

NYT alleges Coinbase underpaying of African American and women is more than ‘normal’ tech industry pay gap

CTFC’s research department published their overview of digital assets and view on regulating futures and options

Binance launches European style options, Deribit announces up to $200,000 Bitcoin options strikes

Video: Cointelegraph interview Mexico's second richest man on why he invested in Bitcoin

Team Update

Latest Efficient Frontier quotes in Coindesk Market Wrap:

“‘The huge price jump has cleared many sell orders on exchanges as they were filled on the run-up, said Andrew Tu, an executive at quant firm Efficient Frontier. “On exchanges, sell-side liquidity is much thinner than buy-side liquidity because we are in uncharted territory,” Tu told CoinDesk. “The lack of liquidity on the sell side means that bitcoin’s price can rise faster, as we’ve seen since it broke the $20,000 figure.’”