Efficient Frontier September 2023

Proof of Cycle

A flash crash, a g-d candle, lowest crypto trading volume since 2020 but a Bitcoin ETF seems inevitable! It’s never a dull month in crypto.

Note from our CEO

Dear Clients, Network, and Friends,

Over the past month, we've been quietly but diligently working on scaling up our oprational capatiy. We've focused on improving many of our operation controls and upgrading internal processes, all improving our capabilities to serve you better.

As part of this process we’re thrilled to introduce two exceptional additions to our team, Ben Abitbul and Johnathan Orlianski, who will play key roles in our growth.

Thank you for your continued trust in us. We look forward to serving you even better in the days ahead.

Warm regards,

Yohai Rayfeld

Chart of the month

The highlight of the month is GBTC, which surged by 17.8% on August 29th after a US appeals court granted it another chance to apply for an ETF status.

GBTC, an exchange-traded Bitcoin trust by Grayscale, holds 643,572 Bitcoins (3% of the total supply) and is the sole American instrument tracking Bitcoin. Due to its unusual structure, its previous discount reached as low as -48.7% compared to Bitcoin. Following recent developments, it now stands at a more 'moderate' -18%. This represents an additional market capitalization of $7.1 billion since last November, out of a total of $16 billion in assets.

This holds significance for two reasons. First, the unanimity and decisiveness of the ruling led Bloomberg's ETF analyst to increase the likelihood of American BTC ETF approval to 95% by Q4 2024. Second, the GBTC discount serves as a key indicator of investor sentiment.

Blogs and feeds

If you're interested in learning about the volume breakdown of BTC & ETH versus the top 50 tokens versus all the others, please check out our blog!

In our Telegram Broadcast, we publishes a timely explainer of recent Binance “FUD” and more. Join us for more market updates.

On our Twitter we shared “Spread 101: Efficient Frontier’s Head of Research explains spreads”, a beginner explanation on the meaning of spreads.

Team update

This month, we are excited to announce that Zach Reingold, who has four years of experience in developing our network, has taken on the role of Head of Ecosystem at Efficient Frontier.

He will be dedicated to fostering collaborations among Efficient Frontier's network, partners, and clients. You can reach out to Zach for connections in the crypto world, including token projects, service providers, exchanges, and VCs!

Conferences: This month, Efficient Frontier is taking on Asia. Our Head of Sales, Andrew Tu, is attending currently Korean Blockchain Week. You still have the opportunity to meet him on Friday if you’d like to say hello.

Our co-founder, Roei Levav, and CTO, Alon Elmaliah, will be flying to Token 2049 in Singapore next week. Feel free to drop us a line if you'd like to say hello at sales@efontier.io.

Commentary: Proof of cycle

Liquidity in cryptocurrency markets is drying up, the mood on CryptoTwitter is reminiscent of 2019 but are there any concert reasons for optimism? Yes.

A Bitcoin bull run requires several factors to converge: cyclical, macroeconomic, and fundamental. In the following post, we will examine these factors.

1. Cyclical

Bitcoin is influenced by both the typical market cycle and its unique halving cycle. It would be easy to persuade anyone following the crypto world that over the past year, Bitcoin has already undergone the “depression, panic, and despondency” stages.

The aftermath of Luna, Celsius, BlockFi and FTX blowing up with Bitcoin touching $15,400 on November 21st 2022 was brutal.

The NUPL/MVRV metric is a quantifiable representation of the depression phase and the subsequent recovery, as explained in detail in our 2020 post here. It has accurately marked the last three Bitcoin market cycle bottoms. Is this time any different?

Lack of Sellers: The following chart tracks on-chain assumed Bitcoin sales. The green line indicates Bitcoin sales for USD profit, while the red lines represent selling BTC at a USD loss.

Both types of sales have significantly fallen since 2021. We believe the large spike in November 2022 was capitulation. Notice that subsequent low prices did not trigger additional large selling events. Higher highs off the bottom in the last few weeks (e.g., $31,800) did not lead to additional profit or loss-taking. There are hardly any sellers left.

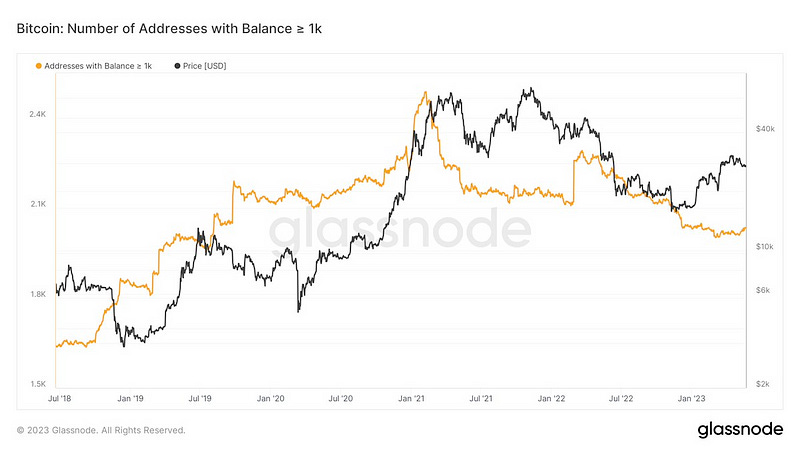

Another chart hinting at the scarcity of sellers is the refusal of the institutional-sized Bitcoin address chart to make a lower low for over 5 months.

Halving Cycle: As we approach the 4th halving event, the concept of the halving cycle has not yet been invalidated. Historically, during each 4-year cycle, the Bitcoin market has hit its bottom in the year leading up to the halving, and it appears we are still following that pattern. Subsequent to each halving, there has been a (gradually diminishing) parabolic surge followed by a roughly 75% drop.

This pattern is expected to persist until Bitcoin technology achieves full adoption. The upcoming halving, projected to occur in April 2024, will reduce daily production from 900 to 450 bitcoins. Consequently, the daily inflows required to maintain price equilibrium will be cut in half to $12.5 million (based on today’s price).

2. Fundamental

Analyzing the fundamental value of Bitcoin warrants a dedicated blog post. However, for the sake of brevity, it can be summarized in terms of adoption, which can be divided into two categories: accumulation and usage.

Accumulation metrics are very strong. Addresses holding over 0.1, 1, and 10 BTC have been steadily increasing since last winter, with individual-sized accounts representing average buyers of 0.1 and 1 BTC at all-time highs.

The amount of trasnaction is fairly stable and growing:

3. Macro

“Bitcoin is a bad main street inflation hedge, but a great monetary inflation hedge”

Until the issue of Western government debt is resolved, there is no reason to expect anything other than further monetary inflation. Bitcoin has historically proven to be a reliable hedge against monetary inflation, as illustrated in the chart below:

There are three likely options:

A) If world currencies, led by the dollar, are printed into oblivion, Bitcoin, gold and real assets will serve as a protection.

B) If the Federal Reserve refused to print the difference, a debt collapse of the US would be even worse for the US dollar and the international currency system.

C) If the United States government achieves miraculous economic growth in the coming years, and the dollar maintains its value, Bitcoin will benefit, as it is the breakthrough money technology in an increasingly computerized and digitized world.

Whether driven by speculative frenzy, hyperinflation fears, or its technological superiority over gold and the dollar, Bitcoin is likely to gain market share, bolstering various segments of the cryptocurrency markets.

Coupled with a shortage of sellers, ongoing adoption, and the cyclical nature of Bitcoin prices, we hold a positive outlook heading into 2024.