Retail spring

Two signs the retail frenzy for Bitcoin and cryptocurrency has returned, market overview and news compilation

As summer begins in the northern hemisphere, Bitcoin has ended its best Q1 in 8 years and the cryptocurrency market awaits its first major company's IPO (Coinbase on April 14th). Since our last newsletter Consolidation Edition, Bitcoin’s price rose from $51,358 to around $56,500 in two days, and since has been ranging between $60,000 per-coin to $54,000, currently at $58,000. Etherum is holding above $2,000 for the first time, now at $2080.

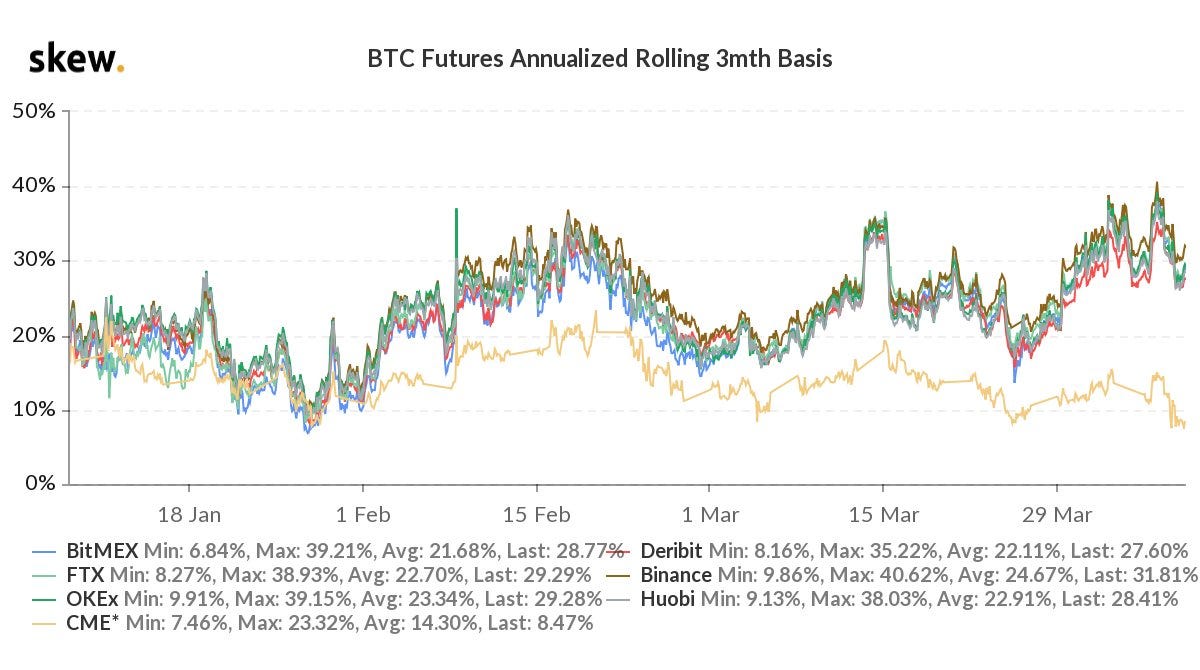

Two metrics, the “Kimchi” South Korean Bitcoin premium, and Bitcoin futures premiums (basis) may hint that retail excitement is back after a long period of institutional dominance:

Bitcoin supply can be slow to reach the South Korean Bitcoin market due to the capital controls in the country so when the South Korean demand for Bitcoin is unexpectedly high, the coin shortage squeezes the price above the normal market price, as seen above. The “Kimchi' premium, reached 15.3% above the global Bitcoin price this week, a level not seen since early 2018.

Bitcoin futures prices on off-shore retail oriented Bitcoin derivatives exchanges are right now close to 30% annually, with the September Bitcoin contract trading above $63,000 at the time of writing, another sign of retail excitement. Meanwhile the basis in institutional-oriented CME has been dropping, as seen above.

Binance, which has continued to dominate the bitcoin futures market over the last year, has seen a record futures basis in the last week.

Other signs of retail excitement: Vanity Fair magazine talking NFTs and Bitcoin with hip hop star Snoop Dog, fast food chain Chipotle does a Burritos and Bitcoin Giveaway, the Mayor of Miami interviews Vitalik, goes on local mining company’s podcast, NBA Sacramento Kings offer to pay salaries in Bitcoin and Bloomberg publish a new bullish crypto report.

Open interest in Bitcoin future and perpetual contracts reached a new record of $23.73 billion on April 3th, and the total cryptocurrency futures market hit a record $5.7 billion worth of open contracts on April 6th. Trading volumes have been stable in the last few weeks as speculators await a breakout.

“… the most deals I’ve ever seen in one week”

commented Nick Carter on the Castle Island weekly cryptocurrency industry update, reporting over $500 million dollars flowing into the cryptocurrency space in the last weeks. The new investment ranged from buying into established companies like Chainalysis (who raised $100 million) and FireBlocks, to the new Bitcoin bank Avanti or TaxBit, to the other side the spectrum with hundreds of millions going to trendy investments such as ICO’s, Altcoins, DEX’s and NFT platforms.

Miners and network

Bitcoin’s network now transfers $137,000 per second around the world with the median transaction size being around $500.

March 2021 has been the most successful month ever for Bitcoin miners, who mined $1.5 billion worth of Bitcoin, with the price of mining per-coin estimated to be below $20,000.

Due to the current shortage in Bitcoin mining rigs, “delivery of new mining equipment is estimated to November 2021 and January 2022. Meaning that we are likely to experience a large growth in hashrate as we enter 2022. This is similar to what we saw in 2018, when the hash rate soared even though bitcoin was in the midst of a dreadful bear market,” wrote Arcane Research.

Bitcoin’s mining difficulty hit a new all time record, reflecting network security and Bitcoin mining power around the world.

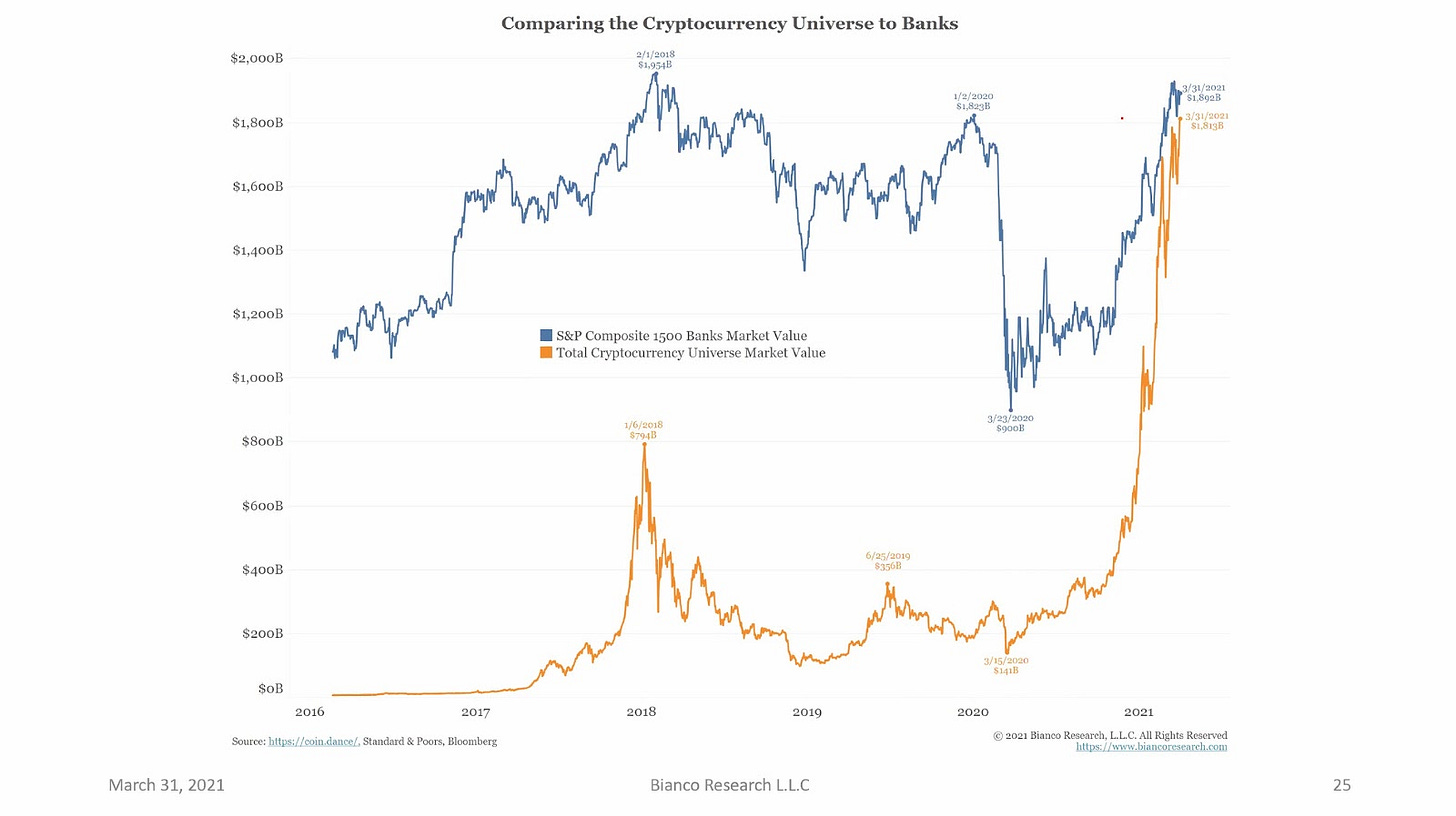

And to end of a very positive note, the chart above from Bianco Research shows Bitcoin’s market capitalization compared to the S&P composite of 1500 banks since 2016.

News & links

CME Group set to launch micro (0.1 BTC) Bitcoin futures in May

Morgan Stanley, the American investment banking giant with $1.4 trillion AUM, files to add Bitcoin exposure to 12 of its mutual funds. Silvergate to provide Fidelity clients with Bitcoin collateralized loans

Kentucky governor signs tax breaks bill for miners while Abkhazia (formerly part of Georgia) wants to ban cryptocurrency mining due to energy crisis

Paypal to integrate cryptocurrency with their 30 million merchants, Visa to allow partners to settle payments in USDC

One coin to rule them all: Coinbase hires former SEC director and E-Toro hires former Israeli banking regulator after last month Binance hired former U.S. senator and ambassador to China.

Fillings show BlackRock held only $6.15 million in Bitcoin futures contracts

Argentina’s Central Bank requests personal information on all customers who dealt with cryptocurrency, Japan to instate FATF for cryptocurrency in 2022, Canada mandates strict KYC rules

Coinbase Opens Office in India Despite Crypto Ban Report, Major Venezuelan satellite TV provider starts accepting cryptocurrency payments

British authorities capture $4.5 million worth of illegal drugs from darknet merchants. DeepDotWeb Operator Pleads Guilty to Laundering $8.4M in Bitcoin Kickbacks from dark net markets

Weekend reading: Glassnode dive into Bitcoin’s position in the current macro environment, Arthur Hayes new article