Sushi Wrap

Covering the last two exciting weeks in the crypto markets from the SushiSwap drama to miner fees, plus Zack Voell’s unique opinion on the future of DeFi

“Just some more bull market volatility….”

Two weeks ago, when we last met, Bitcoin was at $11,500. In the next few days it rose to around $12,000, before quickly dropping by $1,500 on September 3rd to around a low of $10,020.

Above: 14 months of daily BTC/USD candles. Source:tradeblock.com

Currently Bitcoin is still ranging between $10,500 and $9,900, a level slightly above the former base which was formed around the $9,500 price this July, during the “low volatility period” we were complaining about in previous editions.

This shape of rise and drop in price is common in the cryptocurrency markets, amusingly named the Bart Simpson pattern, but it usually happens over shorter durations. Though detecting it has minimal predictive use, some see it as hinting at market manipulation.

Wrapping up the summer season: The following chart shows the correlated trading activity during this summer. After the July 26th breakout to the highest prices Bitcoin and Etheruem have seen this year, the altcoin market experienced a strong buying frenzy, bringing back the much awaited Altcoin Season, especially for coins under the category of DeFi. And according to CMS Holdingsfounder Daniel Matuszewski, one of the leading traders in the cryptocurrency space, the frenzy isn’t over yet.

Uni, Sushi and Sashimi

Clearly leading this stage of the excitement and buying frenzy was the news $SUSHI token. On September 1st, UniSwaprival SushiSwap’s SUSHI token plummeted after the anonymous founder Chef Nomi cashed out his SUSHI tokens for over 37,000 ETH, shaking the faith of the project’s users.This news seemed to break the altcoin market. The panic created by the Sushi crash grew the next day, with unclear news about the biggest South Korean Bitcoin and cryptocurrency exchanges, BitThumb, being raided by authorities. But when the news broke that Chef Nomi had transferred the project’s control to Sam Bankman-Fried, the CEO of the popular cryptocurrency exchange FTX, the sellers stopped. This morning Chef Nomi announced on Twitter he made a grave mistake, and has returned the $14 million worth of Ethereum to the Sushi fund, controlled by the owner of $SUSHI tokens holders.

The total cryptocurrency market, including thousands of different coins and tokens, reached its recent high on September 1st, at a total market cap of $388 billion, before Chef Nomi hit the brakes. The total market cap dropped by 17.5% to $320 billion by September 8th, and since recovered about 5%, and is now at 335 billion, according to coinmarketcap.com.

One sure winner of this season are the Ethereum miners. Daily fees paid to Ethereum miners in order to clear transactions spiked to 38,000 Ether on September 2nd, one day after Ether’s price peaked at $478. In the last week, the magnitude of fees has slipped back to more common levels of close to 8,000 Ethers a day.

For more on Uniswap and DeFi predictions scroll down.

Back to Bitcoin

According to BitMEX’s exchange review report for August, Huobi is leading in futures volume, with August showing the highest levels of trading activity in 2020.

”Derivatives volumes increased 53.6% in August to $711.7bn. Meanwhile, total spot volumes have increased by 49.6% to $944.9 bn. Derivatives continue to represent just over 40% of total market share.” Bitmex wrote.

Willy Woo noted this week that growth of large, ‘whale’ Bitcoin accounts (over 1000 Bitcoin’s in one address) has grown with the USD money supply, which has grown during the covid-19 crisis.

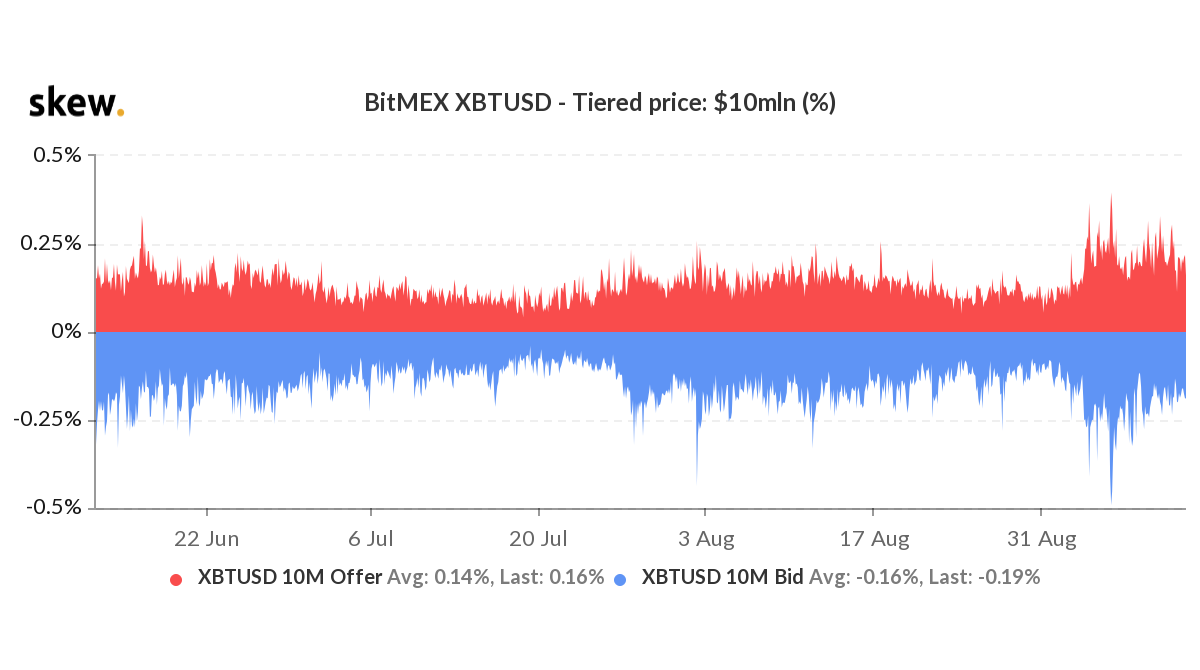

“The market has so far handled the deleveraging well — with the futures curve flipping into backwardation in BTC momentarily on Friday and over the weekend without any signs of market dislocation or stress. This is important for a healthy market that can take corrections breaking key levels without widespread end-of-world panic across the board.” said QCP’s market report on September 7th. Though liquidity in the derivatives exchanges has not recovered.

BitMEX, along with other exchanges, have lost a not insignificant amount of liquidity since the price drop at the start of September, shown in the above chart.

The future of DeFi

“One of the core elements of crypto is always gambling. Where that gambling happens can shift during different cycles, and we’re seeing it on some decentralized exchanges, most notably Uniswap…” explained Coindesk reporter Zack Voell, in a recent interview.

“[describing DeFi] as an economy of games is a very interesting label. There’s a very high level of gambling…but the rules are different in each game…. each protocol is unique and a prominent element of it is trying to outsmart people who are very in the weeds of this tech…There’s very little dumb money in this DeFi stuff right now, given the relative market caps.” Voell said, in his recent conversation withZoomerJD.

According to Voell the catalyst of the current DeFi craze has been Uniswap, the easy to use, no-KYC decentralized exchange using the Ethereum blockchain to clear transactions. “Uniswap is clearly a wildly successful product… it’s loved and it’s fully decentralized, and people are willing to pay more to use decentralized stuff.” Voell believes decentralized exchanges have the potential to become very big, but right now it’s still a “really rustic market, with immense risk and immense possible reward. We‘re seeing people experience both.”

“That gambling will always be there, and Uniswap is a reminder for newer people in the space that [gambling] was a primary attraction to crypto and still is. The chance to gamble and game, this sort of wild west feel, it’s never really going away, regardless of how many institutions come into Bitcoin.”

The conversation concluded with an interesting speculation: decentralized exchanges may keep growing in popularity due to the gaming attraction and lack of technological or regulatory barrier for entry (or exit), until countries start issuing warnings or trying to crack down on the unregulated exchange activity. That’s when Zack Voell and ZoomerJD would call the top.

News and links

1) Tax Tech: The IRS sets bounty of $625,000 on surveillance prototype of Monero and Bitcoin’s Lightning Network

2) Bitcoin VS Ethereum Technicals with Vitalik Buterin and Andrew Poelstra on the leading podcast “What Bitcoin Did”

3) Bank of Japan accelerates digital currency rollout, while Visa starts experimenting with CBDC

5) ‘Forsage’: Second most used contract on Ethereumflagged as scam by Philippines SEC

6) “Be your own bank”: Hong Kong’s Bitcoin Association’s inspiring billboard campaign

Follow us on Twitter & LinkedIn

Efficient Frontier’s market wrap is emailed every other Thursday and published on Medium the following Monday. Join our clients and friends and subscribe to receive it by email