The FTX debacle and the future of crypto

On the fallout of the $10+ billion black hole in one of crypto’s most loved exchanges and why we think this awful event will not impact the long run success of cryptocurrency tech

It’s quickly becoming cliche to say this has been the worst week ever for the cryptocurrency space. Besides the financial harm done to hundreds of thousands of exchange customers and hundreds of companies and trading desks, there is the emotional shock. These events clearly will take time to sink in.

In the following post we’ll try to provide context for this massive ‘bomb going off’ moment and hopefully make it easier to comprehend and process. We extend our sympathy to anyone hurt by this fallout and anyone else affected by this.

Is Efficient Frontier okay?

Yes. Thankfully, or more correctly, thanks to our prudent risk management system and team, we have at this time almost completely avoided the financial fallout and avoided having substantial funds trapped on FTX.

If you’re tired of hearing what happened, jump to our conclusion section at the end, where we’ll offer some positive thoughts and advice.

Executive summary of the main events

This week the crypto world discovered that one of its most beloved exchanges during the recent market cycle, FTX (led by a charismatic CEO, Sam Bankman-Fried or SBF), was insolvent.

The exchange shut its doors on Wednesday when it no longer could process withdrawals. More than $1 billion in customer funds seems to have disappeared. More billions seem to have ‘evaporated’ from FTX’s sister company, the hedge fund and market maker Alameda Research.

The extent of fraud and misappropriation of customer funds has grown by the day, with more and more reports and insight into what was going on behind the scenes and just how bad things were behind the “altruistic” success story.

Inconclusive list of alleged misdeeds that were published by many media and companies in the space:

Hiding the fact that FTX’s sister company Alameda Research was insolvent. This has likely been the situation since the May 2022 Luna crash.

Giving billions in FTX clients’ funds to Alameda to trade, with Alameda losing or misappropriating most of this money.

Using the liquid $FTT token that FTX issued as collateral for billions in liquid loans to Alameda.

Being responsible for backing soBTC (over 16,000 Bitcoin backed tokens) on the Solana network, despite holding 0 Bitcoin according to their bankruptcy filing.

Offering $5 billion dollars (as of now assumed to be misappropriated funds) to assist Elon Musk with buying Twitter.

Creating a ‘backdoor’ in the internal auditing software of FTX so that SBF could move funds between FTX and Alameda at will without being exposed to staff.

Pressuring crypto lending companies to give loans to Alameda (reported at $8 billion on Coindesk) if they want to work with FTX. Pressuring projects they invested in to keep their funds with FTX.

Encouraging employees to deposit their funds in the exchange when they knew they were insolvent

After the exchange shut down, FTX reported on Twitter that Bahamian authorities have directed them to allow customers in the Bahamas to withdraw. However, the Bahamian government has denied giving this order.

Not shutting down deposits for a whole day after exchange was known to be insolvent with no withdrawals possible.

Alameda continued to trade for 2 to 3 days after FTX and Alameda were known to be insolvent.

Alameda was allegedly trying to force Tether USDT into bailing them out.

More information keeps coming out.

FTX’s complex governance structure and subsidiaries hints there may be much more fraud to uncover.

How large is the damage?

According to FTX’s chapter 11 filings, FTX has 56 (!) subsidiaries with between $10 to $50 billion in liabilities and over 100,000 creditors, which makes this fallout the biggest since Enron in 2007.

The list of VCs who invested in FTX is long. They stand to lose in total most of the $2 billion they put into FTX.

The number of crypto companies, projects and funds that held large sums in FTX is unknown but assumed to be in the hundreds. It’s impossible to compile and verify a complete list at this point.

One would assume that the companies who have already publicly reported their losses are better off than the many more that have stayed mute. WuBlockchain compiled a partial list of companies reporting losses.

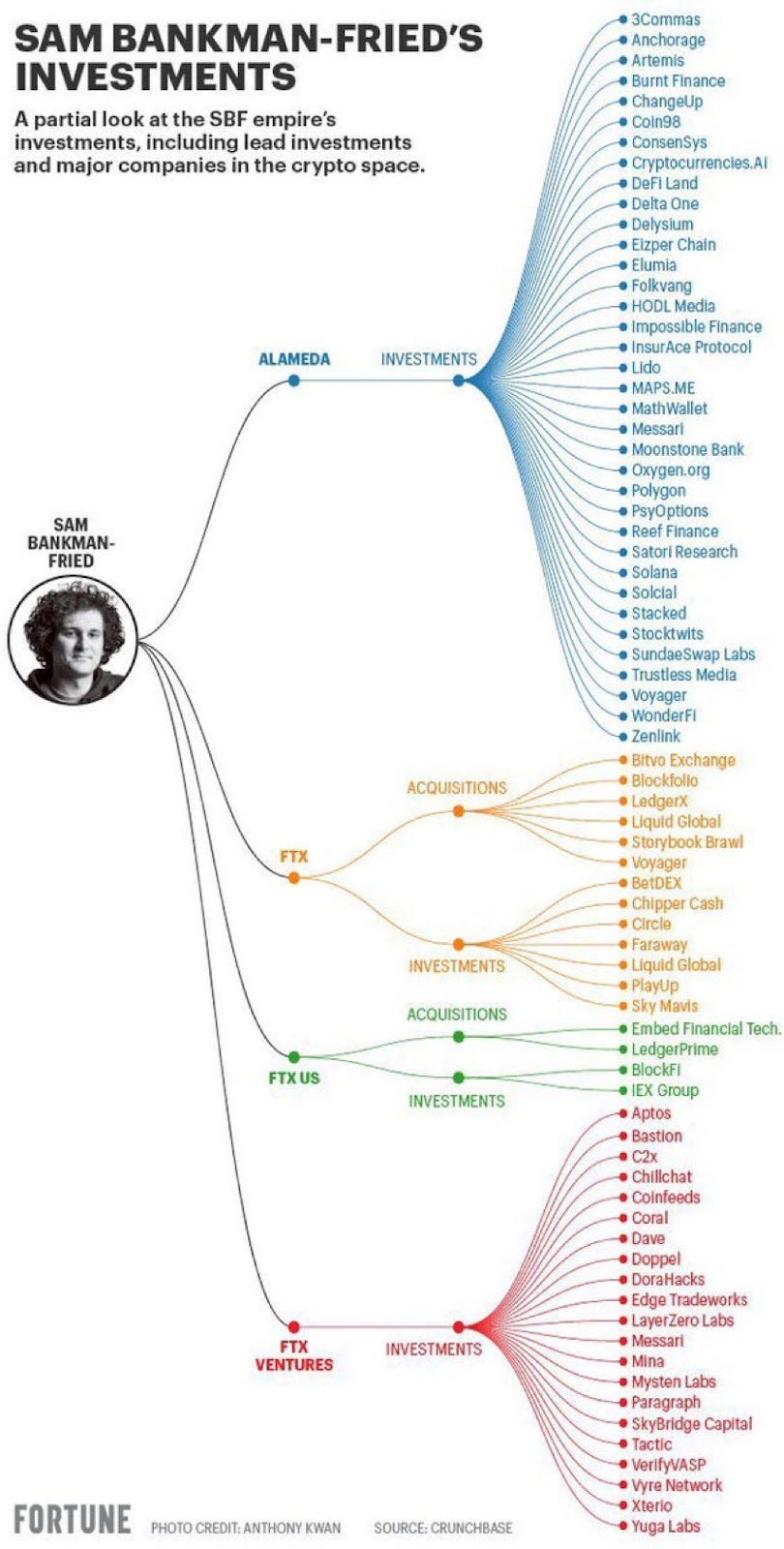

FTX invested in hundreds of companies in the crypto space. This equity will be liquidated.

FTX recently purchased Voyager. Their combined customers’ funds and outstanding loans are estimated to be in the billions of dollars. It is unknown how much of these funds were misappropriated.

Solana, the L1 blockchain was heavily funded and promoted by FTX. Its market capitalization fell from $10 billion to $5 billion this week.

State of the market

Zooming out, the drop in crypto prices has been substantial, but not the sharpest we’ve seen by a long shot. The total altcoin market cap lost 15% this week and Bitcoin lost 22%. These relatively measured reactions are probably due to Bitcoin and crypto already having lost 75% and 78% from the market peak, almost exactly one year ago.

Markets have been quiet, bordering on boring, in the last couple of weeks. Many professional traders assumed this was at least a local bottom, as the fallout from the implosion of Luna and 3AC in May and June seemed to be over. Unfortunately, underneath the surface, massive defaults were about to be exposed.

With the level of trust lost by the FTX events and the amount of fear going on right now, it’s clear that remaining weak entities will be exposed in the coming months.

At the time of writing, rumors and fears about exchanges are being taken seriously and already seem to be causing more ‘bank runs’. We may see more exchange defaults by the end of this week or month.

This is the equivalent of a forest fire. As bad as it is, it will clear the forest of debris, open it up to sunlight and create fertile ground for the next period of growth. The longer FTX would have survived, the bigger the bankruptcies and the worse the fire.

The positive twist

Bitcoin tech has a good and bad side. The very positive side is decentralization - the bad side is piracy. This week we’ve witnessed the huge damage that extreme piracy, opacity and offshore activity can cause when used by bad actors.

Nonetheless, this fallout will bring more focus to the positives of decentralization. Real decentralization ensures that too much power or information is not concentrated in one entity's hands.

DeFi protocols have demonstrated that they function even in the worst of times and proven the value of transparency. During the fallout, open financial protocols and exchanges like MakerDao, Aave, Uniswap and others remained operational and solvent. The reason they are solvent is that they never let debt pile up in the dark. It’s technically impossible. This is the power of real crypto tech: transparency and decentralization.

The collapse of FTX has been a major disaster, but like every previous cycle, this does not spell the death of crypto. Traditional industries, especially traditional finance, have faced similar disasters without going anywhere.

Ultimately, the potential of crypto is still vast and its true promise is far more than just serving as a casino for traders. Looking at the technology of crypto, it provides solutions, products and access to financial opportunities to everyone across the globe like never before.

The basic ideas behind Bitcoin are decentralization and self-ownership. In times like this, it is important to reaffirm these values and build more trustworthy products and services around these ideals.

Despite the current difficulties we are facing, this could be the beginning of a better chapter with less grift, less blind trust and lessons learned from greed and corruption. Hopefully we will also see more real products that actually improve people's lives.

Disclaimer: Alameda Research has been a passive investor in EF since December 2019.