The price of going mainstream

We’ve got some all-time-highs charts for you and bittersweet predictions on the future of Bitcoin.

The concerns about ‘money printing’ are going mainstream, as reflected on the cover of the leading financial magazine The Economist, published in the UK (which sells 1.6 millions copies weekly), as in the price of gold which reached new records over the last week.

The OCC (Office of the Comptroller of the Currency), the government entity supervising banks in the US, made the unprecedented decision on July 22nd to allow banks to provide custody of cryptocurrency. Both the continued rise of central banking balance sheets and the continued improvement in the regulatory landscape for crypto ring the bells for crypto as loud as possible. Bitcoin will become mainstream sooner rather than later.

Bitcoin had for a long time two identities: 1) as cypherpunk money — cherishing privacy and financial sovereignty, and 2) as Digital Gold, focusing on a limited and auditable supply of coins. The entrance to the mainstream will heavily limit the first identity. Hopes for financial digital privacy are quietly making room for the more material hopes of holders and speculators for a $100,000 Bitcoin, or maybe even a $1M coin. But this has its price. On July 5th, The Block shared that the mammoth US cryptocurrency retail brokerage and custody provider Coinbase seems to be in the process of selling blockchain analytics services to the American DEA and IRS. These tools help identify and keep track of activity of cryptocurrency users. On July 20th, 2 days before the OCC announcement, The Block published an article claiming that leading Bitcoin exchanges in the US: Kraken, Gemini and Bittrex have joined Coinbase and Bitgo as part of the FinancialAction Task Force (FATF), an intergovernmental organization founded in 1989 by the G7, which develops policies to combatmoney laundering. According to the FATF requirements, cryptocurrency exchanges must collect information on the recipients and senders of transactions over $1,000.

This follows the European Union’s new 5AMLD (The European Union’s 5th Anti-Money Laundering Directive), which came into effect at the start of 2020 and requires exchanges to report all cryptocurrency addresses belonging to clients, making sure each Satoshi is accounted for. These recent developments show a clear trend of Bitcoin being integrated into the traditional governance system with no apparent pushback. This leads us to think that increasingly clear regulations on cryptocurrency will be provided by western governments. Bitcoin will be leaving the regulatory twilight zone in favor of a highly supervised existence. Though Bitcoin’s network can transfer 1 dollar as easily as a billion, it’s unlikely, in our opinion, that governments will be highly accepting of unsupervised cross-border activity. With Bitcoin’s blockchain being transparent and very easily tracked, and CoinJoins (a method of increasing privacy of Bitcoin transactions) a small percentage historically of the network’s transactions, this doesn’t bode well for privacy. These developments could in the future influence the sovereignty aspect of Bitcoin.

Respected traditional investment institutions are increasingly coming around to the positive price predictions: In February, a Boston-based pension and endowment consulting and investment firm, Cambridge Associates, wrote, “it is worthwhile for investors to begin exploring the cryptoasset area today, with an eye toward the long term,” in an investment note to their (mostly institutional) clients. Not to mention Fidelity, whose survey amongst 800+ institutional investors across the U.S., and Europe had ~60% saying they believe they have a place in the investment portfolio and that in five years. 91% of respondents who are open to exposure expect to have at least 0.5% of their portfolio allocated. Regulators seem to agree.

In conclusion: After 11 years, Bitcoin seems to have gotten the government on board, as well as sophisticated institutions. As Bitcoin markets mature they are becoming more similar to the traditional world’s markets, not only in financial products but also in increasing demands for regulatory compliance. Bitcoin is closer than ever to going to the moon, but it will become increasingly clear to holders that they must leave the cyberpunk vision behind if they want to cash out.

When the market awakens…

On July 15th Bitcoin’s price was hovering above $9,000 when Twitter was hacked, which brought the words “Bitcoin scam” to many headlines. Seven days later, the US OCC announced that US banks are allowed to store Bitcoin, and 2 days after that Bitcoin’s price managed to break through $10,000, and it’s now above $11,000.

One of the positive signs in the latest break of $10,000 was that it prompted less selling than the previous 2 attempts:

The chart above shows in orange the “Bitcoin Days Destroyed” (the number of coins moved * how long the coins were ‘hibernating’ before they moved), pointing at longer term holders selling off coins (as opposed to trading activity).

Panic-buying USDT (& other fun charts)

On Sunday July 26th at 10:12 UTC Tether experienced an unusual spike, momentarily rising 2% above its normal 1.0 USD price, showing a panicked bid for the stablecoin.

USDT/USD Chart July 22 to 29th 2020. Source: CoinGeko

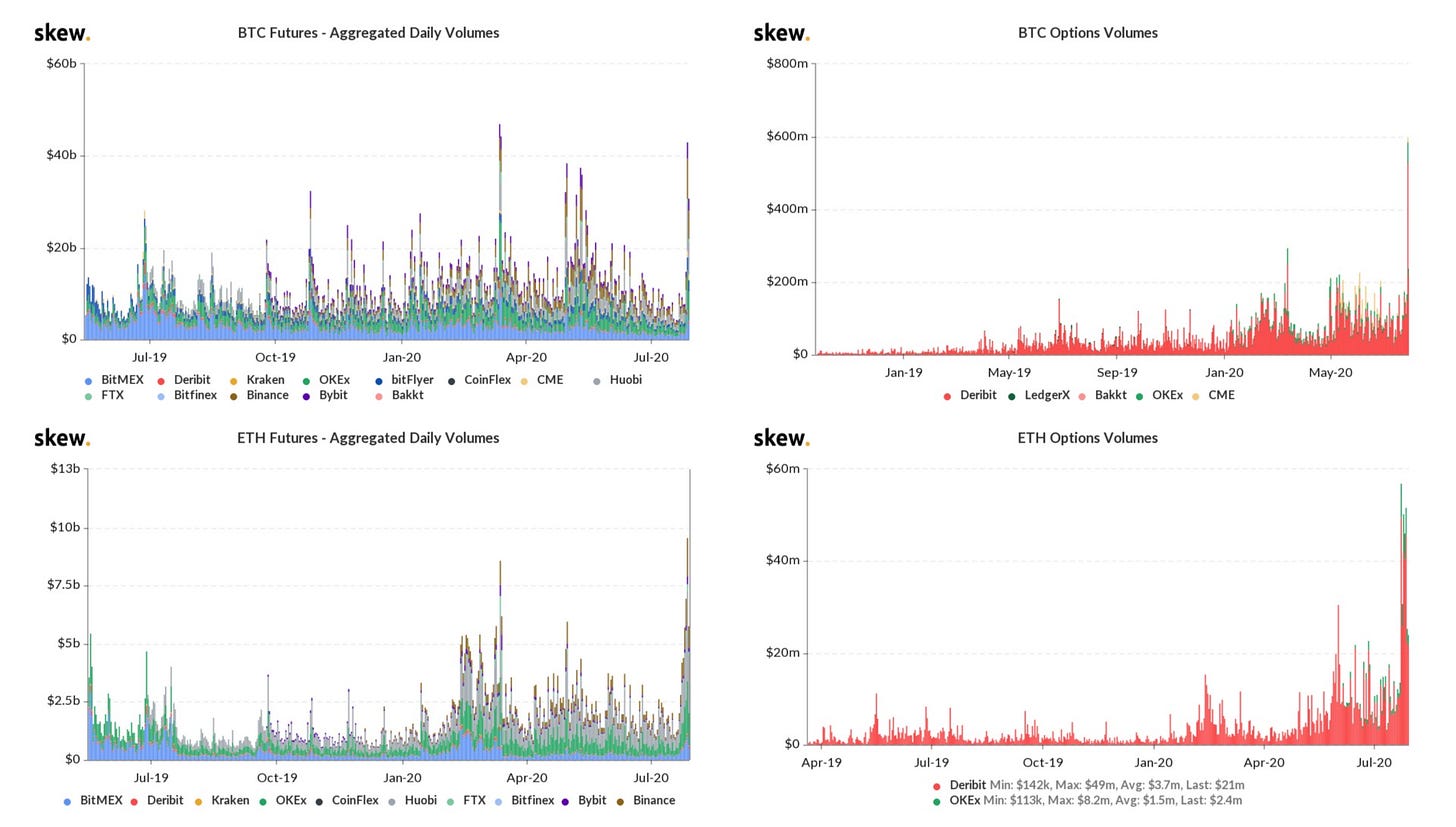

The last time a distortion of this magnitude (or higher) happened was during the Bitcoin crash on May 12th 2020, when traders flocked to the USDT as the price crashed. But this time it was the same day that Bitcoin’s price broke upwards of $10,000 for the first time in over a month. A likely explanation could be a hurried buyer exchanging USD to USDT in order to use a more liquid BTC/USDT pair either for spot buying or futures trading, in an exchange where the Tether pairs are more liquid than USD. Whatever the reason, this signals how strong the reign of Tether is in the cryptocurrency kingdom. Assuming the hurried Tether buyer was betting on Bitcoin’s price rise, he was very correct, as the next day Bitcoin had an unusual $1,000 move, rising in a couple of hours from around $9,800 to almost $11,400. During this action, Bitcoin futures almost broke their March 2020 all-time high records, trading $33 Billion of futures this Monday. Traders also made records in options volume trading, which reached close to $600 million in one day (for comparison, most days in July saw option volume of less than $100 million.)

Meanwhile, Ethereum futures volume broke all time highs on Monday with a volume of $10.6 billion in futures, after breaking option trading records on July 23rd with $56.4 million while Ethereum’s price broke out against Bitcoin and rose from $240 to establish itself above $300 for the time being. Records were also broken in Ethereum trading open interest.

Open interest at the CME also broke its all-time records in open interest, spiking up to $730 million in open contracts bidding on Bitcoin’s price against the US Dollar. Bakkt, the other fully regulated venue, also seems to have woken up at last, creating over $140 million of trading volume. The increase in open interest and volume at both exchanges suggests continued growth in institutional interest in crypto.

The following chart shows a dramatic drop in the price correlation between Ethereum and Bitcoin. The correlation broke down to the lowest 2 years, after Ethereum’s price broke out against Bitcoin on July 23rd.

Help! I’m locked in De-Fi! Today 4.1 million Ethereum coins, worth at the time of writing $3.7 Billion, are hosted or ”locked” in De-Fi contracts amounting to about 2% of all coins.

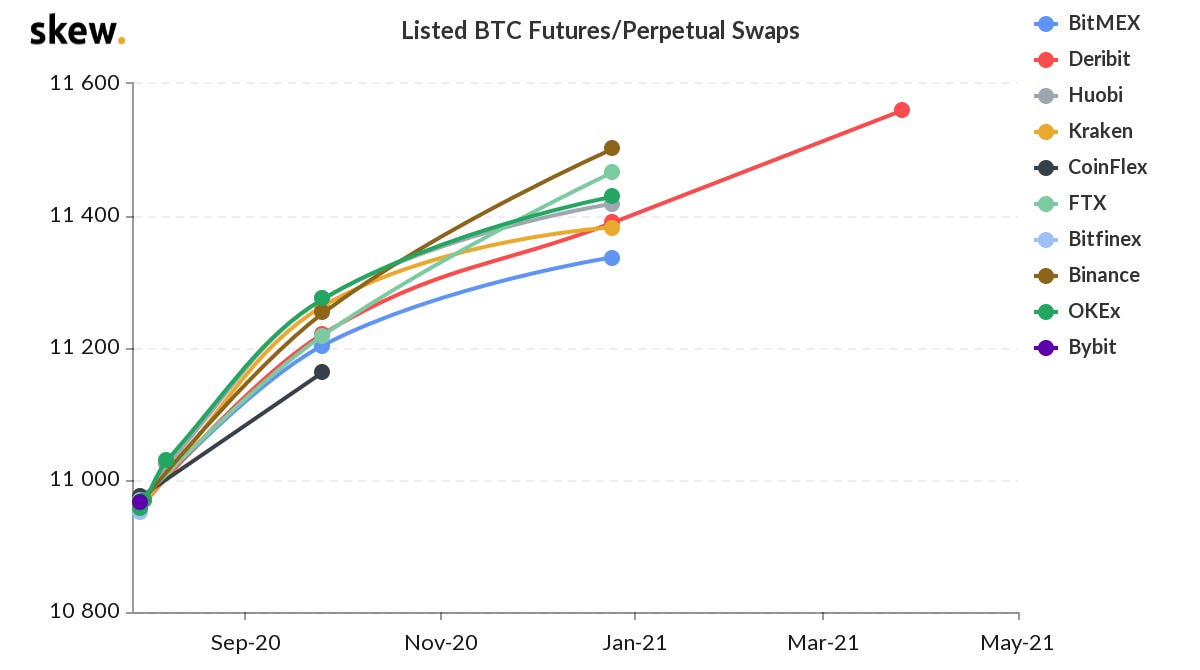

This chart shows the increasingly rapid growth in non-custodial exchange volume on Ethereum. Last month we reported the June 2020 DEX trading volume was at $1.5 billion. In July it has now reached above $3.5 billion. This is prompting excitement on Ethereum prospective use cases, as we discussed here. Excitement is also clearly seen in Bitcoin future’s curve, showing a higher price the later the contracts are set to expire, with the latest contract expiring in March 2021, currently trading $600 above the spot price.

Our last chart comes from the traditional world of fiat currencies, showing the growth of central bank balance-sheets around the world, signifying creation of debt lent out to banks and governments from 1999 to 2020:

Starting at around a cool $2 trillion (2,000 billions,or 2,000,000 millions), it has currently reached $21 trillion.

News and links

1. Cryptocurrency exchanges Huobi and Gate.io add option trading

2. BTSE added new Bitcoin dominance contract

3. Non-custodial Bitcoin derivatives by Crypto Garage enter Beta testing

4.Mining financialization: The Alchemy of Hashpower