Transitory supercycle

Welcome back to Efficient Frontier’s bitweekly newsletter! We’ll start with a quick market overview and then go to some interesting forecasts on inflation, hyperinflation and the Bitcoin market cycles.

Waiting for volatility

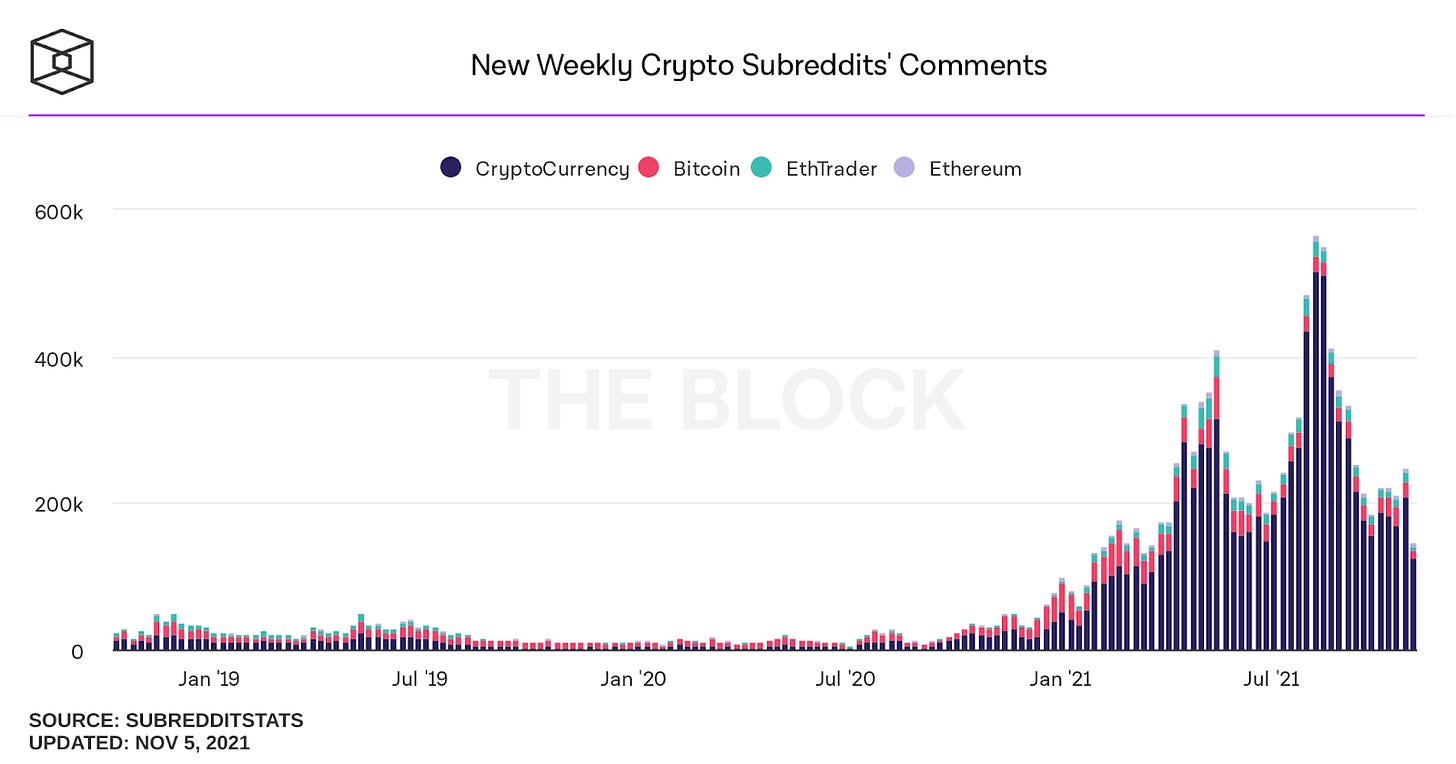

After breaking out to new highs 20 days ago, Bitcoin is close to breaking out again, as we’re writing.

In the previous 19 days, two extremely short bursts of volatility occurred on October 28th and November 3rd, in each occasion a 1-2 minute sharp drop and recovery ranged over $2,000! Dan Matuszewski of trading firm CMS holdings described it jokingly as “The biggest fat finger ever”.

As Bitcoin was consolidating, in altcoin markets $ETH, $SOL, $SHIB and others have reached new all-time highs against the dollar.

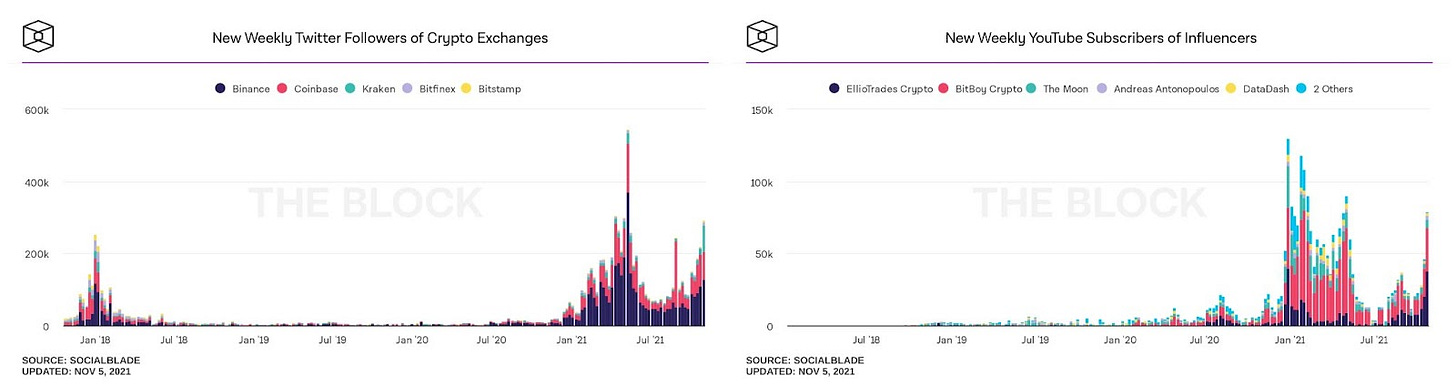

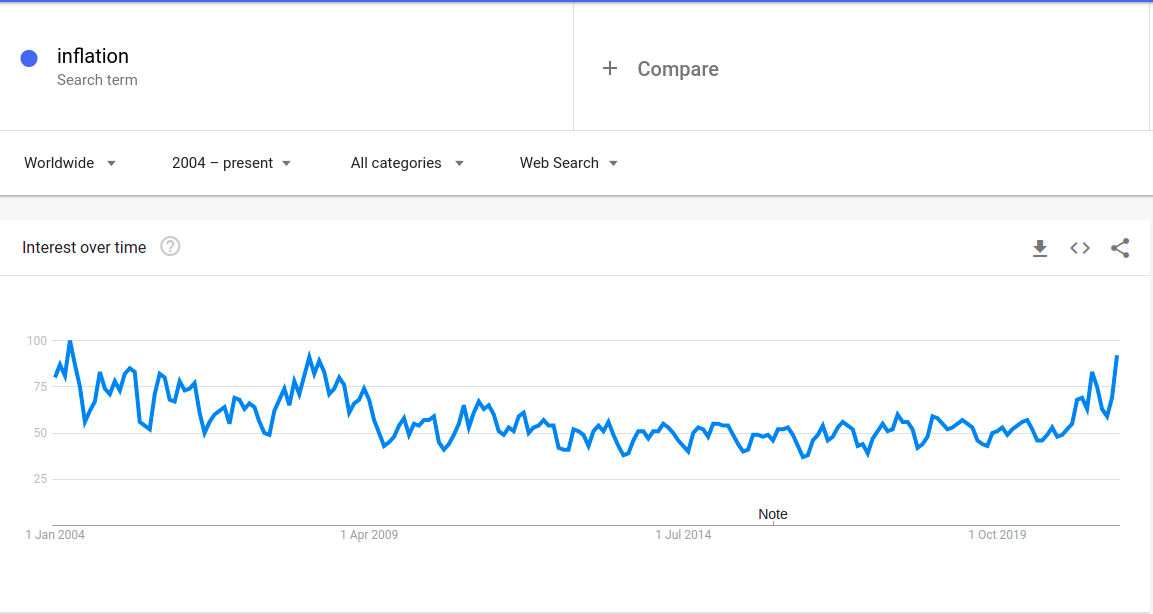

Social media has also reflected the surge of interest in various cryptocurrencies:

However, despite the recent price rises, there still are not extreme levels of euphoria, which can be seen in the drop in conversation volume on online forums:

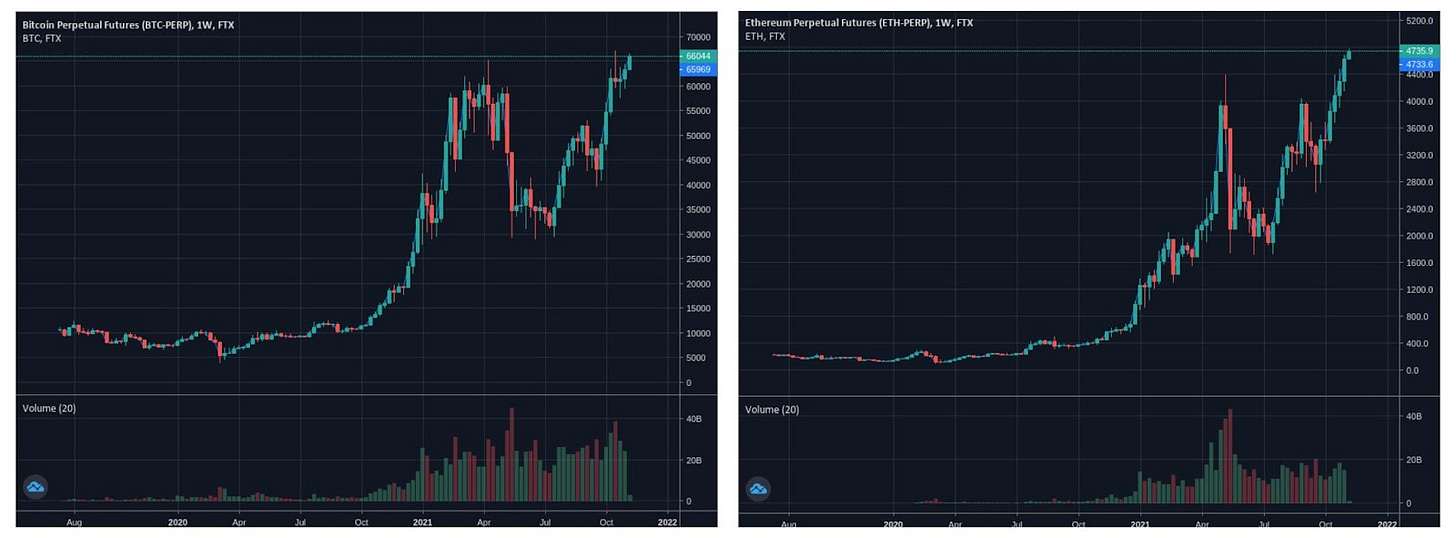

Bitcoin funding rates remain positive but not extreme while the Open Interest in the CME dropped by 24% in the last 10 days, showing some institutional profit taking. Total OI plateaued, currently at $24.53 billion.

Bitcoin options volume (2) is on the rise, trading $30 billion in October, the second biggest month for Bitcoin options ever. The Put/Call ratio (1) made another bullish record as Bitcoin owned by long term holders (3) keeps climbing according to on-chain metrics.

A catalyst for Bitcoin price volatility could be the final verdict on VanEck's Bitcoin spot ETF, coming within the next two weeks.

Supercycle or hyperinflation?

Cryptocurrency investors are increasingly concerned with big questions. Are fiat currencies headed to hyperinflation like Jack Dorsey suggested? And how will this affect the future of the Bitcoin market cycles?

Fortunately, Lyn Alden, founder of Lyn Alden Investment Strategy, a favorite Macro analyst in the Bitcoin industry, brings some of her trademark clarity to these matters.

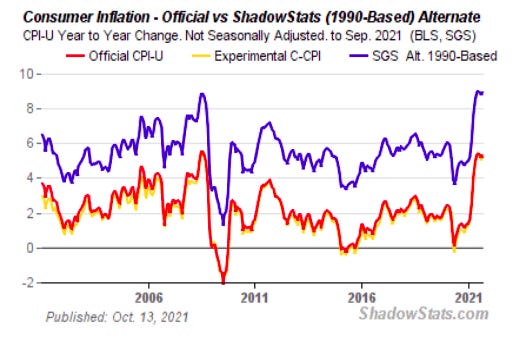

“I expect the 2020’s to be a pretty inflationary decade…[but] in developed markets today we do not see the ingredients of hyperinflation” , Alden told Blockworks. “It’s hard for inflation to exceed the money supply growth for a long time… and currently the money supply is growing by 13% year over year. “

“We’re toward the end of this long term debt cycle, where they pretty much need to hold rates low despite inflation, because otherwise the sovereign entities are insolvent.” Alden said.

Though Alden does not see hyperinflation on today’s horizon, she does not rule out it may happen during this debt cycle if people lose confidence in the system, “especially if you combine that with energy scarcity or de-globalization or potentially any kind of black swan event that could occur.”

“Pandemic lockdowns hit a highly-leveraged economy with millions of people living paycheck to paycheck, putting policymakers in a position to either massively stimulate (increase money supply) or watch a widespread debt collapse happen,” making inflation impossible to avoid. “Those combinations of commodity producers, hard assets, good real estate and then good monies are the protection either way.” Alden concluded.

Bitcoin as an emerging store of value

“Bitcoin has been rapidly coming up to whatever percentage of global assets it’s eventually going to settle toward. I think bitcoin is on track to likely becoming a store of value, but we’re in the earlier stage of investing in the idea that it’s going to go through the S curve and become a store of value.”

Alden gave 4 reasons for the halving cycle having less influence in the following years, meaning that in the next decade, the 4 year Bitcoin cycle might fade away:

Bitcoin’s inflation rate drops in 2024, it may have very little price impact as it goes from 1.8% to 0.9%, compared to a drop of 3.6% and 1.8% in the two previous halvings.

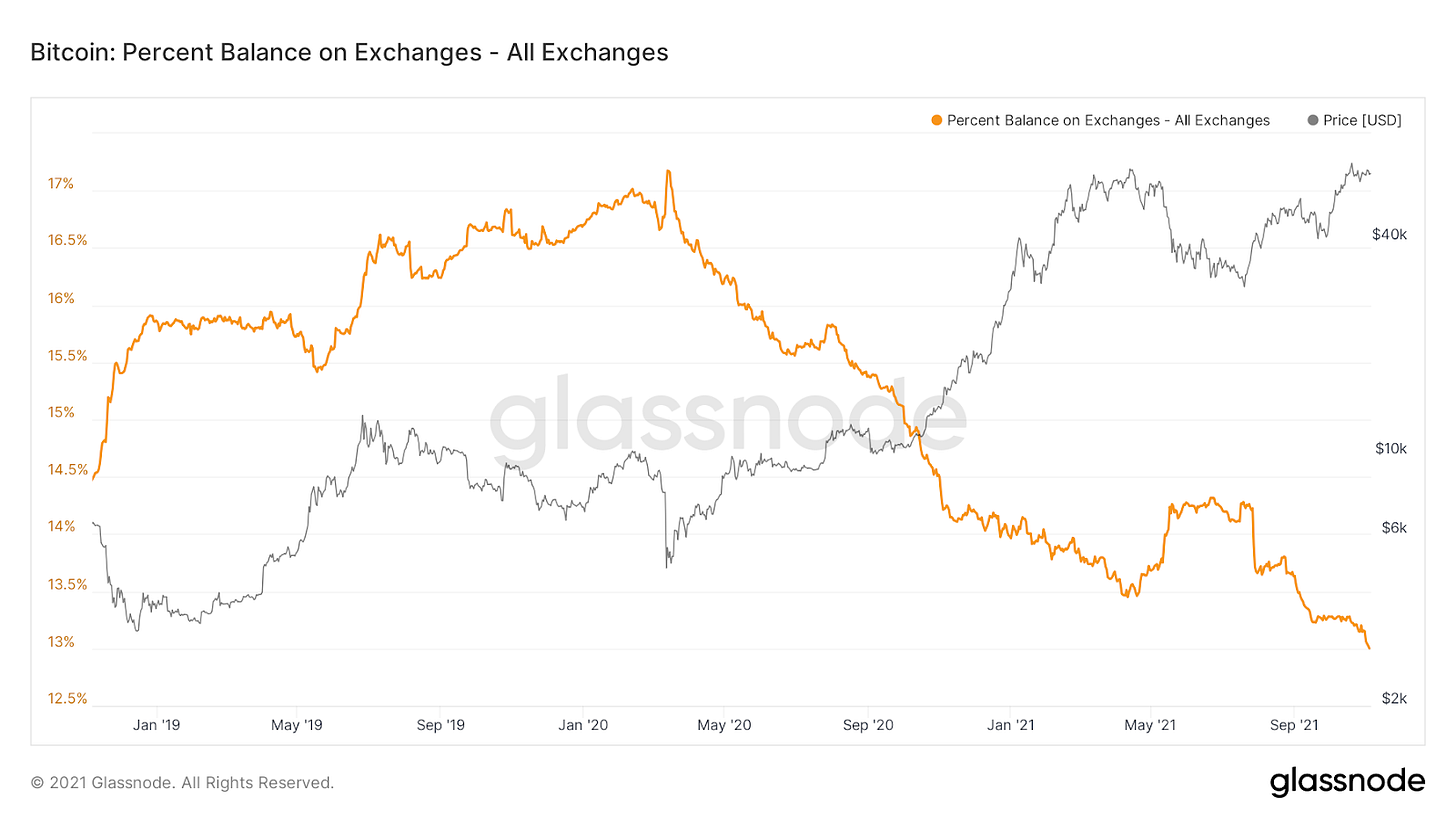

In prior cycles bitcoin on exchanges increased. As we’re nearing the end of the supply distribution, since March 2020 bitcoin has been leaving the exchanges.

Most miners are now operated by larger companies with better access to capital. Today’s miners do not need to sell Bitcoins to finance themselves, and have less chance of experiencing halving-cycle capitulation.

To get a prolonged Bitcoin bear market you’ll need first high market euphoria., currently lacking. If the euphoria stage is met again in the following months, Alden believes that the next downturn will be shorter.

News & Links

The biggest theme of last two weeks was the ‘mainstreaming’ of cryptocurrency investment, as seen above in the crypto.com commercial

FATF publishes new guidelines for cryptocurrency

CME to launch micro-ethereum futures

Coinbase number 1 in AppStore during Shiba Inu surge

FTX US hires former CFTC commissioner

Survey: 24.2% of Nigerians own cryptocurrency

Amazon Web Services seek cryptocurrency specialist to develop financial services

Team Update

This month Efficient Frontier became a permanent supporter of the Woman To Woman Foundation! We are honored and glad to support this important initiative and will continue with routine contributions to this cause.