Usher bucks

In this edition: “extreme” Bitcoin market wrap and how the public is waking up to the sound of the Federal Reserve's money printer

Are Americans hearing the money printer?

One year after the United States started the biggest ‘money printing’ experiment in its history, the American public and media are clearly noticing the changes that is happening. Two striking example lately came to our attention:

“ Every day, some new money weirdness crosses our feeds,” wrote New York Magazine the same week. The famous publication owned by Vox media dedicated the cover of its last issue to the changes in the value and meaning of money, and surprisingly actually shared the following quotes:

“The credible-scarcity component of our existing currencies — they’re losing the credibility part.”

“I see crypto as a mini-revolution, just like GameStop. The central banks and governments are all conspiring to create more money to keep the shareholder class wealthy. Young people think, That’s not good for me, so I’m going to exit the ecosystem and I’m going to create my own currency.”

“We’ll have the euro, the Chinese yuan, the dollar, maybe the yen — and bitcoin. And then everything else just gets hammered.”

The chart topping American singer Usher chose fake money as the theme for promoting his new Las Vegas residency by designing and printing of “Usher Bucks', a bill similar to the US dollars but with Usher's face on it.

As the stunt caught the imagination of the public, the connection was not lost on the viewers. “It might be worth something someday” kwipped DJ Walla one of the hosts on Hot97.fm, with his colleague humorously retorting “Ok, It’s not like a Bitcoin”, while Desus & Mero joked that if Usher would really launch his own currency, he could disrupt the American economy and put the dollar under pressure.

When a pop star’s PR effort makes talk show hosts reference currency wars, and a popular magazines explain the connection between money printing, inequality and the rise of digital scarcity, it’s obvious a large portion of the American public is increasingly awakening to the striking reality that Bitcoin has been preparing for over the last decade.

Market wrap

Bitcoin’s bull market is still recovering for the biggest futures liquidation (yet) in Bitcoin’s short history.

Bitcoin’s price slipped following its new record of $64,829 on the day of Coinbase’s IPO. When it went under $60,000 it triggered an extreme deleveraging of almost $10 billion in liquidations (and even more in losses) in 24 hours. The liquidations triggered a full-on crash which stopped at the $47,440 market. The April 16th-17th’s liquidation was larger than the three previous record liquidations in Bitcoin’s history combined.

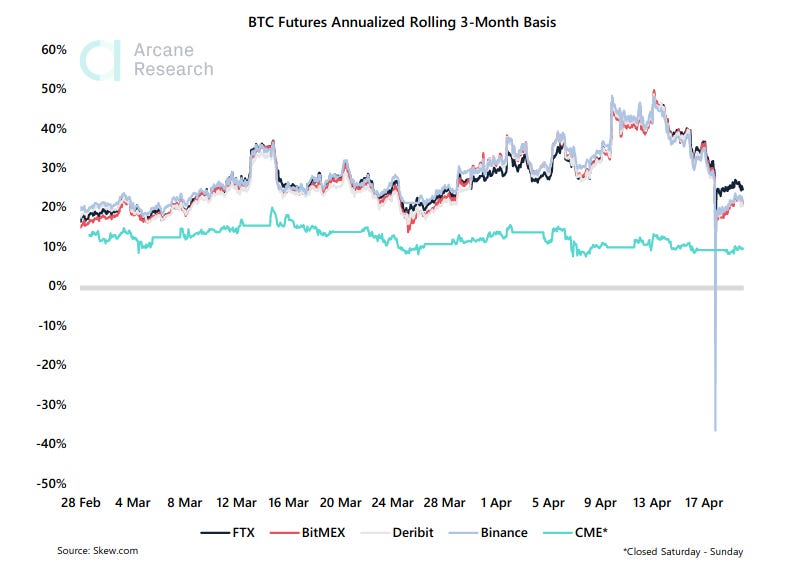

During the crash, futures briefly went into backwardation, trading at a discount to spot, for the first time since March 2020.

Funding rates for the perpetual swaps also became negative before returning to neutral. As we noted in the our last email, throughout April, funding rates (and euphoria) were high, peaking on April 10th at 0.16%.

Mining difficulty

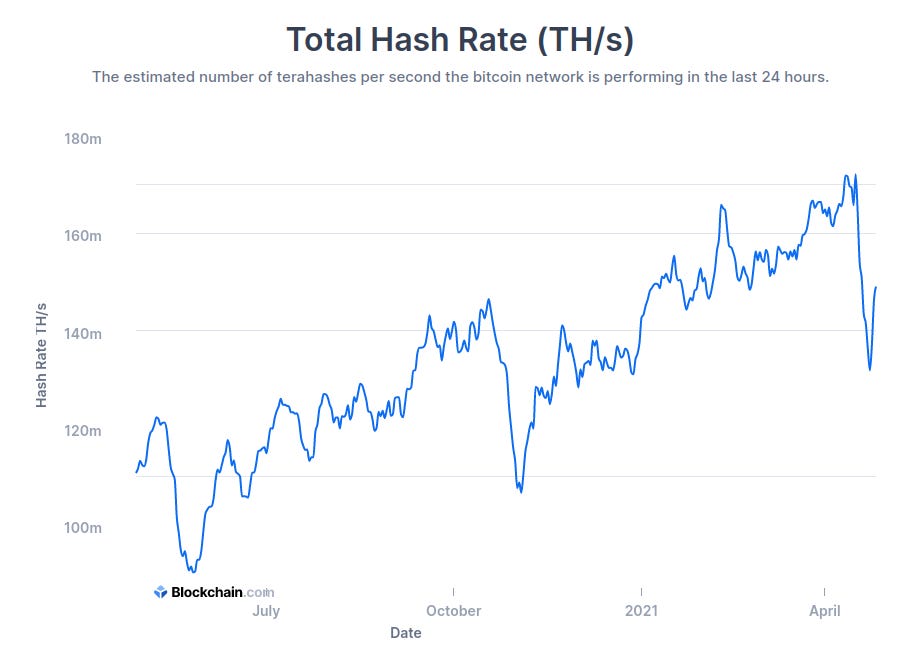

The price crash was accompanied by a large dip in Bitcoin’s hash rate. The week-long drop was due to an electricity outage in the Xinjiang region in China, where a large portion of Bitcoin miners are located during the dry season. The outage was a result of a safety crackdown after several coal mine accidents in the region, some of them fatal, happened in the same week.

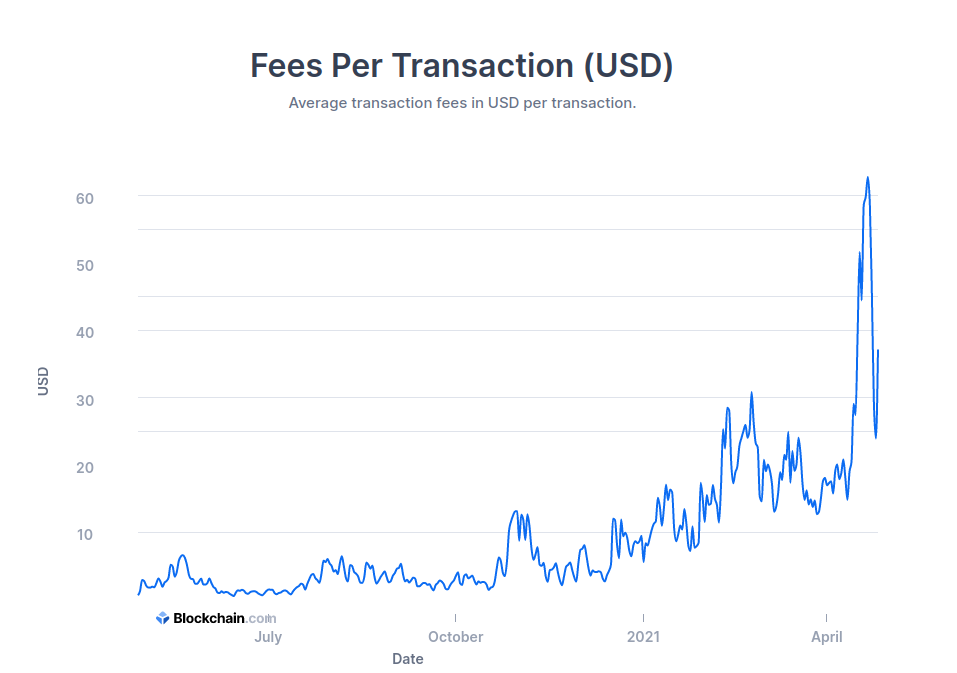

The outages started only hours after Bitcoin’s bi-weekly mining difficulty adjustment. The market disruption and arbitrage opportunities, as well as the temporary drop in block production, combined to make Bitcoin transaction fees jump from an average of $14 on April 11th to $62 on the 16th, now down to $30. The total number of daily Bitcoin transactions is ranging between 200,000 to 300,000 a day.

Bitcoin in the dog house?

With institutions and even companies taking profits on Bitcoin and others unwilling to buy in a rising market, it’s hard to be optimistic about a continued elevator ride up for Bitcoin. But due to the environment we’ve detailed in the previous sections, there is likely a lot of buyer demand from investors if the price goes lower, so it looks like 2021 won’t necessarily end badly for Bitcoin.

News and links

Turkey temporarily bans paying for goods and services in cryptocurrency

Venmo adds buying, selling and holding of Bitcoin, Ethereum, Litecoin and Bitcoin Cash

Coinbase lists USDT Tether

Bank of England and HM Treasury launch CBDC task force, Lagarde says over 80 central banks are looking into creating digital currencies

QCP talks to RealVisionTv about the stablecoin revolution in East Asia

Square whitepaper: “Bitcoin is key to an abundant, clean energy future”

CME will not be launching Dogecoin futures

Podcast: Great interview with CIO and founder of BlockTower Ari Paul

From the NSA to NFTs: Edward Snowden raised $5.4 million for Freedom For the Press by selling a digital image to PleasrDAO, a on-chain investment fund for NFTs