Wind of change

Will Bitcoin replace Switzerland?

Welcome back to Efficient Frontier’s biweekly newsletter!

Bitcoin and cryptocurrency experienced some paradigm changing events in the last two weeks:

1 ) Switzerland ends 500 year of neutrality

Last week Switzerland broke its 500 years of neutrality when it agreed to join the EU’s sanctions on Russia, banning 363 Russian individuals and 4 Russian companies.

Switzerland's long-standing neutrality made it in the past one of the world’s banking centers.

As we noted in our previous edition, preceding Putin’s invasion of Ukraine, on February 21st, the EU threatened to blacklist Switzerland due to money laundering concerns.

2) The Crypto community crowdfunds a war

On February 26th Ukraine turned to the large crypto community on Twitter to help fund their defence. Their tweet brought a flood of contributions, passing $52 million dollars in total from over 85,000 blockchain transactions in 70 different tokens including stablecoins, dogecoin, Tron, Polkadot and of course 6,832 Eth (currently $17.7 million ) and 292 Bitcoin (currently $11.4 million). And a CryptoPunk NFT.

Ukraine also announced an airdrop, which was later cancelled.

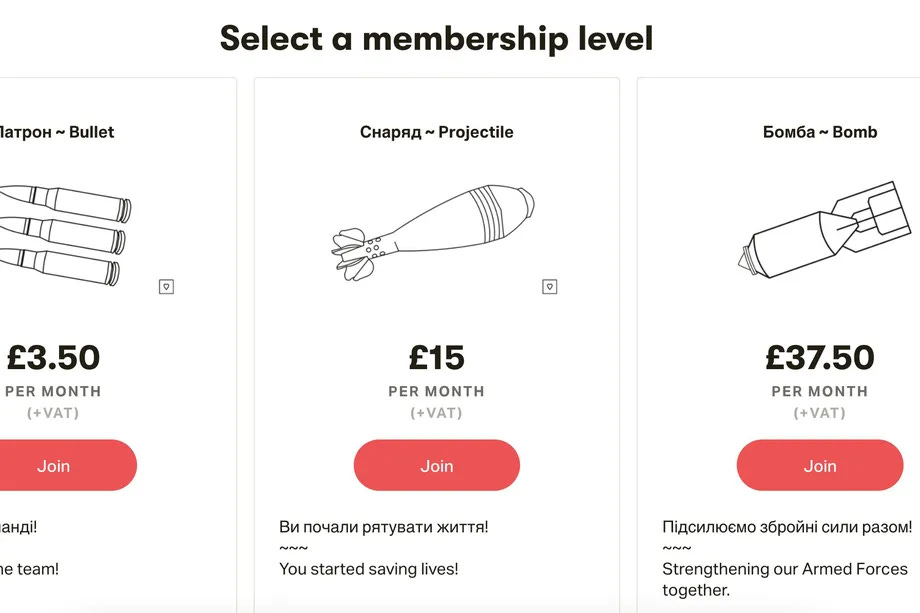

This was a better idea than crowdfunding on Patreon, as the page was taken down after reaching $436,966 in monthly subscriptions to support Ukrainian soldiers.

Ukraine also raised $277 million in government war bonds from the traditional fiat markets, promising 11% interest.

3) Russian sanctions: ”Not your keys not your reserves”

Russia’s foreign reserves were seized, destabilizing the ruble. This is the ”nuclear option” in financial warfare according to analyst Juliette Declercq.

Visa, Mastercard and American Express exit Russia. Russia switches to the Chinese Unionpay network.

Russia blocks Facebook and Twitter. Dozens of international companies leave Russia, including Paypal, Amazon,Google, TikTok and Reddit. VPN apps top chart in Russia.

Russia is preparing to disconnect from the world-wide internet by tomorrow (March 11th).

One source claims Putin’s end game is to roll out a domestic CBDC.

Crypto exchanges comply with sanctions but refuse to ban all Russian citizens.

4) Fear is skyrocketing

“The European Union, for the first time ever, agreed Sunday to directly finance the purchase and delivery of arms, with plans to send more than half a billion dollars worth of military aid to Ukraine,“ CNBC reported.

U.S. oil prices hit their highest level since 2008, and the price of wheat increased 50% due to Ukraine and Russia providing ⅓ of the world’s supply.

Russia leaving the internet is also raising fears of a global cyber attack.

Justified or not, the FUD (fear, uncertainty and doubt) across the planet is at record levels for the 21st century.

Market wrap

Perhaps world wide sanctions, currency scares and fear of various government crackdowns is why Bitcoin has been holding up despite drops in the altcoin market and in tech stocks.

Since our last newsletter Bitcoin rose to a high $45,500 from $38,800, now at $39,150.

Since the start of 2022: FTX’s DeFi index lost 44.6%, the Altcoin index lost 32.7% and Bitcoin lost 18% against the USD.

The S&P stock index lost 10% and the NASDAQ index lost 15.3% in the same period.

Non-custodial trading volume has dropped for 4 consecutive months on the Ethereum network

On-chain profit and loss taking are at similar levels.

3-4. Exchange flows, funding rates and volumes across crypto have been anemic.

The main theme among analysts is low demand for Bitcoin combined with low selling pressure, which creates an equilibrium at this point.

News and links

White House publish cryptocurrency executive order

Bain Capital launches $560 million crypto fund

Ethereum software conglomerate ConsenSys faces lawsuit from shareholders

South Korea's new president promised to deregulate the crypto industry

Kraken exchange gifts $1,000 to each Ukrainian user

Recommended reading: Breton Woods III by Zoltan Pozsar

Team update

Women of Efficient Frontier celebrated International Women's Day in Tel-Aviv on March 8th