Year of the Bull

The mystery of high Ethereum fees explained by one of our industries biggest experts + Bringing you up to date on the (manic) state of the Bitcoin markets and the cryptocurrency world news

Happy lunar new year!

Over the last week a torrent of enthusiasm has broken down the floodgates keeping Bitcoin out of ‘the system’ in the West. Tesla, Mastercard and Visa are all welcoming Bitcoin and cryptocurrencies (though central banks still insist it’s not cool), as well as leading mainstream culture magazines, making it clear that we’ve started that stage of the current bull run- where everyone wants to join the party.

Market review: Ridiculous numbers edition

We’re are glad to inform you that before Tuesday’s price correction, Bitcoin perpetual contract’s funding rates, which reflect traders leverage and general mania, were at the highest levels in over a year, reaching 0.6% per-day across major exchanges according to Cryptoquant, awarded to whoever was brave enough to hold a short position on Bitcoin, thought it has since corrected to more normal levels.

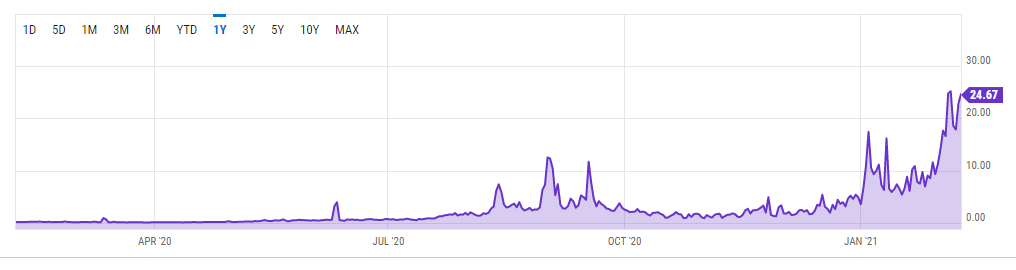

With Bitcoin breaking out this week to a record $48,486 per-coin, after trading in the $30K range, futures trading, not surprisingly, broke dollar volume records as well. CryptoCompare reported that spot and derivatives volumes doubled to all-time monthly highs in January, reaching $1.7 trillion in top tier exchanges and the CME, as well trading a record number of monthly BTC futures contracts.

With the price jump, option pricing, as reflected in Implied Volatility, has jumped as well, as options buyers are willing to pay more to bet on higher prices.

Turning our attention to the tea-leaves of Bitcoin’s on-chain analytics, there might be no need to panic just yet. Both Coin Days Destroyed and the trusted MVRV and MVRV Z-Score put us at high, but not excessive levels.

The magnitude of old coins on the move, as well as their proportions to total on-chain volume, show that prices are not high enough to spook long-time whales into taking profits just yet.

Sentiment reflected by the estimated realized price to market price of on-chain Bitcoin took a large jump in the last several days, while not yet reaching the “insanity” zone market in red, is now deep in the “greed” zone, reflecting the current Bitcoin mania.

Blockchain frenzy alert

The price and magnitude of daily transactions on the Ethereum blockchain has surpassed even the heights of the ICO bubble in 2017, with the average transaction fee on the Ethereum network as of yesterday being a record $25, compared to $5.5 being the records in 2017. With users competing to have their transactions included as fast as possible in new blocks, February 5th saw a record $55.7 million of fees paid to Etherum miners in one day.

Competition between traders inflating transaction prices

While the amount of transactions on Etherum’s network is slightly higher than its peak traffic in 2017, today the average transaction is much more expensive both in Ether and in dollars, meaning the competition for space in the blockchain higher than ever.

What is the reason for the persistence of these very high transaction fees? “It’s 99% due to the different nature of the interactions. There's just way more arbitrage opportunities now, more frequent, across more platforms, with higher profit ceilings.” explained smart-contract expert and ZK Labs founder Matthew Di Ferrante “In 2017, high fees were mostly paid by speculators rushing to enter ICOs. There was a small window to get your transaction in the crowdsale, but there was no point trying once it was full. Now with Uniswap, Curve, and the various DeFi products with variable yield, there are constant arbitrage opportunities that have a far greater upper profit limit.

If for example a trader has 10 million dollars to extract arbitrage from a few pools, they can move it from pool to pool all day as the yield opportunities shift around. Even if the trader only makes 0.1% every time they perform that action, that's still worth it as long as the fees aren't greater than $1,000 per transaction.” Paying expensive network fees frequently is worthwhile for large traders as long as there the opportunities remain in the DeFi ecosystem.

Lunar new year special

Just in time for the year of the Ox we’ve published on the Efficient Frontier blog an overview of the most important trends and stories the cryptocurrency derivatives industry has seen over the last year. From Tether gaining dominance in futures and options coming to life to the fall of BitMEX and the rise of DeFi derivatives and everything else making our markets what they are in 2021.

News & links

India is getting closer to a full cryptocurrency ban. Nigeria Central bank enforces cryptocurrency ban

St. Louis Fed publishes research on DeFi

As Bitcoin broke records in USD trading on Monday Binance suffered technical difficulties and Kraken halted sign ups

Gemini exchange launch interest yielding account

Silly faze: Celebrities Kevin Jonans, Snoop Dog and Mark Cuban promote Dogecoin on Twitter.

Elon Musk tells paparazzi that Bitcoin might become the global currency of planet earth

Warning: Blockchain.com wallet might be compromised

Team update

An excellent interview on the state of the cryptocurrency markets with Andrew Tu, who also shared his perspective with Coindesk last week.