EF reflections on 2021

Welcome back to Efficient Frontier’s biweekly newsletter!

After a quick market wrap we share our tech team’s overview of 2021 and predictions for the year ahead.

1) As you might have noticed Bitcoin started off the year with a blast - to the downside. Since our last email on December 8th Bitcoin price dropped by almost $10,000, now at $41,600 after spending most of December in the $45,000 to $52,000 range.

2) The $45K floor broke down on January 5th, creating a “light” liquidation of $248 million of leveraged traders funds. The next day, January 6th, saw $1.3 billion of Bitcoin losses realized on the blockchain.

3) This was a quiet move compared to December 8th. Even during this recent drop, Bitcoin futures and perpetual contracts funding has remained positive, indicating that while traders are slightly positive, Bitcoin is being sold in the spot markets.

4) The crypto native crowd is debating if this Bitcoin cycle peak has passed, still to come, or perhaps the 4-year Bitcoin cycle pattern is no longer relevant? More on this topic in the next section.

Efficient Frontier’s tech team reviews 2021 (with some predictions)

We sat down with ¾ of Efficient Frontier’s tech team leaders: CTO Alon Elmaliah, Head of Product Shai Kritz and Head of DeFi Engineering Roman Kagan, to hear their insights on the tech developments in crypto in 2021 and their 2022 outlook.

Biggest trends in 2021

Roman: The growth of new blockchains and L2s has been very significant. One year ago there was no Avalanche, no Solana, no Arbitrum. It really helped the ecosystem - new chains, cheap transactions, experiments, incentives. DeFi grew because of this. Liquidity moved to all kinds of places. Solana surprised the ecosystem. This will continue.The DAO domain is growing like crazy (for example Olympus).

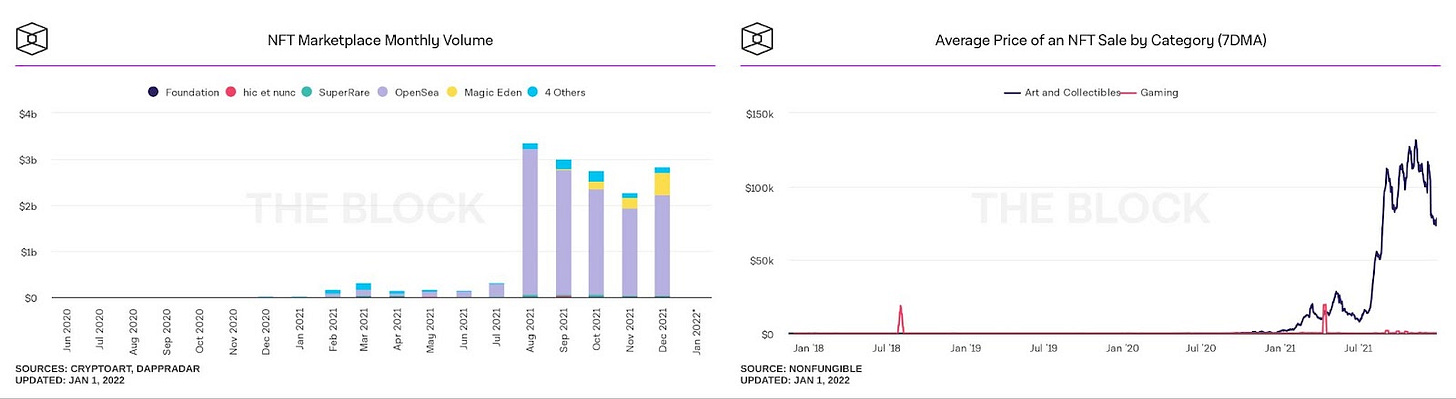

Shai: Definitely NFTs, which can be divided into art or collectibles, Metaverse and Play-To-Earn. Today NFTs are very similar to how DeFi was a year and a half ago, when it was still small, but grew by 10x each quarter.

Alon: Also DeFi 2.0. For the first time new DeFi protocols can use existing DeFi functionality. For example, instead of building your own money market, new applications use Compound’s infrastructure.

DeFi’s year

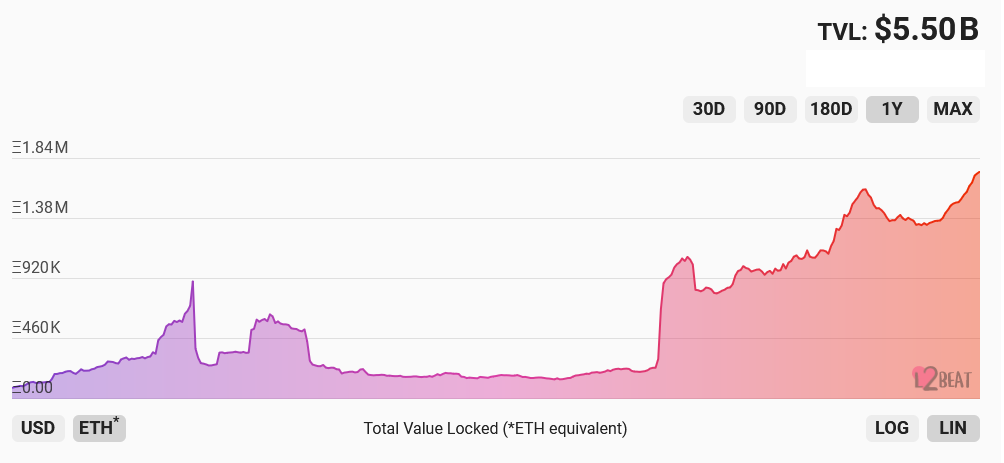

Roman: DeFi matured this past year. There are new projects, new programs. Less hype and more working products now and traditional VCs and hedge funds expressing strong interest in the space.

Shai: On-chain derivatives have become much more sophisticated - perpetuals, options. The liquidity isn’t huge but it’s growing.

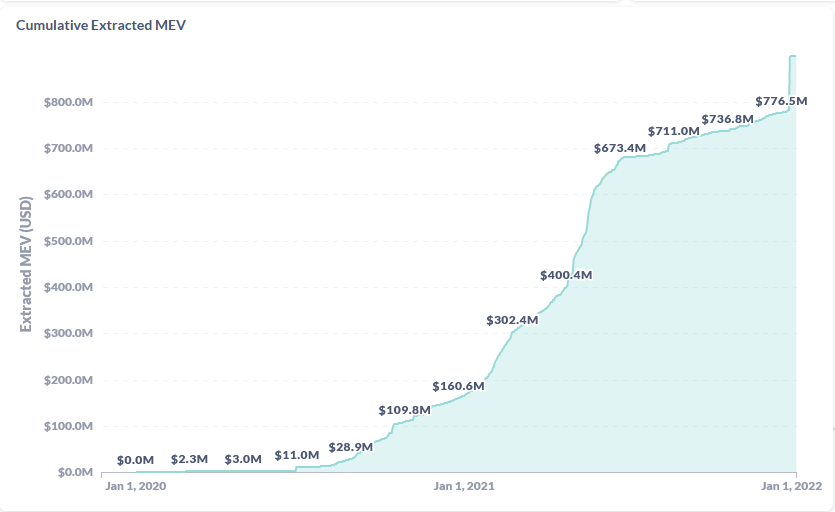

Alon: This year MEV and flashbots, and all the research around it have converged to a generally negative conclusion, but we’ve gone up a level. The sophistication of the bots - bots that attack other bots and all kinds of stuff are being done at a very high level.

ImmuniFi have been doing a great job paying millions in bounties to stop hacks of hundreds of millions. This is the right way. They’re growing an industry of white hat researchers that teach others and create a healthy ecosystem around it. I hope this trend continues.

According to their website, Immunifi has paid $10 million in DeFi bug bounties to date, protecting over $2 billion from hacks with $73,226,717 in open bounties.

Coolest tech

Roman: StarkWare, ZK rollups. dYdX is based on Starknet and reaches thousands of transactions per minute. UniswapV3 was a fresh approach to improve AMM technology and provide concentrated liquidity

Shai: Agreed, and the maturity of multi-chain projects (Cosmos, Polkadot, etc.). Both are technologies that were developed before 2021 but crossed the adoption bridge in 2021.

Alon: A lot of the dApp [decentralized application] tech is ready. Everyone [in 2017] started as dApp developers, but the infrastructure wasn’t good enough and they went back in the stack and realised you need to build the base. But now the base is largely built, there are a lot of working dApps.

The state of the market

Roman: Every few months there was a new trend that drew attention and money. It started with DeFi, then moved to memecoins, then moved to NFTs, play-to-earn. Each time the trend moved. I think there will be another trend coming or we’ll be in a collapse and people will give up on the market.

There used to be cycles tied to Bitcoin and the halving. Today there is so much more tech the cycle has been disrupted. I do think things have slowed down, so it could be that we passed this cycle’s peak.

Shai: It’s definitely not peaked in my opinion…no way it’s over yet (this is not investment advice!). Today the global economy is out of balance and the crypto ecosystem reflects this. You can see when there was uncertainty in the global financial markets, it affected crypto - it’s not unrelated. As long as these trends in the global economy will continue I think it will continue in crypto as well.

It’s also largely a function of a generational change. We’re exactly in the years where the capital is moving to the hands of Gen Y (millennials), which has a different take on investing 50 years into the future.

Alon: But there is an atmosphere of people disregarding the future. People are more nihilistic. I agree with Shai, new people are still joining. We saw an article in NYT about people leaving Google, Amazon and Apple to work in crypto companies in Silicon Valley.

Shai: I wanted to say something about this cycle concept. It's very possible that in 30 years we’ll understand that we were actually in a 15 year bull cycle for crypto. In this bull cycle there was the 2017 peak and a small peak now, and maybe there will be a bigger peak in 6 months, but if we look at it in the macro view we’ll say the whole 15 years were one long bull cycle.

What would you like to see improve?

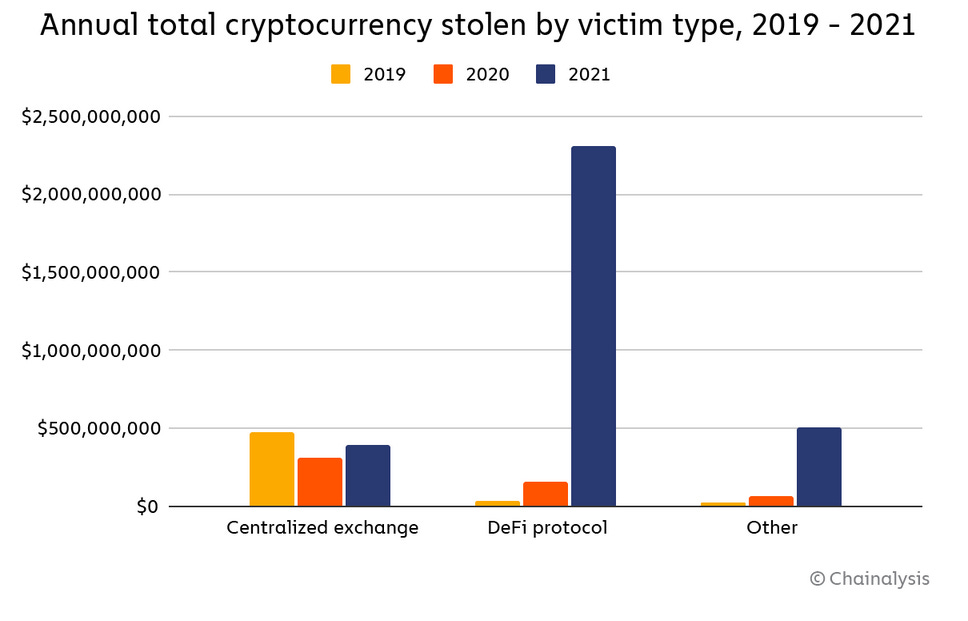

Roman: Less bugs [in DeFi apps].

Alon: Less bugs and less hacks. It does happen in all industries but their impact in DeFi is too big. I would like them to be in the millions and not hundreds of millions.

Shai: With all the progress, the user experience still hasn't improved one tenth compared to the magnitude of the technological development and it is in complete contradiction to the amount of brains and money that are coming into our industry.

Alon: Yes, for example, up until two weeks ago MetaMask wallet didn’t tell you what type of transaction you were doing. Only now for complex transactions it displays the function as well as the parameters.

2022 Predictions

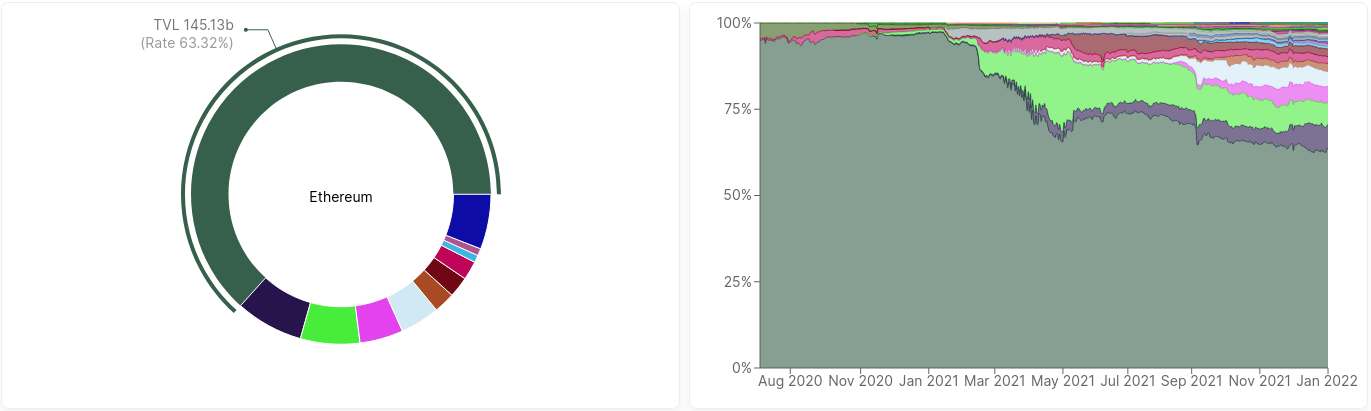

Roman: The new L1 and L2 platforms will keep taking bites out of Ethereum, until Ethereum 2.0 will come along and that will set the stage to a very interesting battle.

Shai: I think physical NFTs will really grow in 2022. They’re really on the fringes now but I think this is one of the things that’s going to happen. “I’ve got this NFT of a Nike I bought the first day this model dropped and here’s the proof…”

Alon: A lot of resources were invested in L2s in trying to bring the next 100 million users to open-blockchains. If I had to gamble I would say this growth can come from GameFi and Metaverse. You see a lot of game studios from outside the crypto world getting involved.

I think this is one of the themes of this year: You go to sleep for one month, go on vacation, and everything changes.

News & Links

China’s leading app, WeChat, add the digital Yuan to payment options

Following violent protests, the Kazakhstan government shut off the nation’s internet. Bitcoin hashrate dropped by 10%.

WhatsApp tests stablecoin payments, PayPal has confirmed that it is "exploring" a stablecoin

Goldman Sachs, BlackRock and PayPal invest in crypto custody Anchorage

Team update

This month Efficient Frontier was very happy to welcomed Roman Kagan, to lead our expanding DeFi activity!