Efficient Frontier November 2023

It’s Springtime for Bitcoin

It's been 1 year since the FTX/Alameda gap. We knew it was going to be a rocky road, but that the flowers will bloom again.

Note from our CEO

Dear Clients, Network, and Friends,

We’ve seen recovery in volumes across the market and our client base, and are glad to see 2023 is coming to a positive conclusion for the market and for our company.

Time has quickly passed this month as we actively engage in prominent industry and unveiled an advanced reporting system tailored to meet the diverse needs of our clients.

"Nature does not hurry, yet everything is accomplished."

Warm regards,

Yohai Rayfeld

Chart of the Month

CME open interest in BTC futures. The Open Interest in the CME Bitcoin contract (in green) is 30% below its all-time high of $5.36 billion. The last time this much capital was betting on Bitcoin’s price through the CME was in December 2021, when Bitcoin traded for $58,600. CME activity reflects business from institutional and traditional financial entities.

Blogs and feeds

EF Blog: Insights from Hong Kong Fintech Week

Our VP of Sales, Andrew Tu, shares his keen insights on the Hong Kong conference, the local ecosystem and the last 2 months meeting with crypto companies in Asia.

Looking back: The FTX debacle and the future of crypto

“On the fallout of the $10+ billion black hole in one of crypto’s most loved exchanges and why we think this awful event will not impact the long run success of cryptocurrency tech". Let's look back now.

Team update

Conferences: Zach Reingold, our Head of Ecosystem, took part in BreakPoint 2023, Solana’s annual community conference in Amsterdam. Andrew Tu, our VP of Sales, attended Hong Kong Fintech Week.

This month we’ve welcomed a promising addition to our trading room-Monitoring Officer Evyayar Haim.

Commentary: Springtime for Bitcoin

We concluded our September 7th newsletter writing “Coupled with a shortage of sellers, ongoing adoption, and the cyclical nature of Bitcoin prices, we hold a positive outlook heading into 2024.”

Now, with the catalyst of BlackRock’s vocal support and anticipation of an American Bitcoin ETF, Bitcoin and crypto trading are awakened from their slumber. The small boost in buyers combined with the lack of sellers drove up BTC by over 30%.

Real liquidity

Bitcoin’s ascent for the $25,000 to $31,000 following the November 16h ETF rumor was on a 2 year low in spot volumes. It was the same money that’s been sloshing around for the last year since FTX’s demise.

When Bitcoin broke above the July high of $35,000, the fun started. Spot volumes jumped, as well as market depth. As trader Avi Feldman noted- altcoins kept going up with Bitcoin, another sign of fresh entrants to the crypto sphere.

In conclusion: It’s alive! But a sign of a life is not the same thing as an ‘up only’ market.

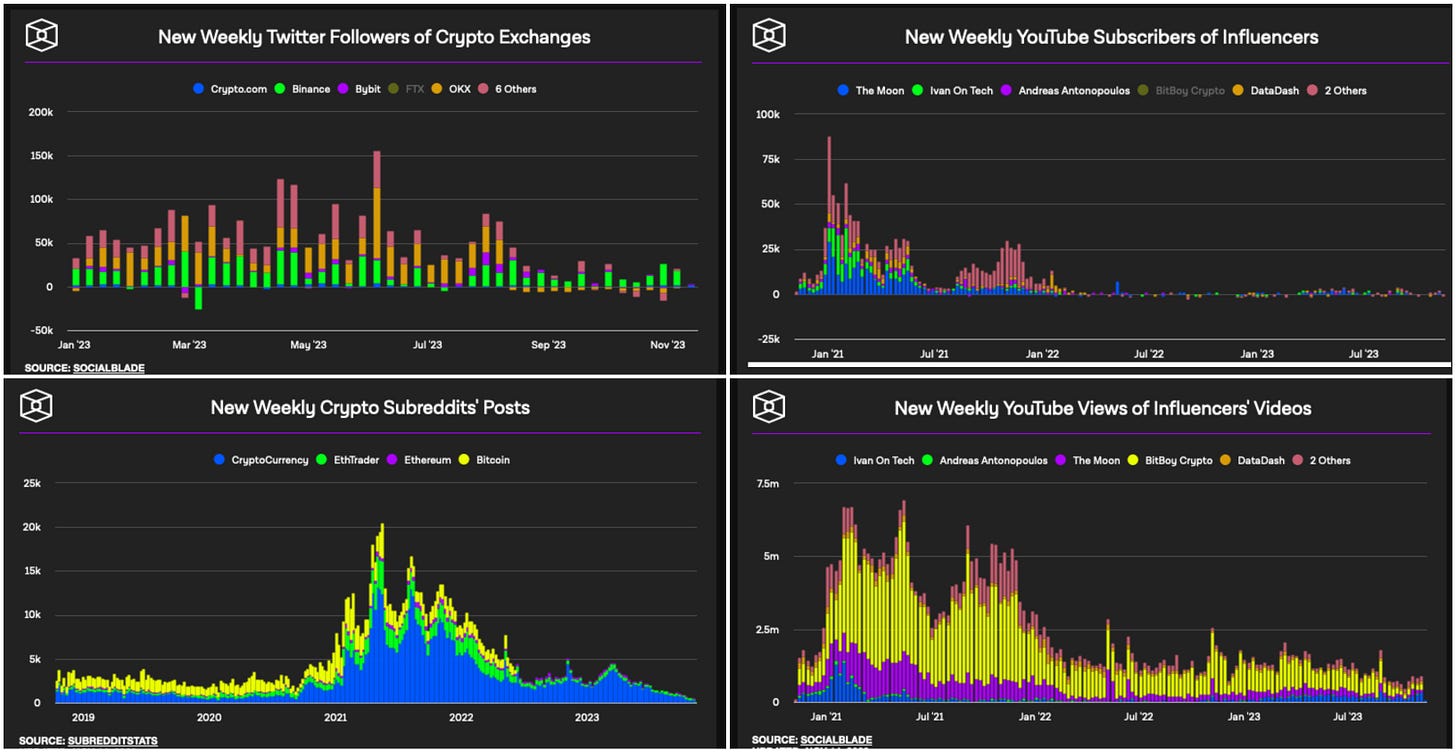

Sizeable public interest is nowhere to be found (yet), as we can see from the social media slumber:

These facts have a positive twist: If a rumor and a few words from BlackRock got Bitcoin to $38,000, it’s jarring to imagine where actual, substantial interest would take this market.

What would create public interest? Well, as we’ve shared above, CME open interest and the 2-year high of $1 billions of inflows to stock market traded crypto products shows that the institutional world is making this bet. Who are we to mock their vision?

If a bit of new liquidity is rain, and institutional interest is fertilizer, to complete the spring metaphor all we need is some time and decent weather.