The growing power of the crypto financial system

How much money has crypto moved in 2021?

In cryptoland, each new day sees a change in the market and sentiment. It seems every day we have new records broken and new protocols launching. Once in a while it’s good to take a step back and look at the bigger picture.

Let's dive into a few mind blowing numbers:

Moving money like a pro

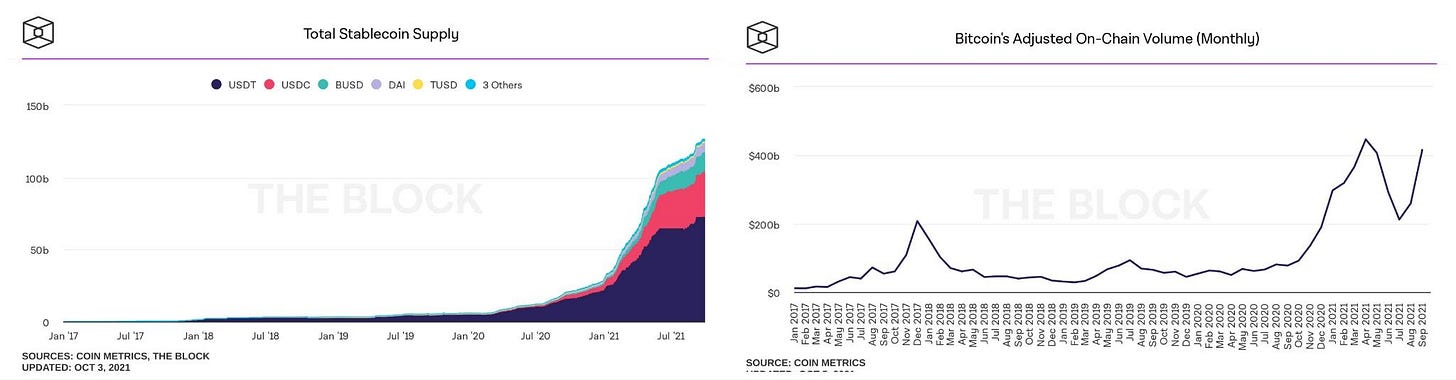

With the stablecoin global market cap at $127 billion, crypto’s digital dollars have settled $4.12 trillion in transactions since January 2021 (According to CoinMetrics blockchain analytics).

Stablecoins display an amazing velocity of money- above 32.

The Bitcoin network itself settled $3 trillion in transactions since January 2021, and the Ethereum network settled $2.7 trillion in ETH alone in less than 10 months since the year started.

The hedge of DeFi and economic freedom

A recent study by NYDIG showed that Bitcoin adoption is higher in countries with more restrictions on economic freedom, showing a demand for open-source money as a hedge against economic controls. DeFi exchanges like Uniswap are demonstrating that banning cryptocurrency trading is not only inconvenient, but completely impossible.

Proof: Recently trading volume of Ethereum’s ETH token on the open-source exchange has rivaled the established (centrally operated and popular) Coinbase’s market. Anyone in the world can access Uniswap, and even Uniswap’s admins cannot delete markets from the platform, but can only remove them from Uniswap’s graphic interface.

If Uniswap has to ban certain jurisdictions or too many tokens, it will simply give rise to a ’DarkUniswap’, an alternative user interface to the same exchange. The back-end remains the same and in order to “stop” trading, regulators would have to take over the Ethereum blockchain, multiple orders of magnitude more difficult than simply banning a centralized exchange from operating.

In conclusion, the extreme level of financial activity, with this powerful infrastructure demonstrates how healthy the crypto-world is, and how much power and potential for growth it has in the coming years.

In our next post on the Efficient Frontier blog we’ll share more on this topic - stay tuned.

Market wrap

Since our last newsletter, the crypto markets sentiments switched around a few times, though we remain extremely positive towards the end of the year. The lowest we’ve seen in the last couple of weeks has been $39,968 for Bitcoin on September 21st; the highest was $55,743 yesterday.

September 23rd, $44,900 -Twitter presents Bitcoin lighting tipping for US and El Salvador with NFT authentication coming soon.

September 24th, $41,000 - PBOC reiterates ban on crypto financial services

Cryptocurrency bans from China’s leadership aren't new, but this time, as the PBOC prepares to launch its sovereign cryptocurrency, more severe measures seem to have rolled out:

Houbi exchange announced it will close mainland China based trading accounts

Avoiding the mining ban in July, Ethereum’s China based second and fourth largest mining pool shut down.

Coingecko, CoinMarketCap and TradingView are reportedly blocked in mainland China

Alibaba announces it will block sales of mining equipment, after a reported surge in retail purchases.

September 30th - Federal Reserve chairman Powell says he has no intention to ban cryptocurrency or stablecoins

Upcoming: the first American Bitcoin ETF

After the head of SEC spoke favorably of approving a CME futures-based Bitcoin ETF, six ETFs were filed last month for approval and the decisions on them are expected to be made in the following weeks.A USA approved Bitcoin ETF will allow easy exposure to Bitcoin for American retirement accounts and funds.

On October 6th, as last month’s Bitcoin’s price record was broken, a liquidation of $120 million of shorts was triggered within one hour. These 24 hours deleted over $200 million in Bitcoin short positions, the most since July 25th.

Open interest has risen alongside Bitcoin’s price since September 20th, reaching 18.4B in open contracts today.

News & links

Laos, China’s tiny neighbor with energy surplus, legalizes mining and trading of cryptocurrency

FTX headquarters move to the Bahamas following regulation

Steve Cohen, Billionaire investor and owner of the New York Mets, invests in crypto quant trading firm

Ethereum developer pleads guilty for advocating cryptocurrency usage in North Korea

US Justice Department has launched a National Cryptocurrency Enforcement Team, targeting money laundering

Team Update

We're excited to be investing in Strips.Finance, a new decentralized interest rate swaps protocol. This is an instrument that is new to the crypto landscape and we anticipate it being a massive market, as it is in the traditional financial markets.